Why Identity and Financial Data Protection Matters More Than Ever

In today’s hyper-connected world, your identity and financial information are more exposed than you might think. With major data breaches hitting companies like Equifax, Capital One, and even government agencies, millions of people have had their Social Security numbers, credit card details, and personal profiles leaked online. What’s alarming is that a single piece of stolen data—like your date of birth or home address—can become the key to a full-blown identity theft. According to the Federal Trade Commission (FTC), identity theft reports surged to over 1.4 million cases in 2022 alone. That’s not just a statistic—it’s a wake-up call.

Understanding the Main Threats: Not Just Hackers in Hoodies

People often picture hackers as lone geniuses in dark rooms, but in reality, threats come in many forms. Phishing emails, fake banking websites, and malware-infected apps are now more common than brute-force attacks. A common scam in 2023 involved fraudsters creating convincing replicas of popular banking sites—tricking users into entering their credentials. Once logged in, the attackers siphoned funds or used the details to open fake accounts. Even public Wi-Fi can be a vulnerability; a man in Chicago lost $7,000 after unknowingly logging into his bank app over an unsecured airport network.

The Basics: Start With Digital Hygiene

Before diving into advanced tools, let’s get the fundamentals right. Strong digital habits can prevent most attacks:

– Use strong, unique passwords for each account. Avoid “123456” or “qwerty”. A strong password includes letters, numbers, and special characters.

– Enable two-factor authentication (2FA) wherever possible. This adds an extra layer of security even if your password is compromised.

– Keep software and systems updated to fix known vulnerabilities. That includes your smartphone, browser, and even your home router.

Real case: In 2021, a ransomware attack on a small business in Florida succeeded because their server hadn’t been updated in over 18 months. A simple patch could’ve blocked the exploit.

Technical Tools That Actually Work

Beyond basic habits, certain technologies can dramatically enhance your protection. Let’s break down the most effective ones:

– Password Managers: Services like 1Password or Bitwarden not only generate secure passwords but also store them safely. They use AES-256 encryption, the same standard used by the U.S. military.

– VPNs (Virtual Private Networks): A VPN encrypts your internet traffic, especially useful when using public Wi-Fi. However, free VPNs can be risky—some log your data or inject ads. Go for paid, reputable providers like NordVPN or ProtonVPN.

– Credit Monitoring Services: Companies like Experian and LifeLock notify you in real time when there’s suspicious activity on your credit file.

Here’s a quick side note: According to a 2023 study by Cybersecurity Ventures, users who employed both a VPN and a password manager reduced their identity theft risk by up to 60%.

Fraud Alerts vs. Credit Freezes: Which Is Better?

One common question is whether to use a fraud alert or go full-force with a credit freeze. Both have pros and cons. A fraud alert notifies potential lenders to take extra steps before opening accounts in your name, but it only lasts one year unless renewed. A credit freeze, on the other hand, locks down your credit file completely, preventing any new accounts from being opened unless you lift it temporarily.

For example, after a data breach at a hospital in Texas, a patient froze his credit reports. While it caused minor inconvenience when applying for a car loan, he avoided a potentially devastating fraudulent loan application made in his name just a month later.

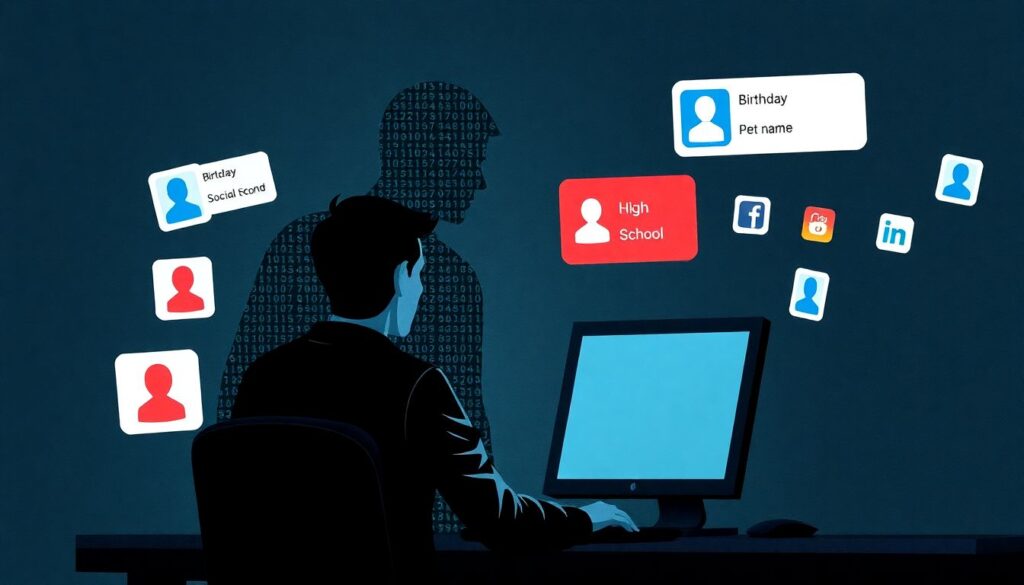

Social Media: A Goldmine for Identity Thieves

We often underestimate how much we reveal on social media. Birthdays, pet names, high school names—these are all common answers to security questions. In one real incident, a scammer pieced together a woman’s identity simply from her public Facebook posts. Days later, he redirected her mail and began applying for credit cards in her name.

Here’s what you can do:

– Avoid sharing personal details like your mother’s maiden name or your pet’s name.

– Regularly review your privacy settings—limit who can see your posts and personal information.

– Don’t accept friend requests from people you don’t know—even if you have mutual contacts.

Final Thoughts: Security Is a Lifestyle, Not a One-Time Fix

There’s no single silver bullet to protect your identity and financial data—it’s about layering multiple safeguards. Think of it like home security: you lock the doors, install cameras, and maybe even get a dog. Similarly, securing your digital life means combining good habits, smart tools, and situational awareness.

Remember, identity theft doesn’t just cost money—it costs time, peace of mind, and sometimes even your reputation. Stay alert, stay informed, and treat your personal data like the valuable asset it truly is.