Category: Budgeting Basics

-

The psychology of overspending: why you blow your budget and how to finally stop

Money leaks are rarely about math. You know how to add and subtract. Yet somehow your bank balance keeps surprising you—in the bad way. That gap between “I’ll be careful this month” and “How did I spend all of that?” is exactly where the psychology of overspending lives. Let’s unpack what’s going on in your…

-

Wants that pay you back: turn everyday treats into smart income-boosting buys

Wants That Pay You Back: Turning “Treats” into Income-Boosting Purchases We’re not going to pretend you’ll stop buying coffee, gadgets, or “little treats.” You won’t. The smart move isn’t to cut all wants, but to make more of them *pay you back* — in cashback, points, assets, or skills that raise your future income. Below…

-

Etfs vs mutual funds for beginners: which is better for your first investment

Understanding the Basics What exactly is a mutual fund? A mutual fund is a pooled investment run by a professional manager. Imagine a big pot where thousands of investors throw in money, and a management team buys a basket of stocks, bonds or other assets according to a stated strategy. You buy “shares” of this…

-

Lifestyle creep: silent budget killer and how to stop it without feeling deprived

What Lifestyle Creep Really Is (And Why It Sneaks Up On You) How Lifestyle Creep Starts Quietly Lifestyle creep rarely выглядит как драматичный разворот: никто не просыпается и не решает «сломать бюджет». Всё начинается мягко: вы переходите с обычного кофе на ежедневный раф, вызываете такси вместо метро «лишь бы не опоздать», снимаете жильё чуть дороже,…

-

How to create a no-guilt fun money category in your budget for stress-free spending

Most people either ignore fun money completely or swing to the other extreme and blow whatever’s left in their account. Both пути приводят к чувству вины и хаосу. Идея “no-guilt” fun money в том, чтобы заранее решить, сколько можно тратить на радости, и потом спокойно наслаждаться ими. Это не про строгую экономию, а про осознанные…

-

Index funds starter guide: how to invest even if you’re scared of stocks

Why Index Funds Feel Safer Than “Stock Picking” Бuying a single stock feels like betting on one horse. If it stumbles, your money limps with it. Index funds spread your money across dozens, hundreds, sometimes thousands of companies at once. When you own an S&P 500 index fund, you’re basically buying a tiny slice of…

