Why Envelopes Still Work (Even in 2025)

If money seems to evaporate from your account every month, the envelope method is basically a reality check in paper form.

Instead of wondering “where did my salary go?”, you decide in advance where every dollar is allowed to go — and you give it a “home” in an envelope (real or digital). When the envelope is empty, that’s it. No more spending in that category.

It sounds strict, but it’s actually freeing: you stop doing math in your head at the supermarket and just look at the envelope.

The catch? If you do it слишком жестко (too rigidly), you’ll burn out in a week. Let’s set it up so you stay sane.

—

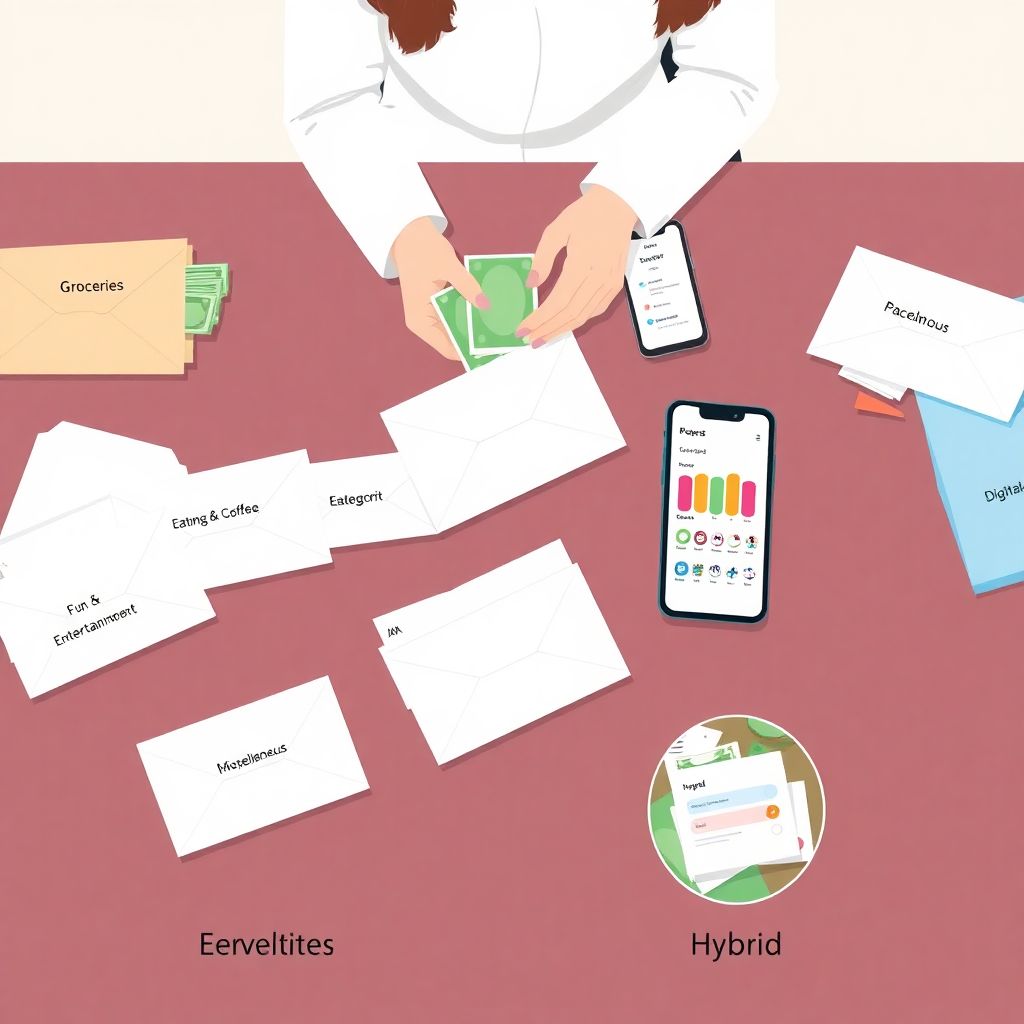

Step 1. Decide: Cash, Digital, or Hybrid?

There isn’t one perfect envelope budgeting system. There are three main flavors, and each has trade‑offs.

Option A: Classic Cash Envelopes

You take out cash after payday, split it into paper envelopes: Groceries, Transport, Fun, Eating Out, etc.

When the “Fun” envelope is empty, Netflix at home it is.

Плюсы:

– Очень наглядно: you literally see money leave.

– Great for impulse spenders — once the envelope is empty, impulse denied.

– Tech doesn’t matter: no apps, no syncing, no battery.

Минусы:

– Cash is inconvenient in a card‑first world.

– You can’t easily shop online.

– Easy to lose or misplace an envelope.

– Takes time every month to get and sort cash.

