Historical Background

The concept of budgeting within households has evolved alongside economic and social shifts. In the early 20th century, family budgeting was largely informal and often managed by one partner, typically the homemaker. With the post-war rise of consumerism and dual-income households, financial planning became more complex. The 1980s and 1990s introduced personal finance education and budgeting software, while the digital age brought automated tools, mobile apps, and real-time expense tracking. Today, smart budgeting is not just a technical process but a collaborative strategy that reflects shared goals, transparency, and adaptive financial literacy for couples and families.

Core Principles of Smart Budgeting

Effective budgeting for couples and families rests on several foundational principles. First, open communication about income, debts, and spending habits is crucial. Without mutual understanding, even the best plans may fail. Second, prioritizing needs over wants helps align spending with long-term objectives. Third, budgets must be flexible to adapt to life changes—new jobs, children, or emergencies. Fourth, automation of savings and bill payments can reduce human error and delay. Finally, regular reviews—monthly or quarterly—ensure that the budget remains relevant and goals stay on track.

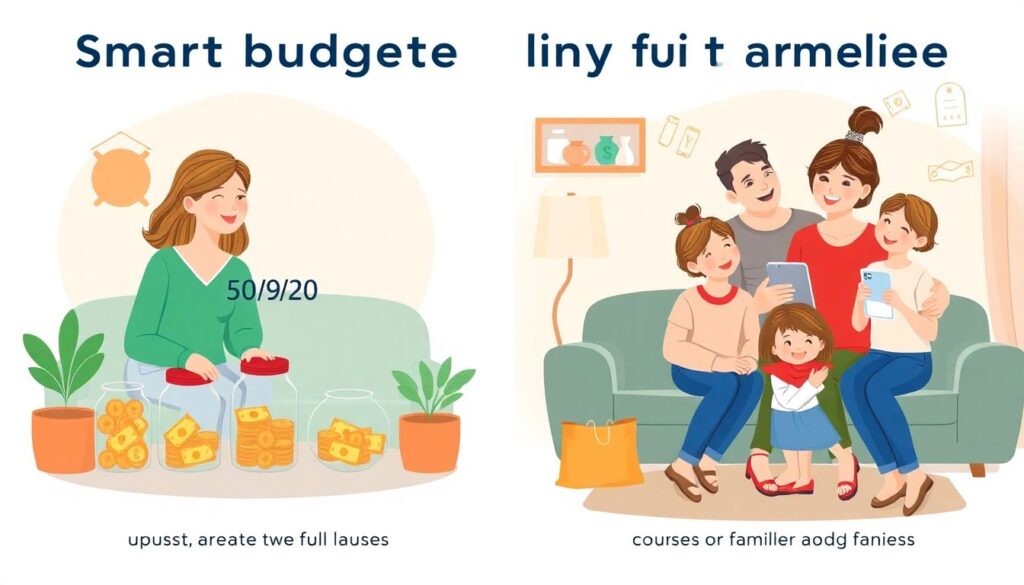

Implementation Examples

Smart budgeting can take various forms depending on family dynamics and financial objectives. For instance, a couple might use the 50/30/20 rule: allocating 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. Families with children often adopt envelope methods or app-based systems to categorize expenses like groceries, education, and entertainment. Another example is shared digital spreadsheets, where both partners input expenses in real time. Regular “money meetings” help track progress and adjust plans. The key is consistency: even simple systems work if applied diligently and transparently.

Common Mistakes by Beginners

Many new budgeters fall into predictable traps that undermine their efforts. Here are five frequent missteps:

1. Lack of Collaboration – One partner managing finances unilaterally often leads to miscommunication and resentment. Shared ownership encourages accountability and trust.

2. Overlooking Irregular Expenses – Ignoring annual or seasonal costs like insurance premiums or holiday spending distorts monthly budgets.

3. Being Too Rigid – Budgets that don’t allow for flexibility can fail when unexpected costs arise, leading to discouragement.

4. Underestimating Small Purchases – Frequent low-cost items (e.g., coffee, snacks) can accumulate and derail spending limits.

5. Setting Unrealistic Goals – Trying to save or cut expenses too aggressively can create frustration and result in budget abandonment.

Understanding and avoiding these pitfalls is essential for building a sustainable financial strategy that supports both daily needs and long-term goals.

Misconceptions About Budgeting

A prevalent misconception is that budgeting restricts freedom. In reality, a smart budget empowers individuals and families to make informed choices, reducing stress and enabling goal achievement. Another myth is that only low-income households need budgets. In fact, higher earners often benefit the most, as their complex financial situations demand structured planning. Some also believe budgeting is a one-time task; however, it requires regular updates in response to life changes. Finally, many assume budgeting tools alone ensure success, but without behavioral discipline and communication, even the best tools fall short.