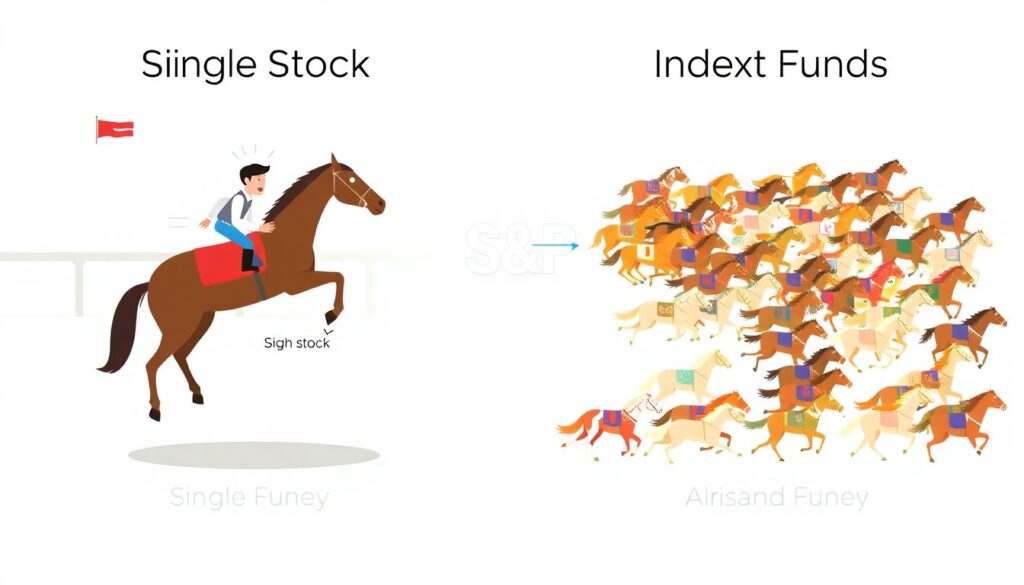

Why Index Funds Feel Safer Than “Stock Picking”

Бuying a single stock feels like betting on one horse. If it stumbles, your money limps with it. Index funds spread your money across dozens, hundreds, sometimes thousands of companies at once. When you own an S&P 500 index fund, you’re basically buying a tiny slice of 500 big US businesses in one shot. So if one company blows up, 499 others cushion the hit. That’s the core reason index funds are friendlier for nervous beginners: you’re buying the whole crowd instead of trying to guess the winner, which makes the ride smoother and the decisions simpler day to day.

Key Terms Without the Jargon Fog

Before you put in a dollar, nail these definitions so you actually know what you’re buying. An index is just a list of securities that represents a market segment, like the S&P 500 for large US companies or a total market index for almost all publicly traded firms. An index fund is a fund that copies that list as closely as possible, instead of trying to outsmart it. An ETF (exchange‑traded fund) is a type of index fund you buy like a stock during the day, while a traditional mutual fund is priced once after the market closes; both can follow the same index with tiny cost differences.

