Understanding What a Long‑Term Wealth Growth Plan Really Is

Think of a long‑term wealth plan as your personal operating system for money: it defines cash‑flow rules, risk limits, and investment priorities over 20–40 years. Unlike short‑term saving, it integrates capital markets behavior, tax regimes and life events such as buying a home, funding education or decumulation in retirement. Research by Vanguard and Fidelity shows that households following a written plan usually save 15–20% more and stay invested through crises, which historically explains a large part of their higher net worth. Instead of chasing hot tips, you’re building a framework where asset allocation, rebalancing and tax efficiency work together, so each financial decision supports a single, coherent growth trajectory.

Setting Measurable Long‑Term Wealth Goals

From Vague Dreams to Quantified Targets

“I want to be rich” is not a plan; “I need $1.2 million in today’s money by age 65” is. A robust goal‑setting process discounts future needs for inflation, models expected portfolio returns, and translates everything into required annual savings. With global inflation oscillating between 2–5% in most developed markets, ignoring purchasing power erosion can cut real retirement income by a third. Modern long term wealth planning services increasingly use Monte Carlo simulations to stress‑test your goals against market crashes, wage shocks and longevity risk. The result is a probability range, not a single magic number, which is far more honest and actionable for real‑world planning.

Short‑Term, Medium‑Term and Lifetime Horizons

Effective plans layer objectives by time horizon. Short‑term (1–3 years) covers liquidity buffers and high‑certainty spending; medium‑term (3–10 years) targets property purchases or business funding; lifetime goals address financial independence and legacy. These layers map to different asset mixes and risk budgets. For instance, an emergency fund requires capital preservation and daily liquidity, while a 30‑year retirement portfolio can absorb equity volatility in exchange for higher expected real returns. Segmenting horizons prevents the common emotional mistake of selling long‑term growth assets to solve near‑term shocks, which is especially destructive during bear markets when opportunity costs are highest.

Key Investment Strategies for Long‑Term Wealth Building

Passive Indexing vs. Active Management

When discussing investment strategies for long term wealth building, the first fork in the road is usually passive versus active management. Long‑run SPIVA scorecards show that a majority of active equity funds underperform their benchmarks after fees over 10–15 years, which explains the surge of low‑cost index funds and ETFs. Passive indexing offers transparency, broad diversification and fee compression, which materially boosts net returns when compounded over decades. Active management still has a role in less efficient segments like small caps, emerging markets or niche credit. The pragmatic approach is a core–satellite structure: a passive core for stability, with targeted active satellites where true skill can justify higher costs.

Buy‑and‑Hold vs. Tactical Asset Allocation

Buy‑and‑hold investors set a strategic asset allocation and stick to it, rebalancing periodically. Tactical allocators tilt exposures based on valuations, macro indicators or momentum. Evidence suggests that market timing based purely on forecasts often destroys value for retail investors, mainly due to behavioral errors and transaction costs. However, valuation‑aware tilting—such as gradually reducing equity exposure when valuations are in the highest historical deciles—can modestly improve risk‑adjusted returns if executed systematically. For most households, a rules‑based buy‑and‑hold strategy with annual rebalancing strikes the best balance between discipline, simplicity and robustness across different economic regimes.

DIY Investing vs. Professional Guidance

Digital tools have made DIY portfolio construction far easier, but not necessarily more effective. A disciplined self‑directed investor can minimize fees, automate contributions and track progress with simple index funds. Yet studies by Vanguard and others estimate an “advice alpha” of around 3% annually from behavioral coaching, tax optimization and smarter withdrawal sequencing. Choosing between DIY and a professional financial advisor for long term wealth growth hinges on your time, temperament and complexity. If you face multiple jurisdictions, business ownership, stock options or large inheritances, the incremental value of expertise and structure can significantly outweigh advisory fees over a multi‑decade horizon.

Economic and Statistical Foundations of Long‑Term Growth

What History Says About Markets and Risk

Over the last century, global equities delivered roughly 5–7% real annual returns, while government bonds lagged at 1–3% above inflation. These are averages hiding violent drawdowns: equity markets can fall 40–50% in major crises and recover over 5–10 years. Statistical modeling uses standard deviation, drawdown depth and correlation matrices to estimate how diversified portfolios might behave across cycles. Long‑term investors exploit the equity risk premium by staying invested through recessions, but only if their asset allocation and emergency buffers are calibrated to their risk capacity. Without that calibration, fear‑driven selling during downturns converts temporary volatility into permanent capital loss.

