Category: Saving Strategies

-

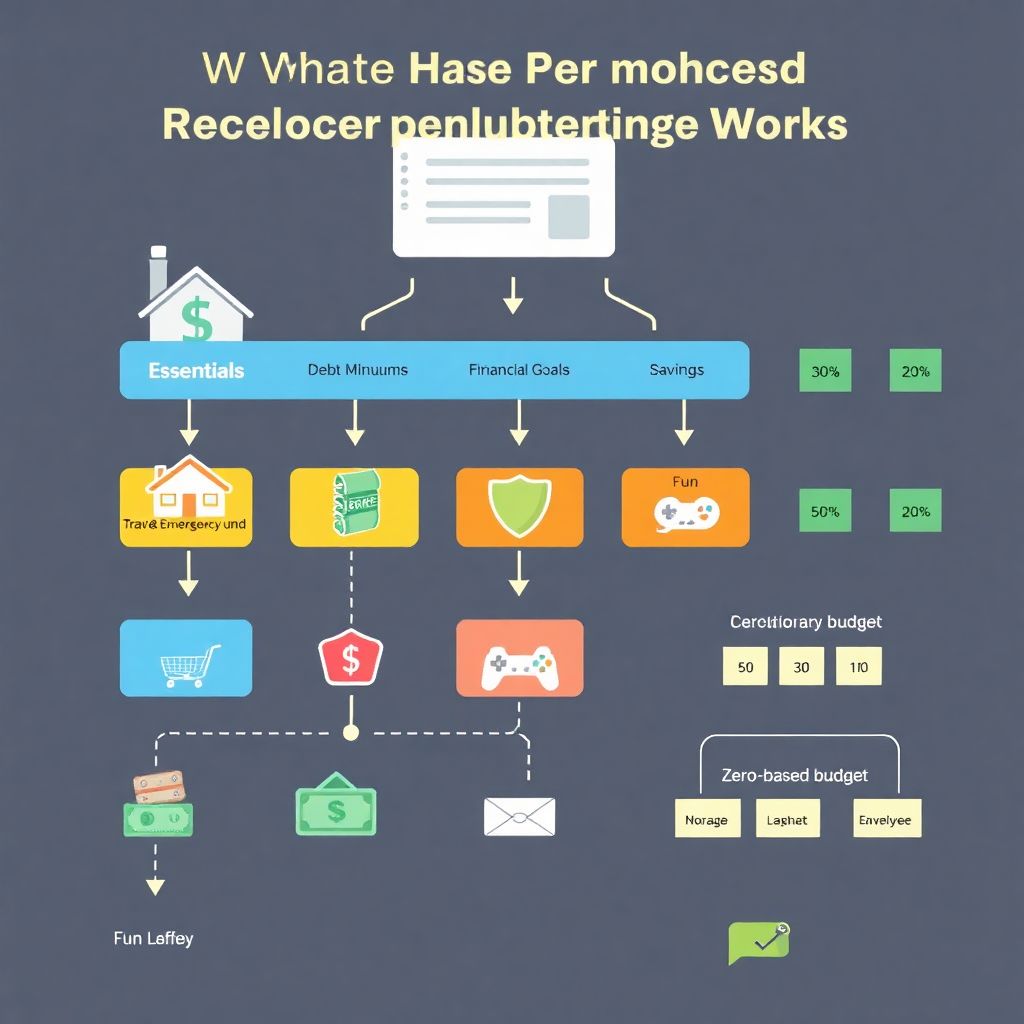

From paycheck to plan: create your first realistic budget that actually works

Why Your Budget Keeps Failing (And Why This One Won’t) Most people don’t need another lecture about coffee or avocado toast. The real problem is that traditional budgets feel like punishment: lots of spreadsheets, no flexibility, zero connection to real life. When we talk about how to create a realistic budget that works, мы имеем…

-

How to automate your finances for saving and investing on autopilot

Why automation in 2025 is no longer optional In 2025 money moves on its own: instant payments, one‑click investing, salary in crypto or stablecoins, AI‑driven banking. Against this background, trying to budget in Excel feels like using a fax. When you automate your finances, you’re not just saving time — you’re protecting yourself from fatigue,…