This is why people say the cash envelope system for beginners is powerful but “old‑school”. It trains discipline fast, but doesn’t always match real life.

Option B: Fully Digital Envelopes

Here, you keep your money in your bank account but split it into “virtual envelopes” in a digital envelope budgeting app or in your banking app if it supports categories.

Плюсы:

– Ideal if you mostly pay by card/phone.

– Automatic transaction import in many apps.

– Easy to adjust categories on the fly.

– Online purchases fit in naturally.

Минусы:

– Discipline relies on you actually checking the app.

– Some apps are confusing or overloaded with features.

– If you hate screens, you’ll ignore it.

This works well if you’re already comfortable with apps and don’t want to touch much cash at all.

Option C: Hybrid (Cash + Digital)

You use cash envelopes for the categories where you overspend the most (for many: Groceries, Eating Out, Coffee), and use digital envelopes for the rest (Bills, Subscriptions, Savings).

Плюсы:

– Strong behavior change where you need it most.

– Less cash handling than full‑cash.

– More realistic for online subscriptions, rent, etc.

Минусы:

– Двойной учёт: you track both cash and digital.

– Requires a simple system so you don’t lose track.

If you’re not sure how to start the envelope budgeting method, the hybrid variant is often the least stressful: you get the benefit of “feeling” money leave, without turning your life into a cash‑only experiment.

—

Step 2. Pick Your Categories (But Don’t Overdo It)

The mistake most newbies make: 27 tiny envelopes, from “snacks at the office” to “shampoo”.

That’s how you go crazy.

Instead, group things into bigger, realistic buckets. For a first month, you might try:

1. Groceries

2. Transport (fuel, public transit, taxis)

3. Eating Out & Coffee

4. Fun & Entertainment

5. Clothing & Personal Care

6. Miscellaneous

7. Savings / Debt Payment

Каждую следующую зарплату you can refine, but start simple. You want a system you’ll actually touch, not a museum of perfect categories.

—

Step 3. Assign Your Money Before You Spend It

On payday (или на следующий день, если очень устали) you do a little “budgeting ritual”.

If You’re Using Cash

1. Check your fixed bills (rent, utilities, minimum loan payments). These usually stay digital and go straight from your bank.

2. From what’s left, decide how much goes into each spending category.

3. Withdraw exactly that amount in cash.

4. Put it into envelopes, write category + amount on each.

Labeling matters. “Groceries – $300” on the envelope is a quiet commitment you see every time you shop.

If You’re Using a Digital App

Most tools that support the envelope budgeting system will let you “assign” money to categories instead of just listing transactions.

Look for features like “fund envelope”, “assign to category”, or “buckets”. Then:

1. Enter your income for the month.

2. Allocate every dollar (or euro) to a category until nothing is left “unassigned”.

3. Check that your must‑pay items (rent, debts, essentials) are fully funded first.

4. Only then fund “Fun”, “Eating Out”, etc.

If you’re hunting for the best apps for envelope budgeting, focus less on brand names and more on three questions:

– Can I see how much is left in a category at a glance?

– Is it quick to log/add a purchase?

– Do I understand the interface without a tutorial?

If “no” to any of these, you’ll stop using it in a week.

—

Step 4. The Daily Habit: Spending from Envelopes Only

This is where people either succeed or quit.

Rule for Cash Envelopes

If the purchase belongs to an envelope category, the money must come from that envelope.

Groceries? Use the Groceries envelope. Coffee out? Eating Out envelope.

No envelope on you? Two options:

– Don’t buy right now, or

– Borrow from another envelope and write it down immediately.

What you must not do: pay with your card “just this once” and promise yourself you’ll “fix it in the budget later”. That’s exactly how your system stops matching reality.

Rule for Digital Envelopes

After each shopping trip (or once a day), you open your app and:

– Check that each new transaction is categorized correctly.

– Correct anything that landed in “Other” or “Uncategorized”.

– Look at how much remains in that category.

Too busy for daily? Try a 3‑minute evening routine: phone in hand, receipts (or banking app) in front of you, update everything before bed.

Think of it like brushing your teeth: a small habit that prevents bigger, more expensive problems.

—

Step 5. Dealing with Empty Envelopes Without Losing Your Mind

At some point, one of your envelopes will hit zero before the month ends. This is the moment where the method really teaches you something.

Option 1: You Stop Spending

Envelope for Eating Out is empty? You cook at home. Fun envelope is gone? You find free activities.

This is the “purest” way — and the most educational. You feel the consequence of your earlier choices.

Option 2: You Move Money (On Purpose)

Sometimes, reality happens: unexpected guest, price increase, surprise school event.