Inflation, Interest Rates and Real Returns

Macroeconomic variables quietly shape your wealth trajectory. Persistent higher inflation erodes cash and low‑yield bonds, while benefiting real assets like equities, real estate and infrastructure. Rising interest rates compress valuations but also increase future expected returns on new fixed‑income purchases. Forecasts from major central banks suggest a “higher‑for‑longer” interest‑rate regime compared with the 2010s, implying that pure growth‑stock strategies may face more valuation headwinds. Long‑term plans therefore need a broader mix of asset classes and geographies. Systematically revisiting assumptions about inflation and real yields every few years helps keep your model tethered to evolving economic reality rather than outdated backtests.

Roles of Different Types of Advisors and Firms

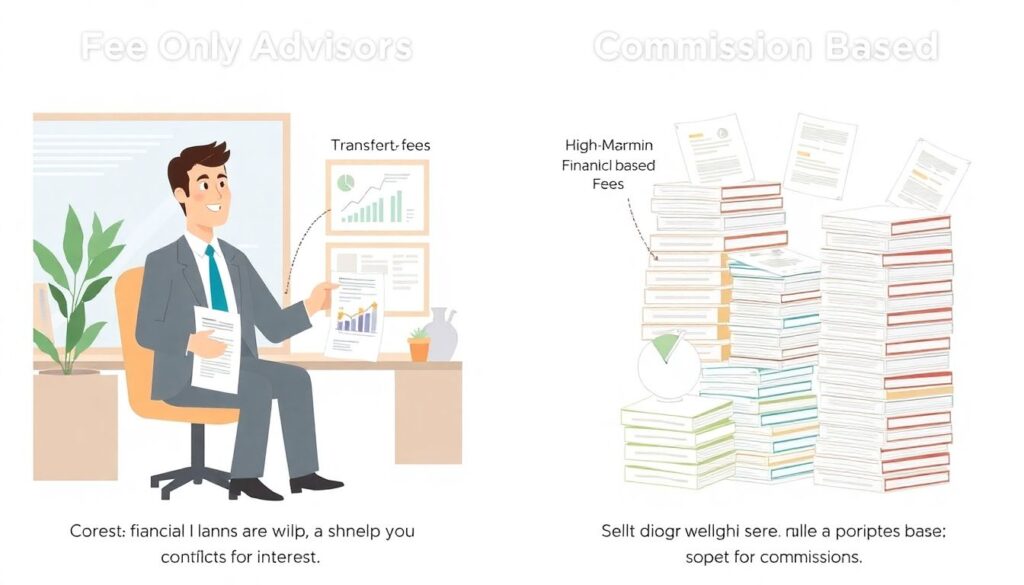

Comprehensive Planning vs. Product‑Driven Sales

Not all advisors operate under the same incentives. A fee only financial planner for wealth growth charges transparent fees for advice rather than commissions for selling products, which reduces conflicts of interest. In contrast, commission‑based models may overweight high‑margin funds or complex insurance vehicles with opaque costs. Comprehensive planners integrate budgeting, risk management, estate structures and tax planning, effectively becoming the architect of your entire financial system. When comparing providers, focus on fiduciary duty, compensation structure, investment philosophy and planning depth. Over 25–30 years, seemingly small fee differences can reallocate hundreds of thousands of dollars from intermediary margins back into your own net worth.

Specialized Services for Retirement and Decumulation

As demographics shift and life expectancy rises, the best wealth management firms for retirement planning are investing heavily in decumulation analytics and longevity modeling. The challenge is no longer just reaching a target pot of capital but converting it into sustainable income without running out of money or underspending out of fear. That requires optimizing withdrawal rates, asset location across taxable and tax‑advantaged accounts, and dynamic spending rules tied to portfolio performance. Firms leading this space integrate annuities, bond ladders and risk‑managed equity sleeves, tailoring solutions to health status and family circumstances instead of relying on naive “4% rule” heuristics.

Industry Evolution and Technology’s Impact

Rise of Digital Platforms and Hybrid Advice

The wealth‑management industry is undergoing structural change as robo‑advisors, low‑cost brokers and planning apps compress fees and democratize access. Long term wealth planning services increasingly combine automated portfolio management with human advisors for complex cases. Algorithms handle rebalancing, tax‑loss harvesting and factor tilts, while humans focus on scenario analysis and behavioral coaching. This hybrid model scales expertise to investors who previously couldn’t afford full‑service advice. As competition intensifies, traditional firms are being forced to justify every basis point of fees with demonstrable value, driving innovation in planning tools and data‑driven risk diagnostics.

