Category: Lifestyle & Finance

-

Use your credit card as a financial tool to build credit and manage money

Rethinking Your Credit Card: From Plastic Trap to Power Tool Most people see a credit card as either “free money” or “a dangerous debt machine.” Both крайние позиции мешают использовать карту как продвинутый финансовый инструмент. Правильный подход ближе к тому, как инвесторы относятся к капиталу: считать проценты, оценивать риск и максимально выжимать выгоду из каждого…

-

Budget wedding planning guide: how to save money and still enjoy your big day

Why Wedding Budgeting Became a Thing Before Pinterest boards and Instagram-perfect decor, weddings were usually small community events: church, backyard, a dress sewn by a relative, food cooked by the family. Money, конечно, тратили, но никто не говорил о «концепции бюджета» — делали ровно столько, сколько позволяли карман и помощь родственников. В середине XX века,…

-

The beginners guide to understanding your credit history and improving it

Why your credit history secretly runs your financial life Your credit history is basically your financial reputation on paper. You don’t see it в магазине, никто его не спрашивает вслух, но от него зависит, дадут ли вам ипотеку, одобрят ли аренду квартиры, повысят ли кредитный лимит и даже возьмут ли на работу в некоторых сферах….

-

Budgeting software options: how to choose the best tools for your finances

Mapping the Budgeting Software Landscape in 2025 Budgeting tools in 2025 are no longer just fancy spreadsheets with charts. They’ve turned into full‑blown financial control centers that sync with banks in real time, categorize expenses with machine learning and forecast cash flow using behavioral data. When people search for the best budgeting software for personal…

-

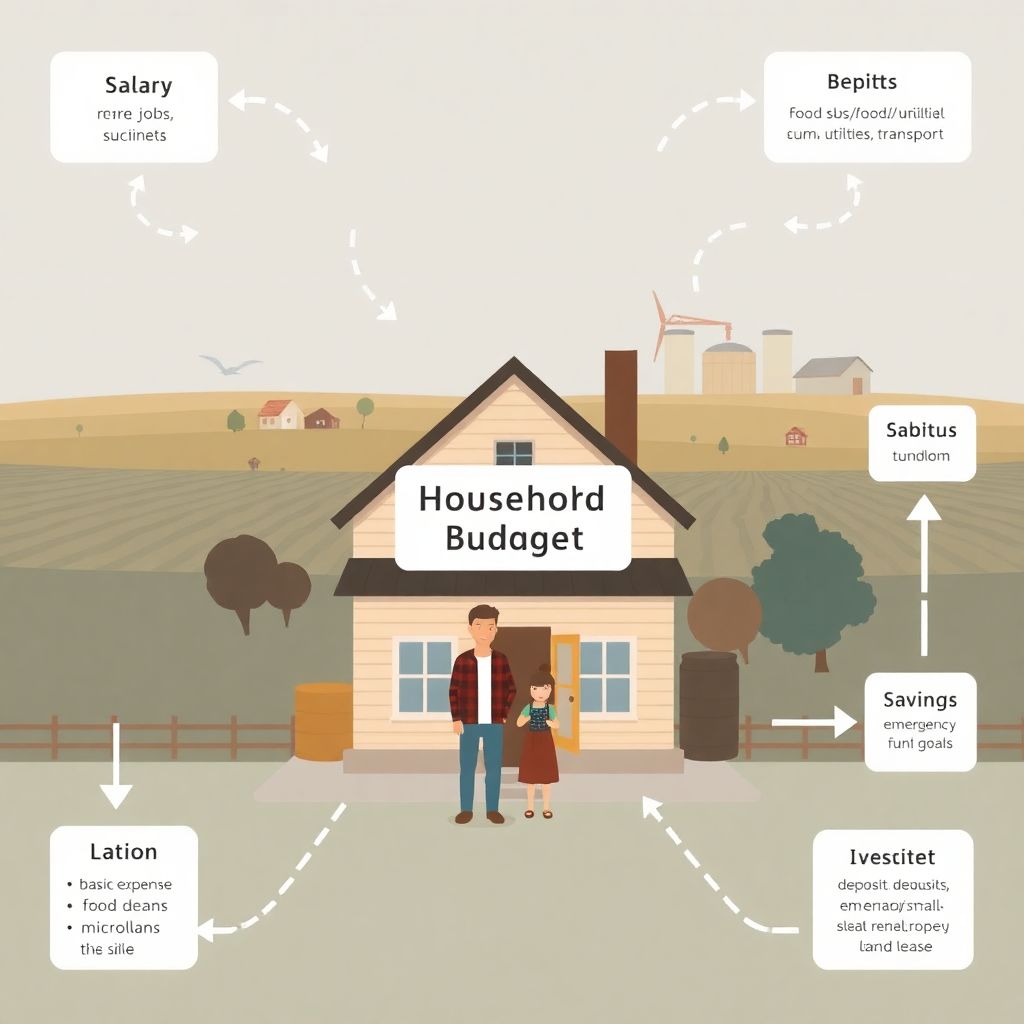

Personal finance fundamentals for small-town living and everyday money success

Why Small-Town Personal Finance Feels Different (And Why It Really Is) Money in a small town lives по своим законам. Формально, те же правила: зарабатывай больше, чем тратишь, откладывай, инвестируй, страхуйся. Но контекст другой: меньше вакансий, ниже цены на жильё, ограниченный доступ к банкам и специалистам, сильнее влияние соседей и родных. Именно поэтому «personal finance…

