Why Local Bonds Are Basically Your Community’s Kickstarter

When you buy a local bond, you’re not just “doing finance” — you’re fronting money so your city can fix bridges, modernize schools or expand hospitals, and then paying you back with interest. In the US alone, the municipal bond market is worth over $4 trillion, and a big chunk of that funds everyday things you actually use. Unlike stocks, these bonds usually aim for stability rather than drama: historically, default rates on high‑grade munis have sat below 0.1% over ten years. So when you think about how to invest in your community through local bonds, you’re basically choosing a quieter, steadier way to support public projects and get paid for your patience.

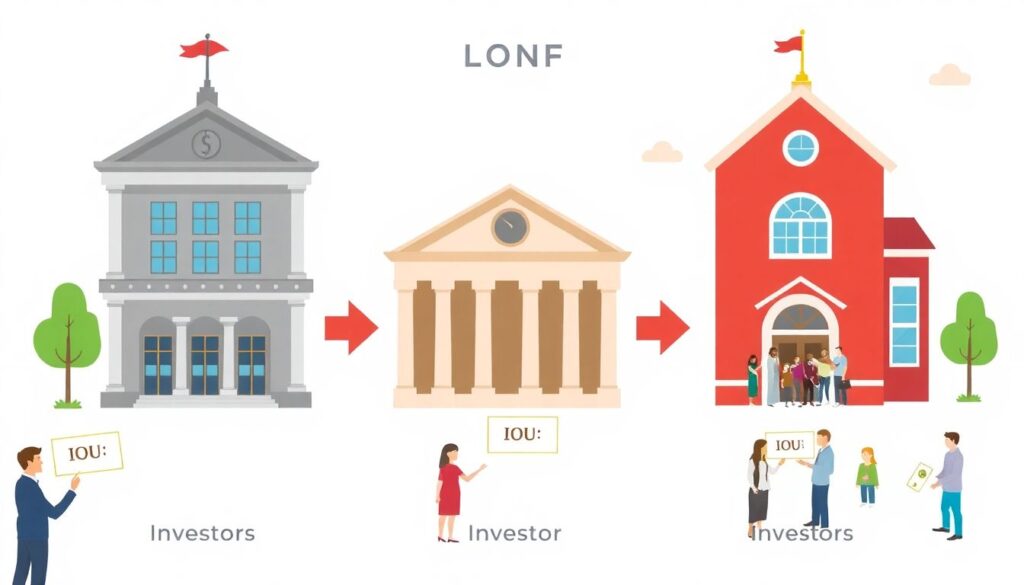

What Exactly Are Local Bonds and Why Do They Matter?

Local or municipal bonds are IOUs issued by cities, counties, or school districts. They borrow from investors, spend on projects, and gradually repay with interest. From an economic angle, it’s a classic win‑win: municipalities access cheaper long‑term funding, while residents gain relatively predictable income. Analysts expect demand to stay solid as aging infrastructure, climate adaptation and digital upgrades require trillions in funding over the next couple of decades. For you, learning how to invest in municipal bonds is partly about understanding that you’re plugging into this long‑term capital pipeline rather than chasing short‑term market buzz.

How Local Bonds Feed the Real Economy

Every time a town issues a bond to build a transit line or water plant, it sparks a chain reaction: contractors get hired, suppliers ramp up, jobs appear, and local spending rises. Studies by public finance researchers show that $1 of infrastructure investment can add $1.50–$2.00 to regional GDP over time through these knock‑on effects. Bond‑funded projects also tend to improve productivity — think shorter commutes, reliable broadband, cleaner water — which makes a region more attractive to businesses. For residents who hold the bonds, the result is a rare combo: potential interest income plus a higher quality of life. In that sense, you’re not a passive saver; you’re a micro‑co‑author of the local economy.

Step‑by‑Step: How to Actually Buy Local Bonds

If you’ve ever wondered how to buy local government bonds without a Wall Street badge, the process is more accessible than it looks. Experts usually break it down into a few practical moves you can follow at your own pace:

1. Clarify goals: income, safety, or community impact — and over what time horizon.

2. Check your city or state website for upcoming bond offerings and project details.

3. Open a brokerage account that gives access to municipal securities.

4. Compare credit ratings, yields and maturities; avoid concentration in a single issuer.

5. Start small, then ladder maturities so bonds come due at staggered dates.

Bond strategists generally suggest capping any single local issuer at a modest slice of your portfolio to keep hometown pride from becoming hometown risk.

Taxes, Risk, and Where Experts Draw the Line

One major attraction of a tax free municipal bonds investment is that interest is often exempt from federal income tax, and sometimes from state and local tax if you live where the bond is issued. That can make a 3% muni yield more attractive than a higher‑yielding taxable bond once you factor in your tax bracket. Still, experts stress two key risks: credit and interest rates. Municipal finances can weaken in recessions, and when market rates rise, existing bonds lose value on paper. Professionals often recommend holding a mix of maturities — short to medium terms for flexibility, some longer for higher yield — and reviewing your positions at least annually, especially if your city’s budget headlines start to look shaky.

Going Indirect: Funds, ETFs and “Set‑It‑and‑Review” Strategies

If you don’t have the time or desire to analyze individual issuers, many advisers propose using mutual funds or ETFs that specialize in municipal debt. The best municipal bond funds for income typically spread your money across hundreds of issues, smoothing out the impact of any one city’s misstep and outsourcing the credit work to professionals. Expense ratios, however, really matter: even a 0.30–0.50% fee eats into returns over long horizons. A common expert tactic is to pair a broad national muni fund with a more focused state‑specific fund, tuning the mix to your tax situation and risk tolerance. That way, you still channel capital into public projects, but with diversified exposure and less day‑to‑day homework.

How Local Bonds Are Reshaping the Finance Industry

Municipal finance is quietly being transformed by technology and new priorities. Digital platforms now let smaller investors participate in offerings that used to be dominated by big institutions, increasing transparency and competition on pricing. At the same time, “green” and “social” muni bonds are growing quickly, funding projects like energy‑efficient schools or flood‑resilient infrastructure. Industry analysts forecast steady expansion of these segments as climate and demographic pressures mount. Compared with traditional options like Treasuries, this evolution makes munis a more nuanced tool: you’re not just lending to a government; you’re choosing what type of future infrastructure your dollars push into existence.

Comparing Options: Munis vs. Treasuries and the Road Ahead

When people weigh municipal bonds vs treasury bonds for investors, three trade‑offs usually come up: safety, yield and taxes. Treasuries are backed by the federal government and are considered virtually risk‑free in credit terms, but their interest is mostly taxable. Munis, by contrast, carry slightly more credit risk but can deliver better after‑tax income, especially for higher‑bracket households. Looking forward, many strategists expect moderate upward pressure on yields as infrastructure needs grow and governments compete a bit harder for investor dollars. For individual investors, that likely means more opportunities to lock in attractive tax‑adjusted income while actively shaping how your community upgrades itself over the next decade.