ESG, Thematic Investing and New Risk Dimensions

Investor preferences are also reshaping product design. Environmental, social and governance (ESG) screens, climate risk and thematic allocations to sectors like clean energy or AI are moving from niche to mainstream. While these themes can align portfolios with personal values, they introduce concentration and regulatory risks if not integrated into a rigorous risk‑management framework. Leading platforms now model climate‑transition scenarios and carbon‑price shocks as part of their long‑term capital‑market assumptions. For a sustainable long‑term growth plan, the key is treating ESG as an additional analytical dimension, not as a free lunch promising higher returns without commensurate risk.

Comparing Three Practical Approaches to Long‑Term Wealth Growth

Approach 1: DIY Index Investor

The pure DIY index investor builds a low‑cost portfolio of global stock and bond ETFs, automates contributions and rarely trades. This model maximizes fee efficiency and transparency; historical data suggests that simply holding a diversified portfolio and rebalancing annually can outperform many stock pickers. The downside is behavioral: without guardrails, investors are prone to panic during crashes or chase speculative assets during bubbles. DIY also demands time for ongoing education about tax rules, product changes and macro shifts. For disciplined individuals with straightforward finances, this approach can be extremely effective, but it offers little protection against self‑inflicted errors.

- Advantages: ultra‑low cost, high control, simple implementation.

- Risks: behavioral mistakes, tax inefficiencies, potential under‑diversification.

- Best suited for: financially literate investors with stable incomes and moderate complexity.

Approach 2: Traditional Full‑Service Advisory

Traditional advisory relies on a dedicated human advisor, often at a bank or independent firm, who builds a holistic plan, manages investments and coordinates with tax and legal professionals. This structure is valuable for families with businesses, cross‑border exposure or significant real‑estate holdings. However, some legacy models still use expensive active funds and opaque fee layers, which can materially drag on long‑term performance. The quality dispersion is wide: some advisors deliver genuine planning alpha, others focus on product distribution. When evaluating a financial advisor for long term wealth growth, transparency of total costs and alignment of incentives matter as much as personal rapport.

- Advantages: holistic support, behavioral coaching, access to specialists.

- Risks: higher fees, potential conflicts of interest, variable advisor skill.

- Best suited for: complex financial situations and time‑constrained clients.

Approach 3: Hybrid Digital‑First Planning

Hybrid platforms combine algorithmic portfolio construction with on‑demand human planners. Investment engines use low‑cost ETFs, factor tilts and tax‑loss harvesting, while planners focus on goals‑based modeling, insurance analysis and estate considerations. Pricing typically sits between DIY and full‑service wealth management, with clear, asset‑based or flat‑fee structures. This model leverages data to personalize asset allocation, yet still offers human judgment for nuanced trade‑offs, such as when to exercise stock options or how to stage early retirement. For many investors, hybrid planning offers a pragmatic middle path that balances cost, sophistication and behavioral support over multi‑decade horizons.

- Advantages: competitive fees, modern tooling, access to human advice.

- Risks: platform dependency, possible service tiers and limitations for edge‑case scenarios.

- Best suited for: tech‑comfortable investors seeking structured guidance without full private‑bank pricing.

Building Your Own Actionable Roadmap

Translating Theory into Concrete Steps

Turning all these concepts into a working roadmap starts with a personal balance‑sheet review, then moves to codifying goals, selecting an asset‑allocation policy and choosing the operating model—DIY, traditional advisory or hybrid. Document a short investment policy statement covering risk tolerance, rebalancing rules and conditions under which you might change your strategy. Automate as much as possible: salary deductions, periodic investing and rebalancing alerts reduce reliance on willpower. Finally, schedule structured reviews annually or after major life changes. Over time, this repeatable process matters far more for your wealth trajectory than any single stock pick or market forecast.

How to Choose the Right Partners

If you opt for external help, compare platforms and firms the way an underwriter assesses risk: objectively and with data. Review long‑term performance after fees, planning capabilities, and whether they provide genuine long term wealth planning services rather than just portfolio management. Ask how they’re compensated, what benchmarks they use, and how they handle down markets. For retirement‑focused investors, confirm that decumulation modeling, tax‑aware withdrawals and healthcare contingencies are built into the process. Matching the right partner model to your goals, complexity and temperament is one of the highest‑leverage decisions you’ll make for your financial future.