-

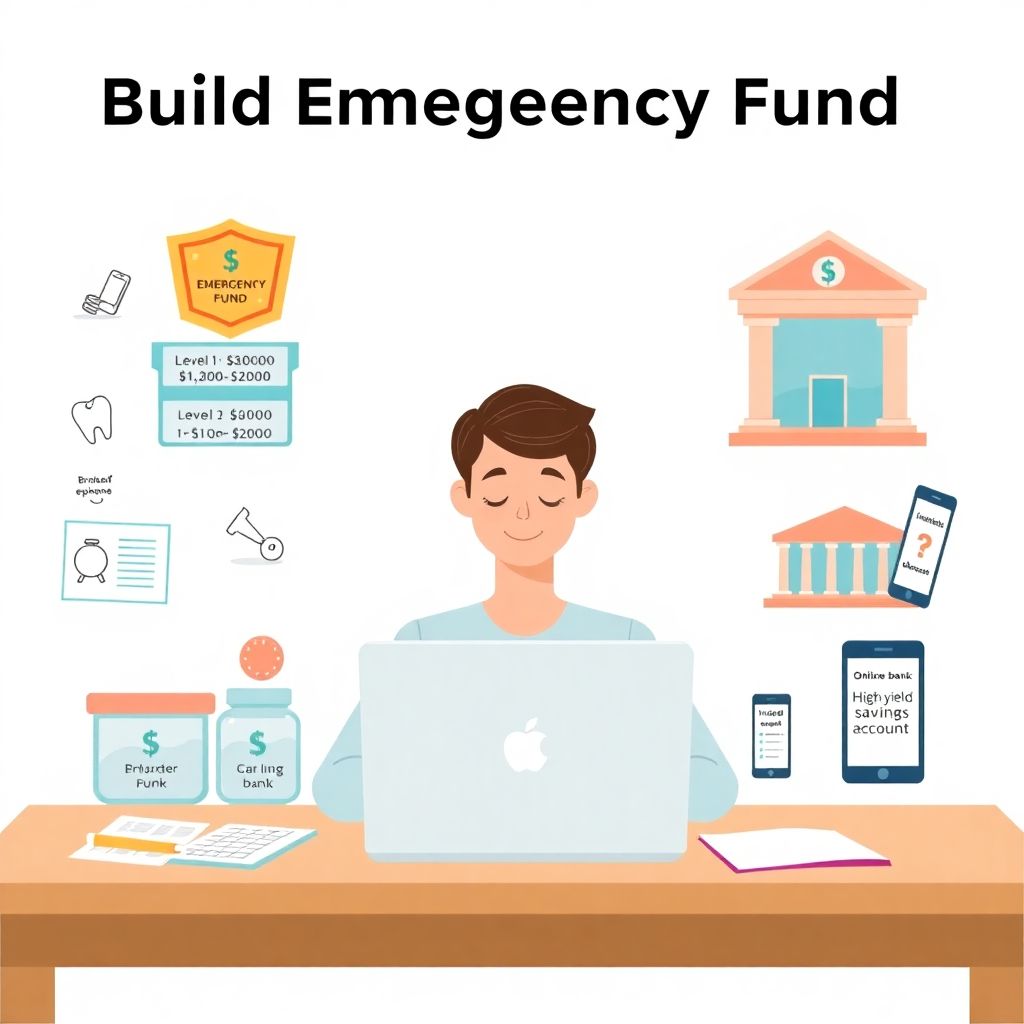

Building an emergency fund: how much you need and the best places to keep it

Why an Emergency Fund Matters More Than You Think An emergency fund звучит скучно, пока не прилетает счет за срочный ремонт зуба или увольнение «с понедельника». В этот момент деньги на депозите внезапно становятся свободой выбора: вы не соглашаетесь на токсичную работу, не влезаете в кредитку под 20% годовых и не просите взаймы у родственников….

-

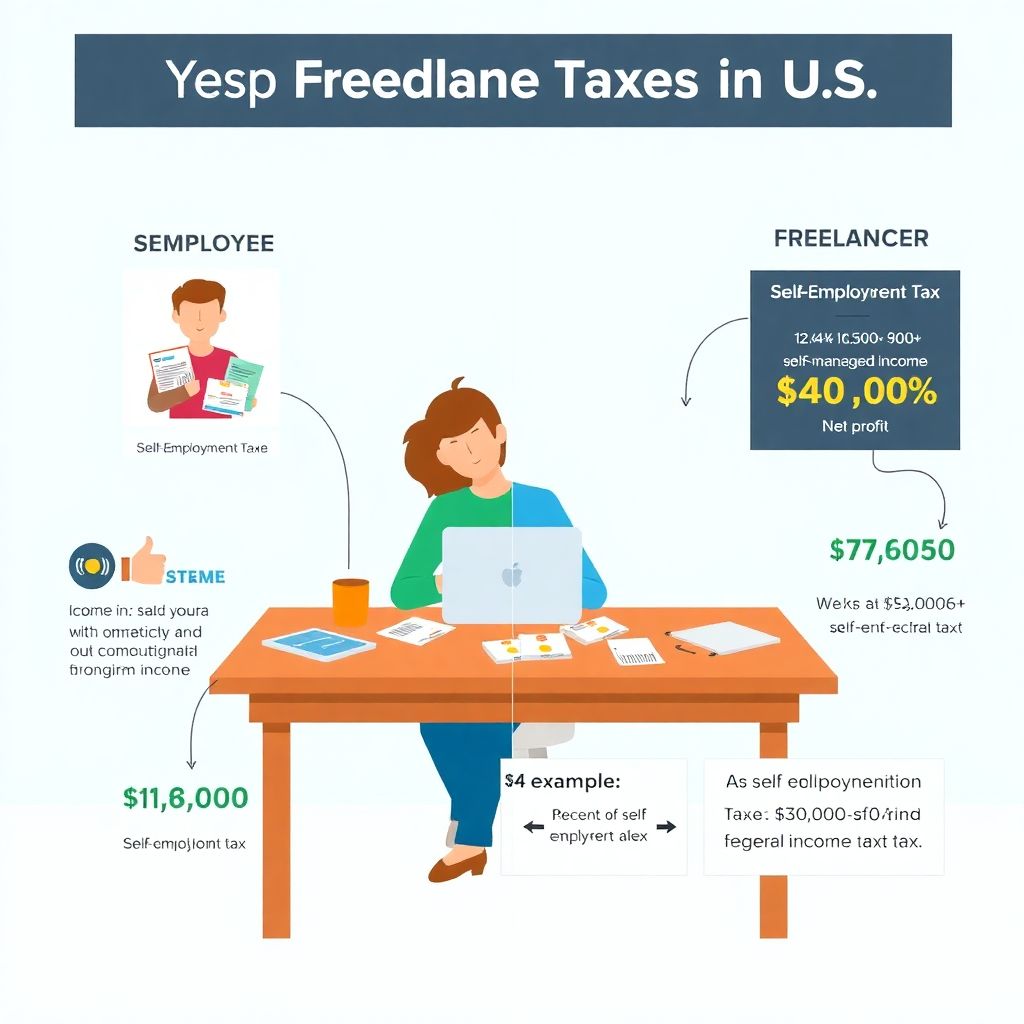

Understanding your tax obligations as a freelancer in the united states

Why Freelancers Need to Treat Taxes Like a Business Problem When you go freelance, nobody withholds taxes from your paycheck. That feels great in the beginning… until your first big tax bill lands and you realize: “Wait, I owe how much?” As a freelancer you’re effectively running a small business, even if it’s just you…