-

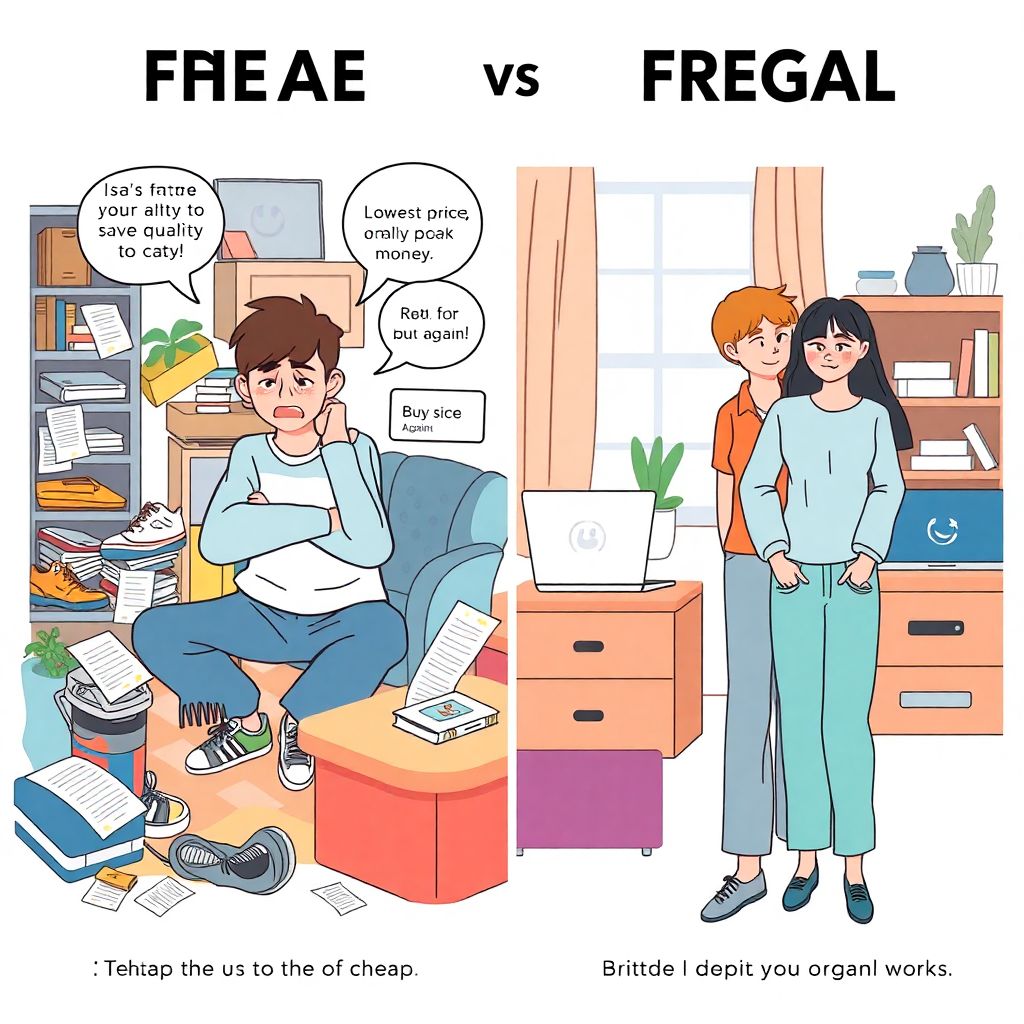

Frugal vs cheap: cut costs wisely without ruining your quality of life

Frugal vs Cheap: Why the Difference Matters What “Frugal” Really Means (And Why It Feels Better) Frugal doesn’t mean counting every grain of rice. It’s about asking: “What brings me real value?” и then consciously cutting всё остальное. The frugal vs cheap difference в том, что дешёвый подход игнорирует последствия: купил что подешевле — сломалось,…

