Understanding the Basics

What exactly is a mutual fund?

A mutual fund is a pooled investment run by a professional manager. Imagine a big pot where thousands of investors throw in money, and a management team buys a basket of stocks, bonds or other assets according to a stated strategy. You buy “shares” of this pot, not of each individual company. The price of one share — NAV (net asset value) — is calculated once per day after the market closes. If you place an order at 11:00, you’ll get the end‑of‑day price, whatever it turns out to be. Most mutual funds still carry built‑in costs: a management fee, sometimes sales loads, and often minimum investment amounts that can feel unfriendly to first‑timers with smaller portfolios.

What exactly is an ETF?

An exchange‑traded fund, or ETF, is built from the same basic ingredients — a diversified basket of assets — but trades on an exchange like a regular stock. Instead of one end‑of‑day price, you get live prices from market open to close, and you can buy just one share at a time. Mechanically, ETFs use market makers and an “creation/redemption” process so that ETF share prices stay close to the value of the underlying basket. For you as a beginner, this mostly shows up as tighter spreads, lower ongoing fees, and flexibility: you can invest whenever the market’s open, often with no minimum investment beyond the cost of one share and your broker’s policies.

How ETFs and Mutual Funds Actually Work

A mental diagram of both structures

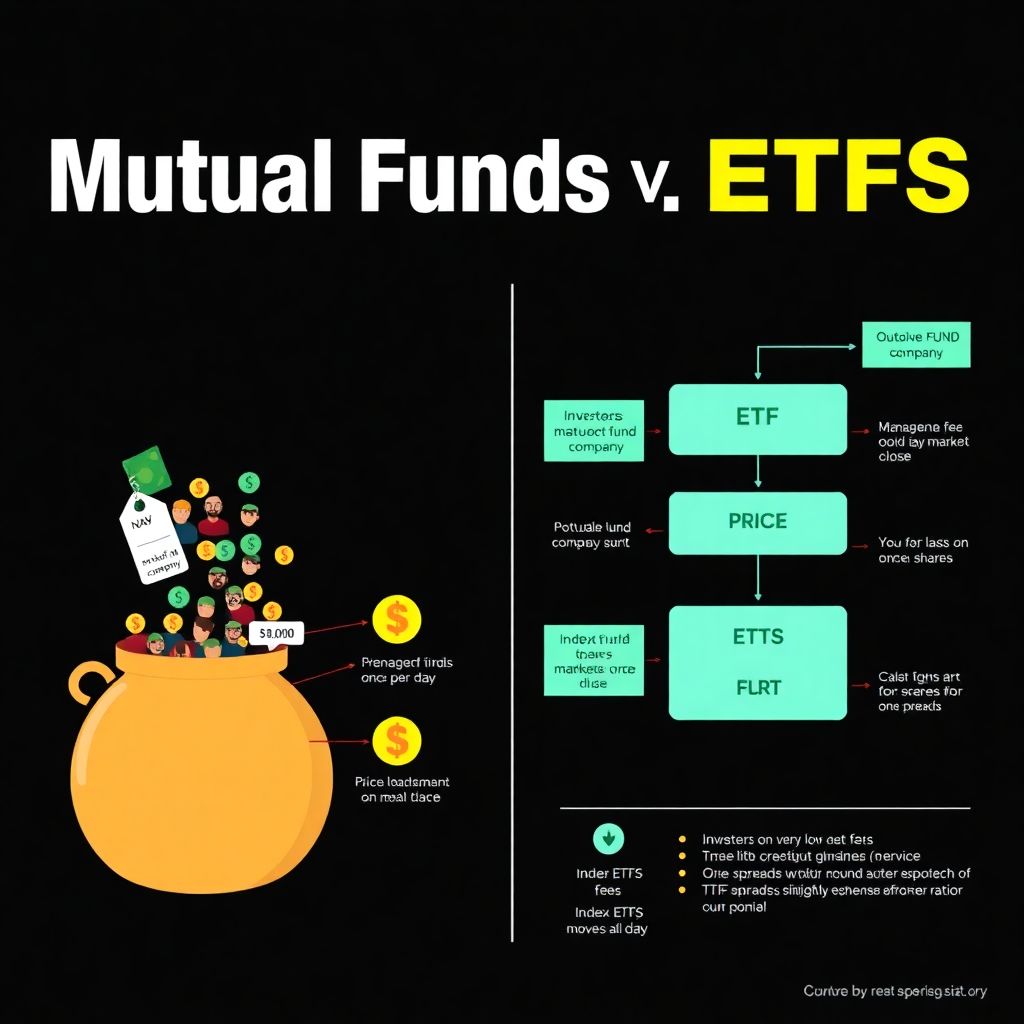

Picture two funnels leading into a big portfolio of assets. For a mutual fund, money from investors goes straight into the fund company, which issues or redeems shares at NAV once per day.

[Diagram: Investors → Mutual Fund Company → Portfolio, price set once daily.]

For an ETF, it’s a bit more layered: big institutions assemble baskets of securities and swap them with the ETF provider for ETF shares, while you trade those ETF shares with other investors on the exchange.

