Why Your Investment Portfolio Deserves Your Full Attention

Your investment portfolio is basically your financial story told in numbers: every stock, bond, fund or piece of real estate is a line in that story. When professionals talk about a “portfolio”, they simply mean the collection of all your investments viewed as a single whole, not as isolated bets. Experts often say that people obsess over picking the next “hot” stock, while real results come from how the overall mix is structured, monitored and adjusted. Thinking this way changes your focus from “Did I choose the right share?” to “Does my portfolio, as a system, match my goals, time horizon and nerves?” That mindset shift is the starting point for understanding what you actually own and why you own it.

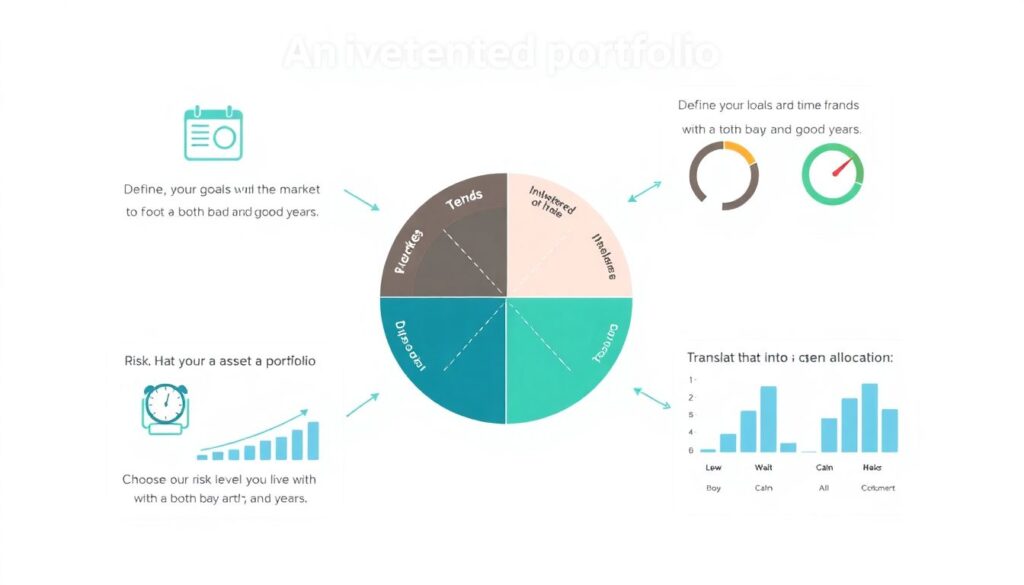

Key Terms: Risk, Return, Volatility And Allocation Without Jargon

To navigate your portfolio confidently, you need a few precise yet friendly definitions. “Return” is how much you gain or lose on an investment over a period, usually shown as a percentage. “Risk” is not just the chance of losing everything, but the range of possible outcomes: wide swings mean high risk, small swings mean lower risk. “Volatility” describes how jumpy the price is day to day, and it is one way of measuring risk. “Asset allocation” is simply how your money is split across major buckets such as stocks, bonds, cash and alternatives. Picture a pie chart: each slice is an asset class, and the angle of each slice shows its proportion in your total portfolio. Experts consistently agree that this split explains more of your long‑term results than individual security selection.

Seeing Your Portfolio As A System: Text-Based Diagrams

It often helps to visualise the architecture of your holdings in a simple text diagram. Imagine your net worth drawn as layers. At the top you have: GOALS → retirement, home, kids’ education. The next layer is TIME → short term (0–3 years), medium term (3–10), long term (10+). Below that sits STRATEGY → conservative, balanced, growth. Finally, at the bottom sits IMPLEMENTATION → specific ETFs, stocks, bonds and cash accounts. Read it top to bottom as “why → when → how much risk → what exactly”. Another useful mental diagram looks like this: INCOME NEEDS → expected withdrawals per year → stability bucket (cash, short bonds) + growth bucket (equities, real assets). When you map your actual accounts onto these sketches, it becomes clear where you are overexposed or underprepared.

What Diversification Really Means (And What It Doesn’t)

People often think owning many positions automatically means safety, but true diversification is more subtle. The goal is to combine assets that do not move in perfect lockstep, so that when one part zigs, another part zags or at least zigs less. Owning ten tech stocks is variety, not diversification, because they’re all driven by similar forces. A more robust structure mixes global equities, high‑quality bonds, some inflation‑linked or real assets, and a cash buffer for short‑term needs. Experts like to describe diversification as “defence, not magic”: it cannot eliminate losses, but it reduces the odds that a single event wrecks your entire plan. If you imagine another text diagram, think of columns for different regions, sectors and asset types; good diversification fills many columns reasonably, instead of stacking everything into one tall tower.