-

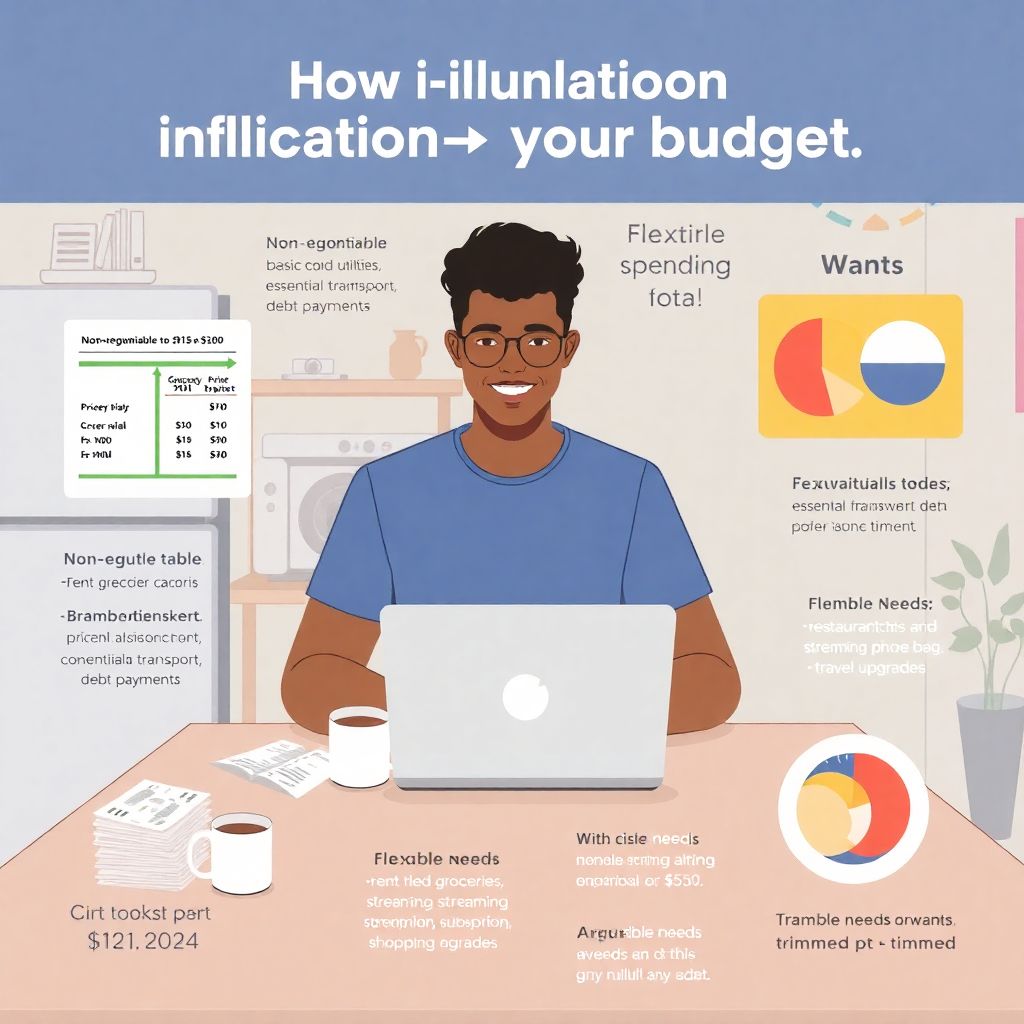

Inflation-proof your budget by balancing needs, wants and investments

Why your budget suddenly feels too tight If your paycheck seems to disappear faster than it did a couple of years ago, you’re not imagining things. Prices really did jump — and then kept creeping up. That’s exactly why people are searching for how to inflation proof your budget instead of just “how to save…

-

Sinking funds: the overlooked savings strategy to stop surprise bills

Why sinking funds quietly solve “surprise” bills Sinking funds are just labeled mini‑savings buckets for known‑in‑advance, irregular costs: car repairs, holidays, vet visits, annual subscriptions. Instead of panicking when the bill drops, you’ve been pre‑funding it every month in tiny portions. That’s the core of sinking funds how to start: you identify predictable but non‑monthly…