-

Digital transformation budgeting for your life: how to plan and manage costs

Why your money needs a digital upgrade Imagine your money life as an old office packed with paper folders. Everything вроде работает, but you waste time, lose details and constantly “check later”. Budgeting for a digital transformation in your life — это про то, чтобы навести порядок, не превращаясь в бухгалтера. Цель не в том,…

-

Short guide to building wealth in your 20s and creating a rich future

Why Your 20s Are the Best (and Weirdest) Time to Build Wealth Building wealth в 20 лет звучит как что‑то из взрослой жизни, в которую вы еще не полностью вписались. Доход нестабилен, карьерный путь туманен, а советы из соцсетей часто противоречат друг другу. Тем не менее именно сейчас решается, будете ли вы постоянно «догонять» деньги…

-

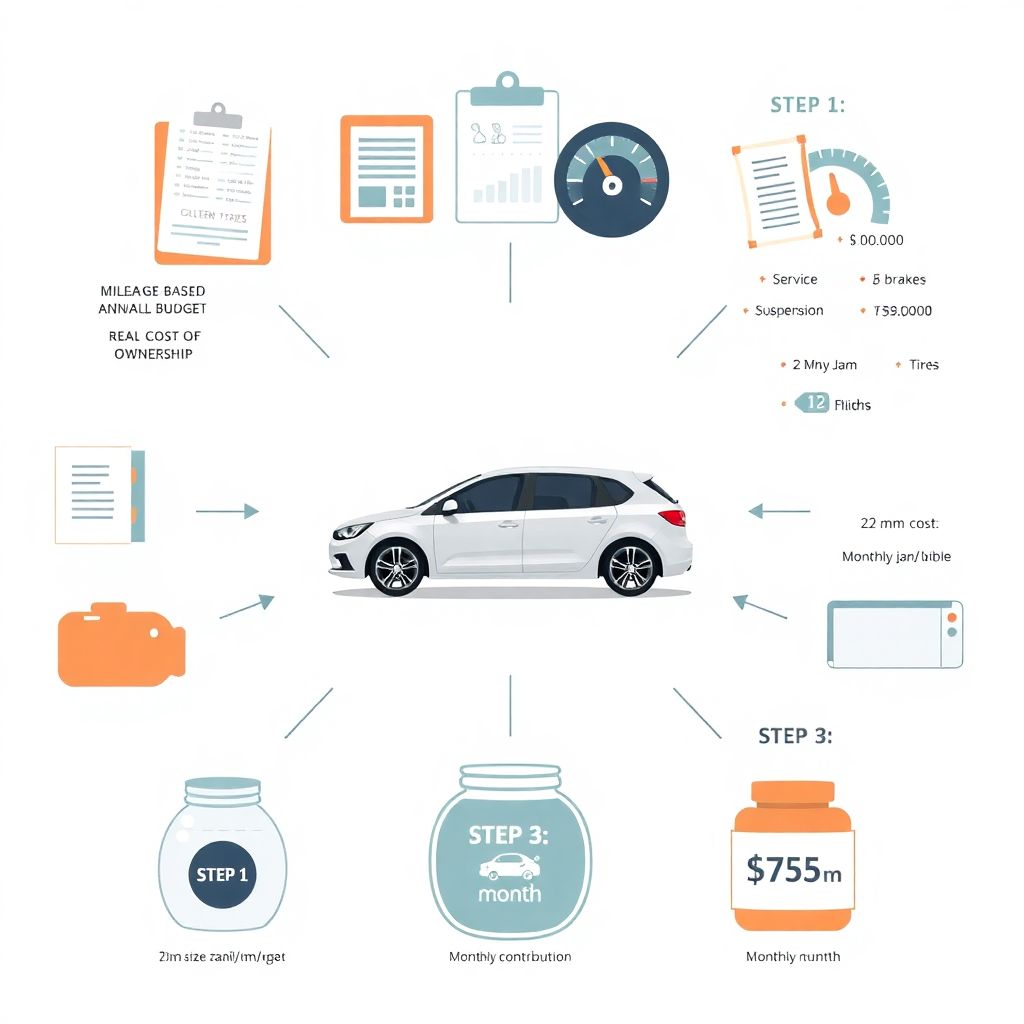

How to create an auto budget for car maintenance and cut ownership costs

Why an Auto Budget for Car Maintenance Is Non‑Optional Most drivers планируют только бензин и страховку, а обслуживание вспоминают, когда мотор уже «кричит о помощи». В итоге ремонт всегда кажется внезапным и дорогим. На деле львиная доля расходов предсказуема: ТО, колодки, шины, жидкости, мелкие поломки из‑за износа. Продуманный авто‑бюджет превращает хаотичные траты в управляемый поток:…

-

Debt reduction tactics for small business owners to regain financial control

If you’re staring at a pile of bills and wondering how you’ll ever get your company out from under it, you’re not alone. Many owners only start thinking seriously about debt when the pressure is already painful: calls from creditors, sleepless nights, juggling payroll and rent. The main thing is not to panic and not…

-

Understanding your employee stock purchase plan benefits and how to maximize them

Why Employee Stock Purchase Plans Matter in 2025 Understanding your employee stock purchase plan benefits has become a real edge in 2025. Компании все чаще используют ESPP, чтобы конкурировать за таланты, а не только раздавать классические опционы и бонусы. При высокой инфляции и волатильных рынках возможность покупать акции со скидкой 10–15% выглядит не как приятный…