Rethinking What Phased Retirement Really Means

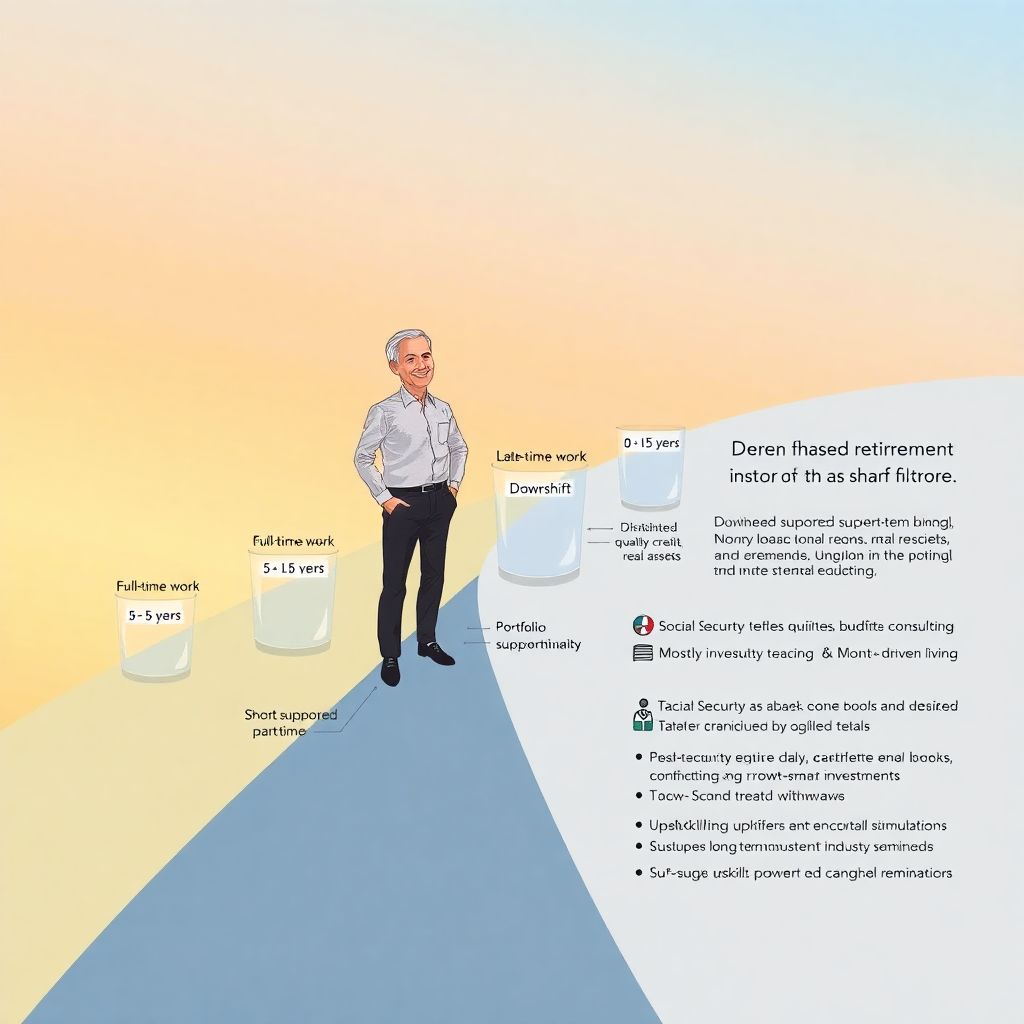

A phased retirement investment plan starts with accepting that retirement is no longer a cliff; it is a slope. Surveys from Gallup and the OECD show that 30–40% of workers expect to keep earning after traditional retirement age, and the share rises every cohort, which means your money has to coordinate with part‑time work, not replace it overnight. Instead of planning for a single “magic number”, think in stages: full‑time, downshift, portfolio‑supported part‑time, and finally mostly investment‑driven living. This mindset lets you delay heavy portfolio withdrawals, extend compounding, and use human capital as a buffer against market volatility, which is far more robust than the old “work–stop–spend” script most calculators are still built around.