-

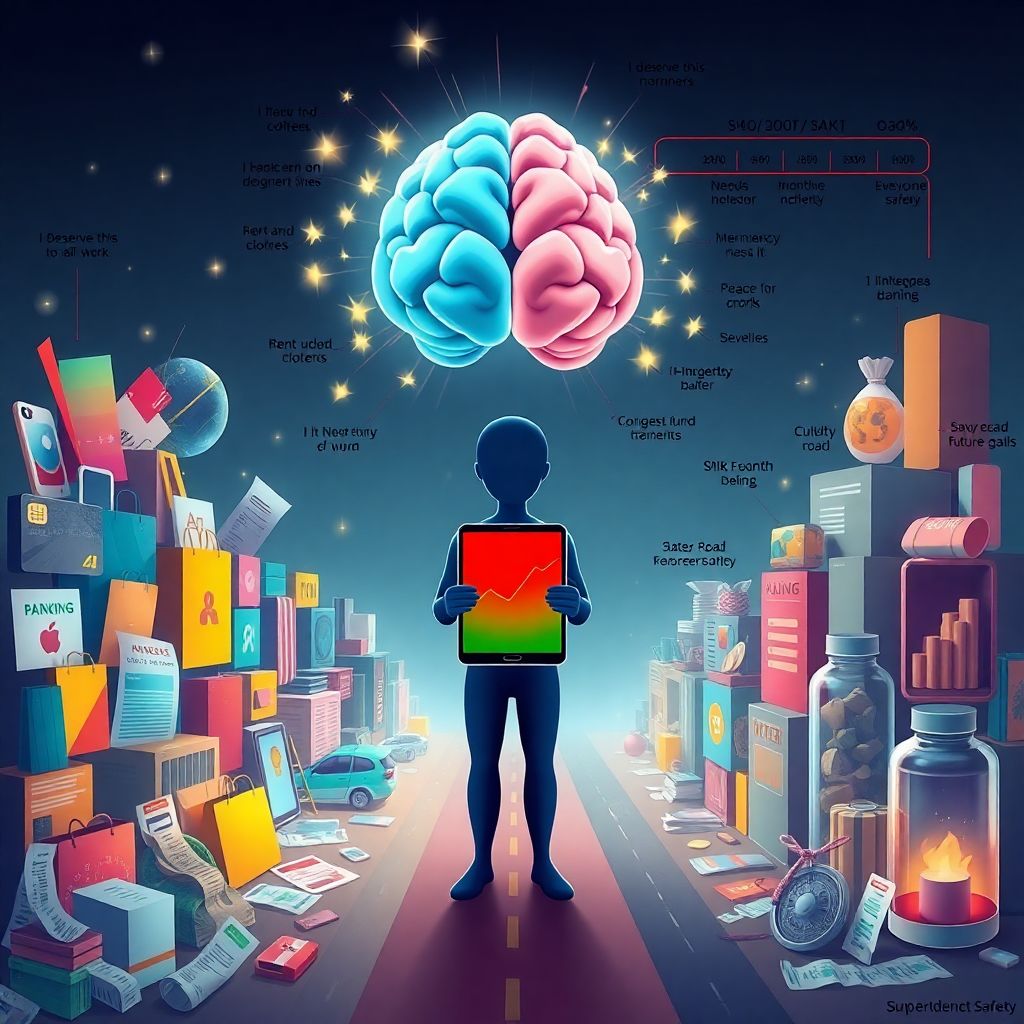

The psychology of wants vs needs: train your brain to spend money wisely

The silent war between your wants and needs Most people think they know the difference between “want” and “need” until they open their banking app and panic. On бумаге everything is clear: rent, food, meds are needs; gadgets, trips, décor are wants. But in real life the line gets blurry fast. “I need a new…

-

Lifestyle creep: how small upgrades quietly destroy your long-term wealth

Historical roots of lifestyle creep The term “lifestyle creep” sounds modern, but the phenomenon is as old as money itself. As soon as people started earning more than им было нужно для выживания, они тут же искали способы потратить излишек на статус и комфорт. В индустриальную эпоху рост зарплат рабочих тут же съедался модной одеждой…

-

How to invest for growth while protecting capital in todays markets

Why growth plus protection beats “all or nothing” investing When люди ищут how to invest for growth and capital preservation, многие мысленно делят варианты на два лагеря: либо максимальный риск ради доходности, либо полная оборона и деньги мертвым грузом на депозите. В реальности устойчивый рост капитала строится между этими крайностями. Ваша задача — не угадывать…