You’re allowed to “steal” from another envelope, but always:

1. Write it down on the envelope (or in the app).

2. Decide which category will have to tighten its belt.

3. Accept that “more here” means “less there”.

The important part is that you consciously decide, not just swipe your card and hope it sorts itself out.

—

Step 6. End‑of‑Month Review (The Non‑Boring Kind)

Budgeting is not “set and forget”. It’s “set, test, adjust”.

At the end of the month, sit down for 15–20 minutes and ask:

– Which envelopes had money left over?

– Maybe you overestimated that category. You can shift some of it next month.

– Which envelopes were empty halfway through the month?

– Either your amounts were unrealistic, or you overspent on purpose. What will you change?

If you’re using a digital envelope budgeting app, this review is even easier: most tools show you graphs or category summaries. Ignore the fancy charts at first and focus on one thing: “Where did I feel squeezed, and where did I have slack?”

—

Common Mistakes That Make People Quit (And How to Avoid Them)

Mistake 1: Being Too Extreme from Day One

Some people decide to track every cent, cut every “unnecessary” purchase, and use only cash, starting Monday.

By Friday they hate life and budgeting.

What to do instead:

– Change 1–2 categories first (e.g., Groceries and Eating Out).

– Keep the rest of your spending “as usual” for a month.

– Once you feel confident, add more envelopes.

You’re not auditioning for a finance reality show; you’re building a habit you can keep for years.

Mistake 2: Way Too Many Categories

If your wallet or app has 18 envelopes, you’ll get tired just thinking about opening them.

Fix:

Start broad:

– Food (all food in one envelope)

– Transport

– Personal & Fun

– Bills

Then split only when a category is consistently a problem.

Mistake 3: Never Adjusting the Plan

Life changes, prices change, salaries change. If your envelopes never change, your budget slowly becomes fiction.

Fix:

Use your monthly review to tweak amounts:

– If you regularly have 30–50% left in a category, lower it.

– If you regularly blow through a category even when you try, raise it a bit (and reduce something less important).

—

Tips for Newbies to Stay Sane

1. Aim for “Better”, Not “Perfect”

Your first month won’t be accurate. That’s normal. The goal is simply to become more aware:

– “Wow, I really do spend that much on delivery.”

– “Apparently my ‘small’ subscriptions are not so small.”

Awareness alone often makes spending drop 10–20% without any strict rules.

2. Put Friction Where You Overspend

If your weakness is takeout, using cash for that category is powerful. Walking to the envelope makes you think twice.

If your problem is random online shopping, make it a rule to check your app first: if the “Fun” envelope is low, you wait 24 hours before buying.

3. Make It Visual

Whether you use real envelopes or an app, make your categories visible:

– Sticky notes on envelopes with little goals: “Dinner out with friends” or “Concert ticket”.

– In apps, rename categories to something that motivates you: not “Entertainment”, but “Weekend Joy”.

The more concrete the category feels, the easier it is to say “no” to random stuff and “yes” to what you actually care about.

4. Don’t Do It Alone If You Share Money

If you have a partner, and you secretly build a budget they know nothing about, expect conflict.

Better approach:

– Have a short talk: “I want to try envelopes for 1–2 months as an experiment, not a life sentence.”

– Agree on “no‑questions” money for each person — a small envelope that you can each spend however you like.

This prevents resentment and “budget policing”.

—

Comparing Approaches: Which One Fits You?

To tie it all together, here’s how the three approaches feel in real life.

Cash‑Only Envelopes

– Best if: you’re constantly overspending with cards and need a hard reset.

– Feels like: a strict but clear diet — limited choices, but no confusion.

– Risk: frustration with ATM runs and cash in a digital world.

Fully Digital Envelopes

– Best if: you’re tech‑friendly and rely heavily on online payments.

– Feels like: having multiple “sub‑wallets” in your phone.

– Risk: ignoring the app when you’re busy and slipping back into autopilot spending.

Hybrid System

– Best if: you want discipline where it hurts (food, fun) but convenience for fixed bills.

– Feels like: training wheels — structure where needed, freedom where not.

– Risk: mild confusion if you don’t have a simple process for tracking both cash and digital.

If you’re trying a cash envelope system for beginners and find it too rigid, switching to a hybrid or digital version is not “cheating”. It’s adapting. The real success is sticking with some version long enough to see your money behave differently.

—

Putting It All Together

Using envelopes — physical or digital — is less about stationery and more about decisions:

– You decide your priorities before the month starts.

– You watch how your real life matches (or doesn’t match) those priorities.

– You adjust. Repeat.

Choose one approach (cash, digital, or hybrid), keep your categories simple, update your envelopes regularly, and allow yourself a messy first month.

That’s how the envelope budgeting system works without driving you crazy: not as a punishment, but as a very honest mirror showing where your money actually goes — and giving you the power to change it.