[Diagram: Investors ↔ Exchange ↔ Market Maker ↔ ETF Provider ↔ Portfolio, price moves all day.]

Same idea of pooling, but different plumbing, and that difference drives many of the pros and cons.

Fees, taxes and the small print

Costs are where ETF vs mutual fund investment for beginners starts to matter a lot. Many index ETFs have rock‑bottom expense ratios, sometimes under 0.05% per year, while comparable index mutual funds can be slightly more expensive due to legacy fee structures. Actively managed versions on both sides are pricier. In the US, ETFs often have a tax edge: the in‑kind creation/redemption mechanism lets them minimize capital gains distributions, whereas mutual funds frequently distribute gains when the manager sells appreciated holdings. For a long‑term, taxable account this difference compounds. However, in some countries local tax rules and fund wrappers can reduce or even reverse this advantage, so you need to check your jurisdiction rather than rely on US‑centric assumptions.

Choosing Your First Investment

How to choose between ETFs and mutual funds

When you think about how to choose between ETFs and mutual funds, start with your own constraints, not the marketing. If you prefer “set and forget” investing and your broker offers automatic monthly purchases, a mutual fund can be extremely convenient, especially for small, regular contributions. Many retirement plans still use mutual funds as the default building blocks. On the other hand, if you value intraday flexibility, want the lowest possible fees, or your broker offers commission‑free ETF trades, ETFs become attractive. Also consider minimums: some mutual funds require $1,000 or more to start, while you can often buy a single ETF share — or even a fractional share — making ETFs vs mutual funds for first-time investors tilt toward ETFs in many modern online platforms.

Risk, volatility and behavior

From a pure market‑risk standpoint, similar index ETFs and mutual funds tracking the same benchmark are almost identical. The real difference is behavioral. Because ETFs trade all day, it’s tempting to “check the price” constantly and overreact to short‑term swings. Mutual funds, priced once daily, put a natural speed bump between you and impulsive trading. Think of it as a throttle on your emotions. If you’re just starting out and know you’re prone to panic, a plain vanilla mutual fund inside an automatic investment plan might quietly protect you from yourself. Conversely, if you’re disciplined and simply want cheap exposure to a broad index, some of the best ETFs for beginners — broad market, low‑cost, high‑volume funds — are likely to be perfectly suitable.

Practical Comparisons and Examples

Real‑world scenarios for beginners

Consider two hypothetical investors in 2025. Alex opens a workplace retirement plan that only offers mutual funds; here, ETF vs mutual fund investment for beginners isn’t even a choice — Alex should just pick low‑cost index mutual funds and automate contributions. Meanwhile, Jamie uses a mobile broker that offers zero‑commission trading and fractional shares of ETFs. Jamie can buy $20 of a global stock ETF every payday, regardless of its current share price. In practice, Alex and Jamie might both own nearly the same underlying indexes; the wrapper is different, but the diversification, expected return drivers and long‑term strategy can be almost identical, as long as both keep fees low and contributions consistent through market ups and downs.

Comparisons with other investment options

When we talk about ETFs vs mutual funds which is better, it’s also helpful to contrast both with single stocks and with “alternative” platforms. Buying individual stocks gives maximum control but demands research, emotional resilience and time — not an easy starting point. Robo‑advisors often build portfolios entirely from ETFs, essentially automating what you could do yourself with a handful of broad funds. As for trendy app‑based products that resemble games, they may lack the diversification and transparent structure of ETFs and mutual funds. In that sense, plain diversified funds — in either wrapper — sit in a sweet spot between control and simplicity, offering exposure to thousands of securities with a few clicks and a clear rulebook behind the scenes.

Looking Ahead: The Future of Funds After 2025

Where the ETF–mutual fund debate is heading

By 2025, ETFs already hold a massive share of global assets, and the momentum is still with them. Many asset managers are converting old mutual funds into ETFs or launching “twin” vehicles that track the same strategy. We’re also seeing more active ETFs, factor‑based products and even semi‑transparent structures that blur the line between classic stock‑picking and index‑like efficiency. Over the next decade, expect user interfaces to hide much of the complexity: your app may simply ask about goals, risk tolerance and timelines, then place you in a model portfolio built from underlying ETFs and, in some regions, low‑cost mutual funds. The wrapper becomes less visible, while regulation, fee pressure and tax rules continue nudging providers toward more investor‑friendly, ETF‑style designs.

So which is better for your first investment?

For a first‑time investor in 2025, ETFs often have a slight edge: lower average fees, tiny or no minimums, easy access through modern brokers and strong tax efficiency in many markets. That said, if your main investing channel is a retirement plan full of mutual funds, forcing ETFs into the picture adds complexity without real benefit. Instead of chasing a single universal winner, think in layers: first, decide on an asset allocation that matches your risk and time horizon; second, pick diversified index products; third, choose the wrapper that best fits your platform, taxes and behavior. If you do that, the “ETFs vs mutual funds which is better” question becomes less about labels and more about calmly building wealth, one automated contribution at a time.