-

Budgeting for a seasonal business cycle to stabilize cash flow and profits

Why Seasonal Budgeting Feels So Hard (and Why It’s Different in 2025) Budgeting for a seasonal business cycle отличается от классической модели «ровного» года, потому что ваша выручка ведет себя как синусоида, а обязательства — как прямая линия. В 2025 году это особенно заметно: циклы спроса усиливаются из‑за климатических сдвигов, турпотоков и онлайн‑трафика, который резко…

-

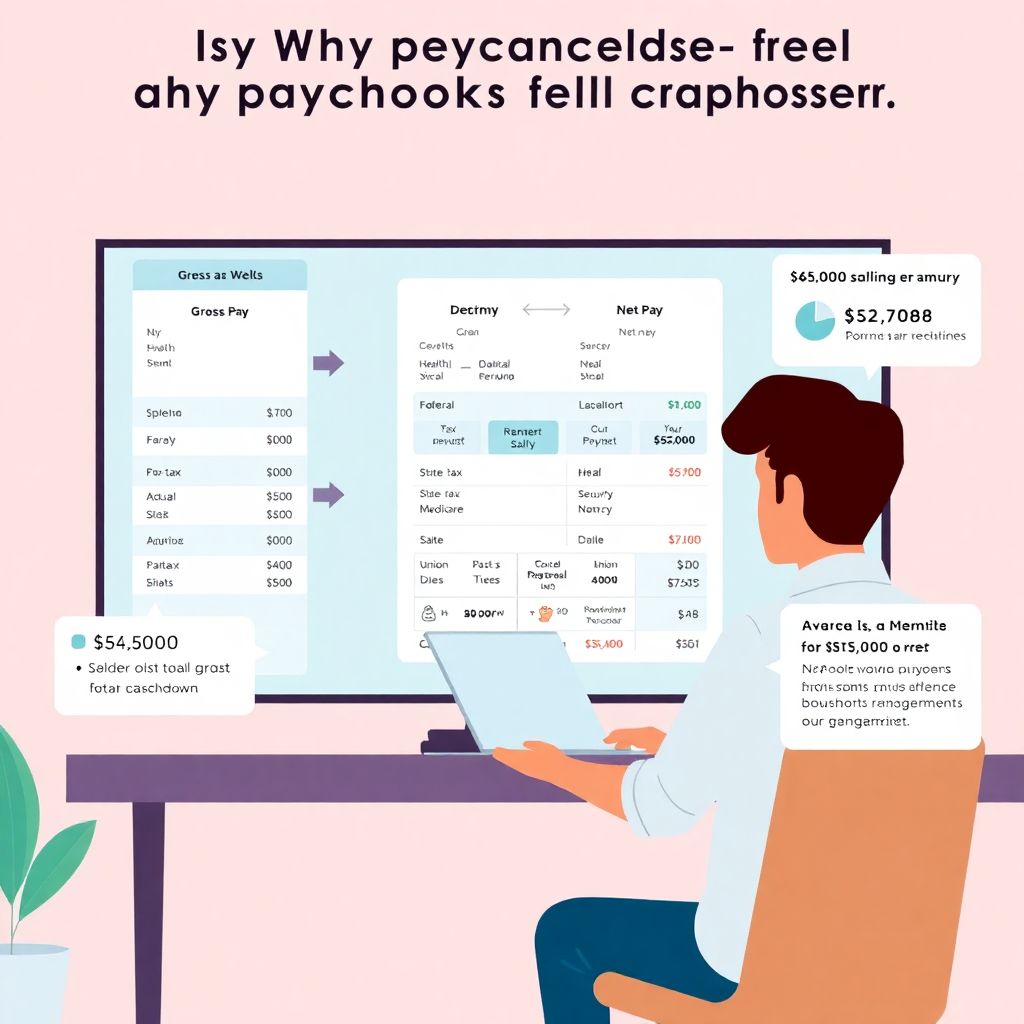

Understanding your paycheck: net pay and benefits explained clearly

Why your paycheck feels like a mystery (and why it shouldn’t) If every payday you open your banking app, see the number, and think “wait, that can’t be right,” you’re not alone. Modern paychecks mix taxes, insurance, retirement, and random-looking codes that make it hard to answer a basic question: how much did I actually…