Setting Unconventional but Practical Goals

Classic retirement calculators ask “How much do you need at 65?” and ignore that you might earn solid money until 70 or even 75. A more realistic phased retirement investment plan asks three different questions: how much income you must cover if you cut to 60% workload, how quickly you want to gain bargaining power with your employer, and what burn rate keeps you flexible. Empirically, spending often dips in the early 60s, then rises in late 70s on health care; planning multi‑phase cash‑flow bands instead of one flat number captures that arc. Nonstandard move: target “work‑optional” at, say, 62, not “fully retired” at 67. That psychological shift lets you treat any extra earned income as risk capital for delayed Social Security, Roth conversions, or tactical investments when markets are temporarily discounted.

Designing Cash‑Flow Buckets for a Smoother Glide Path

When people ask how to invest for retirement income, they often jump straight to yield products, but for phased retirement the first step is time‑segmented liquidity. Picture three buckets: near‑term (0–5 years), medium (5–15), and long‑term (15+). In the near‑term bucket, hold cash, T‑bills, and short‑duration bond funds covering your basic spending gap after part‑time wages. Medium‑term assets can take moderate volatility: diversified equity funds, high‑quality credit, maybe a slice of real‑asset exposure for inflation hedging. Long‑term capital stays aggressively growth‑oriented, since it will not be touched until late‑life stages. This bucket system is simple but powerful: it converts scary market downturns into mere timing issues, because your paycheck plus the safe bucket give your growth assets years to recover without forced selling.

Tax‑Smart and Flexible Withdrawal Tactics

A huge edge of phased work is tax efficiency. Because part‑time income fills only part of the bracket, you can pull from different accounts to “smooth” lifetime taxes. A creative phased retirement 401k withdrawal strategy is to start small, controlled distributions in low‑income years between, say, 62 and 70, while delaying full Social Security and minimizing required minimum distributions later. Mix these with partial Roth conversions so future withdrawals are tax‑free, giving you more control over your marginal rate. Another twist is to fund health savings accounts aggressively in your final high‑income years, then use those balances tax‑free in later phases. Treat withdrawals as a dynamic lever you adjust annually based on markets, tax law, and your current workload, not as a fixed percentage carved in stone.

Rethinking Risk: Human Capital as a Financial Asset

Instead of asking the best financial advisors for retirement planning only about model portfolios, ask them to underwrite your human capital. The ability to teach, consult, or freelance for even 10–15 hours a week can slash required portfolio withdrawals by thousands per month. Statistically, each extra year of work can increase total retirement wealth by more than 7–9% through delayed benefit claims and additional contributions. That means your skills, networks, and health habits are effectively a diversifying asset class. Nonstandard but powerful idea: invest money in upskilling at 55—certifications, digital tools, networking events—explicitly to boost your earning capacity in your sixties. The ROI on that “education bond” can beat most low‑risk financial products, while also giving you more autonomy over where and how you work.

Where Professional Advice Actually Adds Value

Many people see retirement income planning services as glorified sales pitches for annuities or managed accounts, but you can use them in a more surgical way. Look for fee‑only planners who will model multiple employment scenarios: staying in your main career, switching industries, or creating a portfolio of gigs. Ask for Monte‑Carlo simulations that combine varying work hours, market returns, and health‑care shocks, instead of a single deterministic forecast. Use advice sessions to stress‑test nontraditional decisions, like temporarily downsizing housing to free equity for investing, or relocating to lower‑tax regions while you are still semi‑employed. The value is not a magic product, but better decision architecture: turning fuzzy what‑ifs into quantified trade‑offs that support a phased retirement lifestyle rather than a one‑time exit.

Industry Shifts and Future Opportunities

Demographic forecasts from the UN and World Bank point to a global doubling of the 65+ population by 2050, which is already forcing financial firms to rethink how to invest for retirement income in flexible, not binary, ways. Expect more products designed specifically for phased careers: variable annuities with delayed start dates, target‑date funds that slow the glide path, and hybrid advice platforms that integrate HR data from employers. Asset managers are retooling risk models around longer working lives and later benefit claims, while regulators explore frameworks for employer‑sponsored phased retirement 401k withdrawal strategy options. For investors, this shift means more tools—but also more complexity. Building your own narrative, then using the market’s evolving toolkit selectively, will matter far more than chasing whatever “retirement innovation” is trending in a given year.