How To Build A Diversified Portfolio Step By Step

When you are figuring out how to build a diversified investment portfolio, start from your real‑life constraints, not from market headlines. First clarify your time horizon: money needed within a couple of years belongs mainly in cash and short‑term bonds, not volatile stocks. Next evaluate your emotional tolerance for losses; studies and expert interviews show that most people overestimate how calm they’ll be during a 30–40% market drop. Then translate this self‑knowledge into a target split, for example 60% global equities, 35% bonds, 5% cash for a moderate risk profile. Only after that should you pick specific funds or securities. A common expert recommendation is to lean on broad, low‑cost index funds as the core, and keep any speculative positions small enough that their failure would not derail your main goals.

Comparing DIY Approaches With Professional Management

There is a spectrum between managing every detail yourself and handing everything to professionals through investment portfolio management services. Doing it entirely solo gives you maximum control and typically lower explicit fees, but demands time, discipline and a decent grasp of tax rules and behavioural traps. Using a robo‑advisor sits in the middle: algorithms handle rebalancing and basic tax optimisation for a relatively low cost, following pre‑set models. Full‑service human managers can offer deeper planning, estate and tax coordination, and behavioural coaching, though fees are usually higher and quality varies widely. Seasoned experts often suggest starting with a simple, low‑cost structure you understand, and considering professional help mainly when your finances become complex, your time becomes scarce, or your emotions repeatedly sabotage rational decisions.

Tools And Apps That Help You Read The Numbers

Modern portfolio analysis tools for investors make it far easier to see what is actually going on inside your holdings. These tools can break down your exposure by region, sector, currency and asset class, estimate risk metrics, and simulate how your portfolio might have behaved in past crises. Many of the best investment portfolio apps also aggregate data from multiple brokers and retirement accounts, calculate your overall allocation, and alert you when you drift too far from your target mix. Experts recommend not getting lost in every metric available; instead, focus on a few key ones such as total fees, equity versus bond split, diversification across geographies, and the percentage of your portfolio in any single position. Use the software as an X‑ray, not as a slot machine.

When And How Often To Review Your Portfolio

A sensible review rhythm is crucial: too often, and you end up trading impulsively; too rare, and small drifts can turn into big mismatches. Many professionals suggest a structured check‑in once or twice a year, plus a special review after major life events like job changes, inheritance or new dependants. During a review, you compare your current allocation with your target diagram, rebalance by trimming what grew too large and topping up what shrank, and verify that your investments still match your goals and time horizon. Imagine another text diagram: TODAY’S PORTFOLIO → compare to TARGET → decide REBALANCE ACTIONS → log REASONS. Writing down your reasoning creates a paper trail that makes you less vulnerable to panic or euphoria in the next market swing.

The Role Of Human Advice In A Digital World

Even with good software, many people benefit from a trusted financial advisor for investment portfolio decisions, especially when emotions run high. A competent advisor does more than pick funds; they translate complex choices into plain language, challenge overconfident assumptions, and help you stay the course during stressful markets. Expert panels often emphasise the importance of checking how an advisor is compensated, preferring transparent, fee‑only arrangements where they are paid for advice, not for selling specific products. Think of the advisor as a coach who helps you design the playbook (your long‑term plan and allocation) and also keeps you from abandoning it after one bad quarter. If you choose to stay fully DIY, it may still be useful to book a one‑off session every few years to audit blind spots.

A Walkthrough Example: Turning A Mess Into A Coherent Plan

Imagine someone in their late thirties with three brokerage accounts, a workplace retirement plan and a forgotten old pension. On paper they own twenty‑five different funds and a scattering of individual stocks, yet they have no idea what their overall picture looks like. Using an app that aggregates accounts, they discover that 80% of their money is actually in US tech, with minimal bonds and no international diversification. Following expert recommendations, they sketch a target diagram: 70% equities split between domestic and global markets, 25% high‑quality bonds, 5% cash. Over several months they simplify by selling overlapping funds, buying a few broad index ETFs that match the plan, and setting up automatic contributions. The number of positions shrinks, but the clarity and resilience of the portfolio increase dramatically.

Putting It All Together Without Overcomplicating Things

Understanding your investment portfolio is less about mastering exotic products and more about seeing the big picture in a structured, honest way. Define your goals and time frames, choose a risk level you can live with in bad years as well as good ones, translate that into a clear asset allocation, and then use simple, diversified tools to implement it. Periodically review, rebalance, and adjust only when your life changes, not because markets are noisy. Whether you rely mainly on your own judgement, lean on technology, or work with professionals, keep asking one grounding question: “Does this portfolio still make sense for the person I am and the future I want?” If you can answer that calmly and clearly, you are already doing what many seasoned experts consider the core of sound investing.