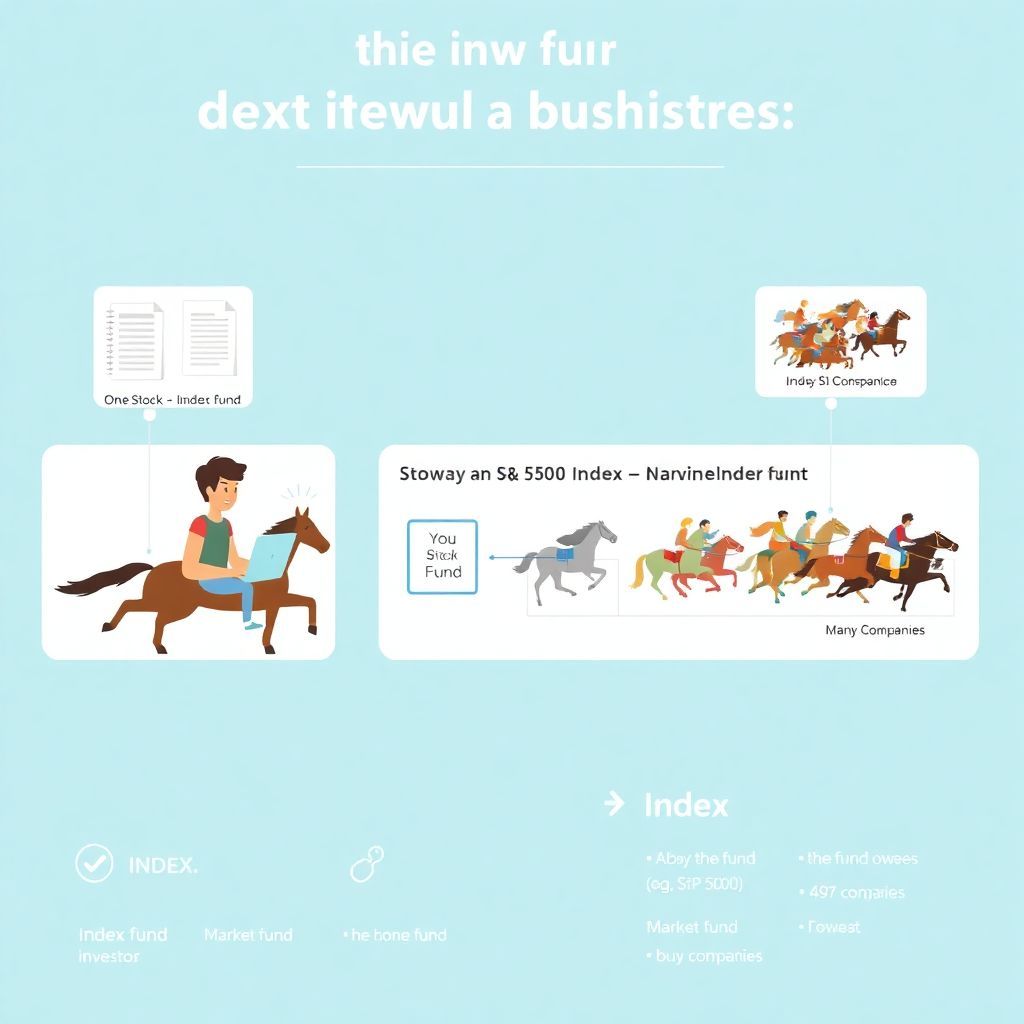

“Picture” of How an Index Fund Works

Imagine a simple diagram in your head:

1) Index (S&P 500) →

2) Fund copies index list →

3) You buy shares of the fund →

4) Fund automatically holds all 500 companies for you.

Visually, think of it like this:

[You] → [S&P 500 Index Fund] → [Apple, Microsoft, Amazon, 497 others]

Instead of researching every company, you just buy the middle box. Internally, the fund manager and computers rebalance the holdings whenever the index changes, so your share of the market stays aligned without you lifting a finger or reading earnings reports every quarter.

Why Costs Matter More Than You Think

Fees are the silent leak in the boat. An expense ratio of 0.80% may not sound terrifying, but over 30 years it can consume tens of thousands in gains. That’s why people keep talking about low cost s&p 500 index funds for long term investing: they often charge 0.03–0.05% per year, which is almost negligible. When your money compounds, every fraction of a percent you don’t pay in fees stays in your account, not in someone else’s. For a scared beginner, this is a rare situation where “cheaper” is often genuinely “better” in a mathematical, not emotional, sense.

Choosing Between Vanguard and Fidelity

You’ll often see a vanguard vs fidelity index funds comparison in forums, as if there’s a secret winner. In reality, both offer extremely cheap S&P 500 and total market index funds with long histories and huge asset bases. The differences are usually tiny: maybe one has a 0.02% lower expense ratio, or slightly different minimum investment rules. For a new investor, the “winner” is usually the provider that: 1) lets you open an account easily from your country, 2) has no annoying account fees, and 3) offers automatic investing so you can set it and forget it monthly.

Getting Started With Very Little Money

If you’re wondering how to start investing in index funds with little money, the answer is: use brokers or apps that have no‑minimum accounts and allow fractional shares. Instead of needing $3,000 to meet an old‑school mutual fund minimum, you can start with $5, $20, or $50 at a time. The key is making it automated: link your bank and set a recurring transfer into a single broad index fund every month. Don’t wait to “save up” a big lump sum; time in the market beats perfect timing, especially when you’re nervous and likely to hesitate for years.

Simple First-Fund Ideas for Beginners

If you feel paralyzed by choice, stick to plain, broad funds. Many experts discussing the best index funds to invest in for beginners usually point to:

– A total US stock market index fund

– An S&P 500 index fund

– A global or international index fund (optional add-on)

The exact ticker is less important than the pattern: super‑diversified, very low fee, and from a reputable firm. Start with one core fund instead of building a complex portfolio; you can always add more later when your confidence and account balance grow.

Basic Index Fund Investing Strategy for Retirement

Your index fund investing strategy for retirement doesn’t need to be complicated. First, pick 1–3 broad, low‑cost funds (for example, US total market plus international). Second, decide on a rough stock/bond split based on your risk tolerance and time horizon—more stocks when you’re younger, more bonds as you near retirement. Third, automate contributions every payday and avoid tinkering. Most of the “strategy” is just consistency: letting decades of market growth do the heavy lifting while you refuse to panic when headlines scream doom.

Managing Fear While You’re Actually Investing

Fear doesn’t vanish just because you know the theory, so build guardrails.

– Don’t check your account daily; monthly or quarterly is enough.

– Decide in advance: “I will not sell just because prices drop.”

– Keep 3–6 months of expenses in cash so you’re never forced to sell in a downturn.

Think of short‑term drops as “temporary sales” on the market index you already planned to own for decades. The more you treat investing like a boring bill you pay automatically, the less room anxiety has to hijack your decisions or push you into market‑timing.

Comparing Index Funds With Other Options

Compared with actively managed mutual funds, index funds don’t try to beat the market; they aim to match it, which means lower trading, fewer surprises, and normally lower fees. Versus picking individual stocks, they require almost zero research time and give you instant diversification. Against trendy stuff like crypto or meme stocks, index funds look painfully boring—but they are built around real companies selling products, paying salaries, and generating profits. For someone scared of the stock market, that boring, rules‑based approach is a feature, not a bug.

From “I’m Scared” to “I’m an Investor” in Three Moves

You don’t need to become a finance nerd to start. Boil it down to:

– Open an account with a low‑fee broker (Vanguard, Fidelity, or similar in your region).

– Choose one broad, low‑cost index fund (total market or S&P 500).

– Set up automatic monthly contributions, even if it’s $20.

Once those three pieces are in place, you are investing in the stock market without having to “play” it. Your job shifts from predicting the future to simply not quitting, letting time and diversification do the heavy work while you get on with living your life.