-

Budgeting for a home renovation on a realistic timeline without costly delays

Why Budgeting for Renovation in 2025 Is a Different Game Inflation, TikTok Trends and the “Renovation Trap” Renovating in 2025 feels very different from even three years ago: materials keep jumping in price, labor is booked out months ahead, и соцсети подкидывают тысячи красивых, но дорогих идей. Люди часто попадают в «renovation trap»: начинают с…

-

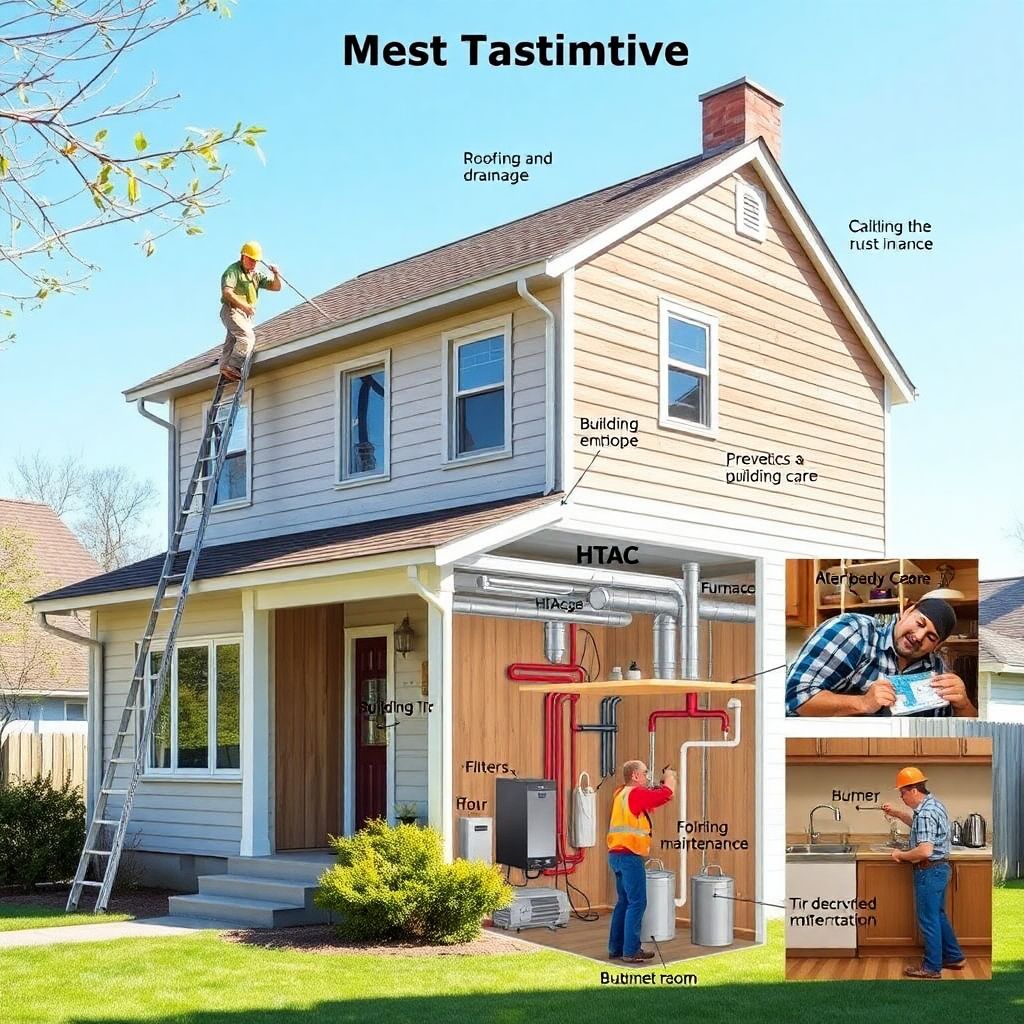

Cost-effective home maintenance: a practical guide to saving money

Why Cost-Effective Home Maintenance Matters More Than Ever Many people think of home maintenance as a never‑ending list of annoying chores, but in reality it’s one of the cheapest forms of insurance you can buy. When you handle small issues early, you avoid the big, dramatic failures that wreck your budget and your nerves. This…