Category: Saving Strategies

-

Smart budgeting for college graduates entering the workforce: essential tips

Why Smart Budgeting Matters Right After Graduation You’ve got a degree, a job offer, and maybe a half-broken coffee machine from your dorm. What you probably don’t have yet is a clear system for managing the money that’s about to start flowing into — and out of — your bank account. Smart budgeting isn’t about…

-

How to invest in a tax-advantaged way and legally reduce your tax bill

Инвестировать с умом — это не только выбрать хорошие активы, но и не отдавать лишнее налоговой. Tax‑advantaged подход — это попытка собрать максимум посленалоговой доходности, а не просто гнаться за красивыми цифрами до налогов. Финансовые консультанты часто говорят: два портфеля с одинаковой «сырой» доходностью могут дать очень разный результат на руки, если один построен с…

-

Beginner’s guide to understanding your mortgage payments and monthly costs

Why Your Mortgage Payment Is More Than Just the Loan Понимание ипотеки начинается с осознания простой вещи: ваш «ежемесячный платеж» — это не только возврат долга банку. В него обычно входят основной долг, проценты, налоги, страховка, а иногда и взносы по HOA. Новички часто смотрят только на процентную ставку и радуются «дешевой» ипотеке, но затем…

-

How to use a spending journal to improve your budget and control your money

Most people don’t overspend because they’re bad with money; they overspend because they don’t actually see where their money goes. In 2025, with instant payments, subscriptions, and “buy now, pay later” everywhere, money leaks are almost invisible. That’s where a spending journal comes in. It’s basically a zoomed‑in diary of your daily transactions that helps…

-

Practical guide to understanding your retirement accounts and planning ahead

Why Your Retirement Accounts Matter More Than You Think Turning vague worries into a concrete plan Most people treat retirement accounts like a black box: money goes in, statements arrive, anxiety lingers. Instead of pretending to understand everything, imagine you’re learning the “operating manual” for your future lifestyle. When you see the different retirement account…

-

Maximize your savings with a high-interest savings account and grow money faster

Why a High-Interest Savings Account Can Change the Game Most people treat savings accounts like a dusty drawer: you put money in and try not to think about it. The problem is that a regular account at a brick-and-mortar bank often pays something like 0.01–0.10% APY, which is basically nothing. With inflation hovering around 3–4%…

-

Personal finance essentials for military families to build stability and security

Why money works differently for military families Personal finance for military families выглядит иначе, чем для гражданских, и это не просто фигура речи. Зарплата разбита на оклад и надбавки, переезды происходят чаще, чем смена сезонов, супруг может то работать, то терять работу из‑за PCS, а к этому добавляются боевые командировки, льготы, особые кредиты и специфическая…

-

How to build a budget that supports career growth and long-term success

Most people планируют бюджет вокруг выживания: аренда, еда, кредиты, максимум отпуск. Но если честно, такой подход не помогает расти в профессии. Деньги просто «гасит пожары», вместо того чтобы работать как топливо для роста. Бюджет, который поддерживает карьеру, выглядит иначе: в нём есть отдельная строка на обучение, переход в другую сферу, сеть контактов и даже запас…

-

How to navigate student loan forgiveness programs and maximize your relief

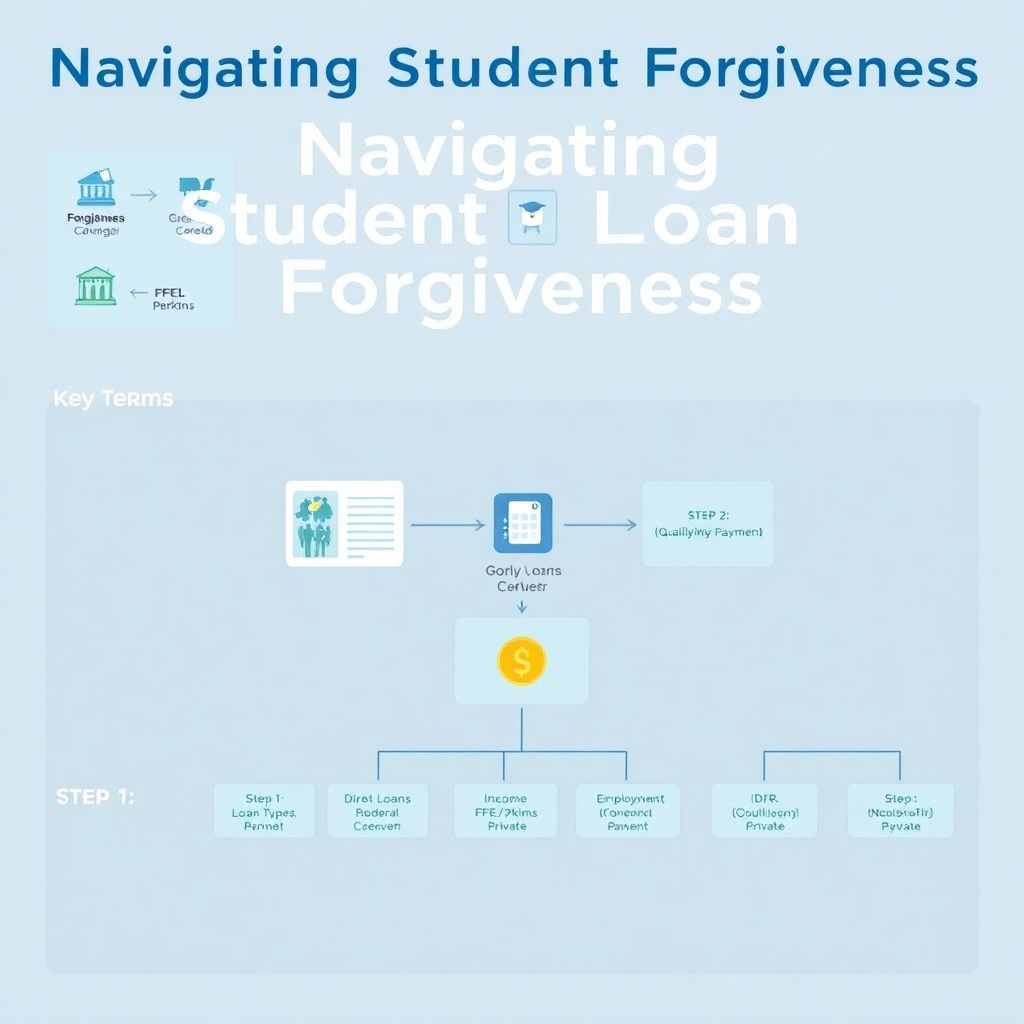

Overview: What “Navigating Forgiveness” Really Means When people talk about “student loan forgiveness,” they often mix together several different concepts. From a technical standpoint, you’re dealing with a few distinct mechanisms that each have their own rules, eligibility criteria, and processing flows. At a high level, navigating student loan forgiveness means: – Identifying which federal…

-

Tax credits: how to make the most of your tax savings this year

Understanding how tax credits really work is the difference between a painful tax season and money back in your pocket. Credits directly cut your tax bill dollar‑for‑dollar, so a $1,000 credit reduces your liability by the full $1,000, while a $1,000 deduction just lowers the income that gets taxed. In practice, I routinely see middle‑income…