Category: Smart Spending

-

How to build a sustainable budget for college town living and save money smartly

College towns look cheap from afar — used couches on every porch, dollar pizza, roommates stacked like Tetris. Но без нормального плана деньги утекают в кофе, доставки и «мелочи». Дальше — разбор, как собрать устойчивый бюджет, не превращая жизнь в вечную экономию и не зависая в приложениях без реального эффекта. — Понять реальную стоимость жизни…

-

Saving for a car purchase while maintaining other financial goals

Why Saving for a Car Doesn’t Have to Kill Your Other Dreams Пutting money aside for a car часто воспринимается как марафон без финишной черты: чем больше копишь, тем дальше кажутся отпуск, обучение или инвестиции. На практике «saving for a car vs other financial goals» можно превратить не в конфликт, а в проект с понятной…

-

Practical steps to invest your first $1000 wisely and start building wealth

Before we talk tools and apps, park your first instinct: don’t chase a “1000% in a month” story. The real best way to invest first 1000 dollars is to treat it as your training ground. Вы учитесь управлять риском, а не угадывать рынок. Think in three buckets: safety (чтобы не откатиться назад), рост (чтобы деньги…

-

Doing more with less money: a practical guide to smarter spending

Why “Doing More with Less” Matters in 2025 In 2025, “living within your means” is no longer просто скучный совет от родителей. Это вопрос устойчивости — личной и глобальной. Цены на жильё и еду растут быстрее зарплат, технологии постоянно соблазняют подписками, а реклама круглосуточно убеждает нас тратить ещё. При этом у нас есть то, чего…

-

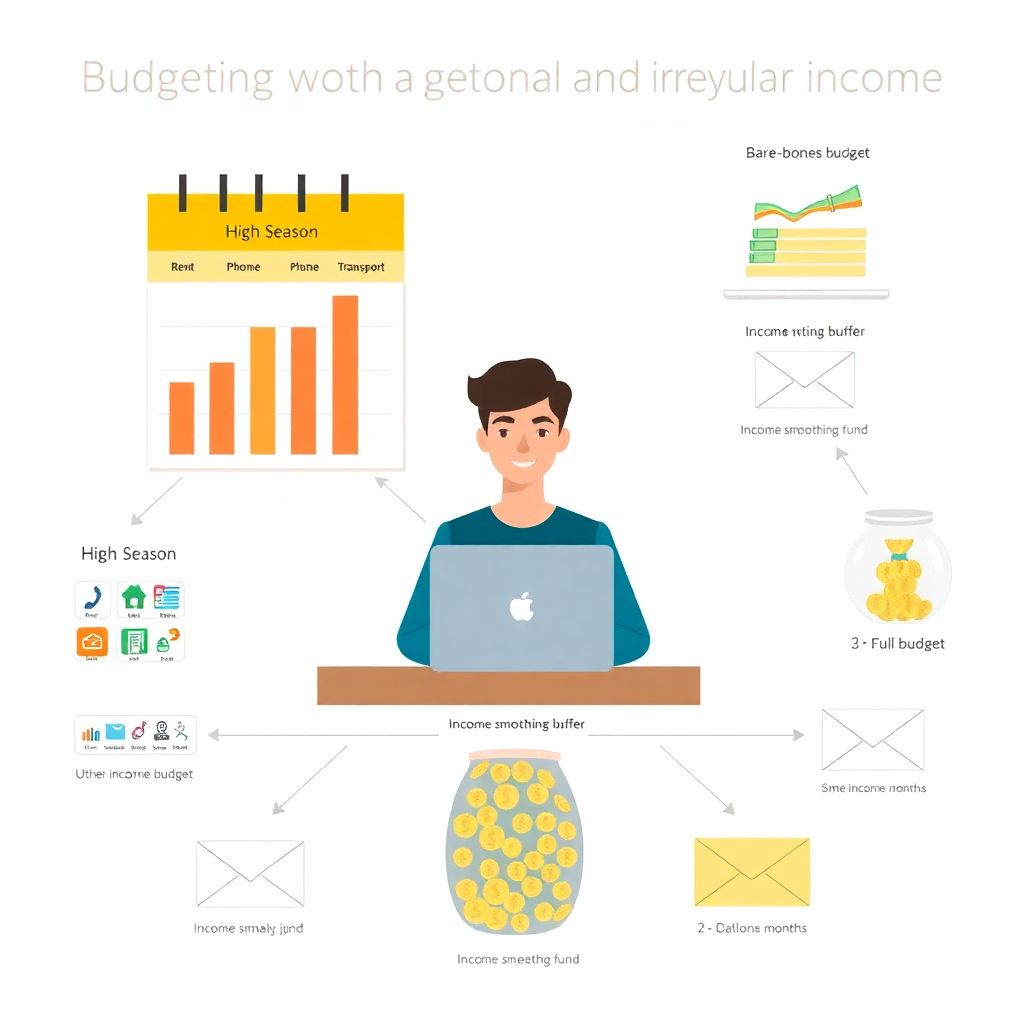

Budgeting for seasonal income and gigs to stay financially stable year round

Why budgeting for seasonal income feels so hard (and why it’s fixable) If you live on tips, contracts, high season shifts or weekend gigs, classic budgeting advice often sounds like it was written for someone on a fixed government salary. When money hits your account in waves instead of a steady stream, it’s stressful to…

-

Beginners guide to understanding your employee benefits and making them work

Why Your Employee Benefits Matter More Than You Think When people accept a job offer, они обычно в первую очередь смотрят на зарплату. Но спустя пару лет большинство сотрудников признаётся на HR‑опросах, что именно пакет льгот стал решающим фактором остаться или уйти. Понимание, как устроены ваши отпуск, страховка, пенсионные накопления и прочие «плюшки», напрямую влияет…

-

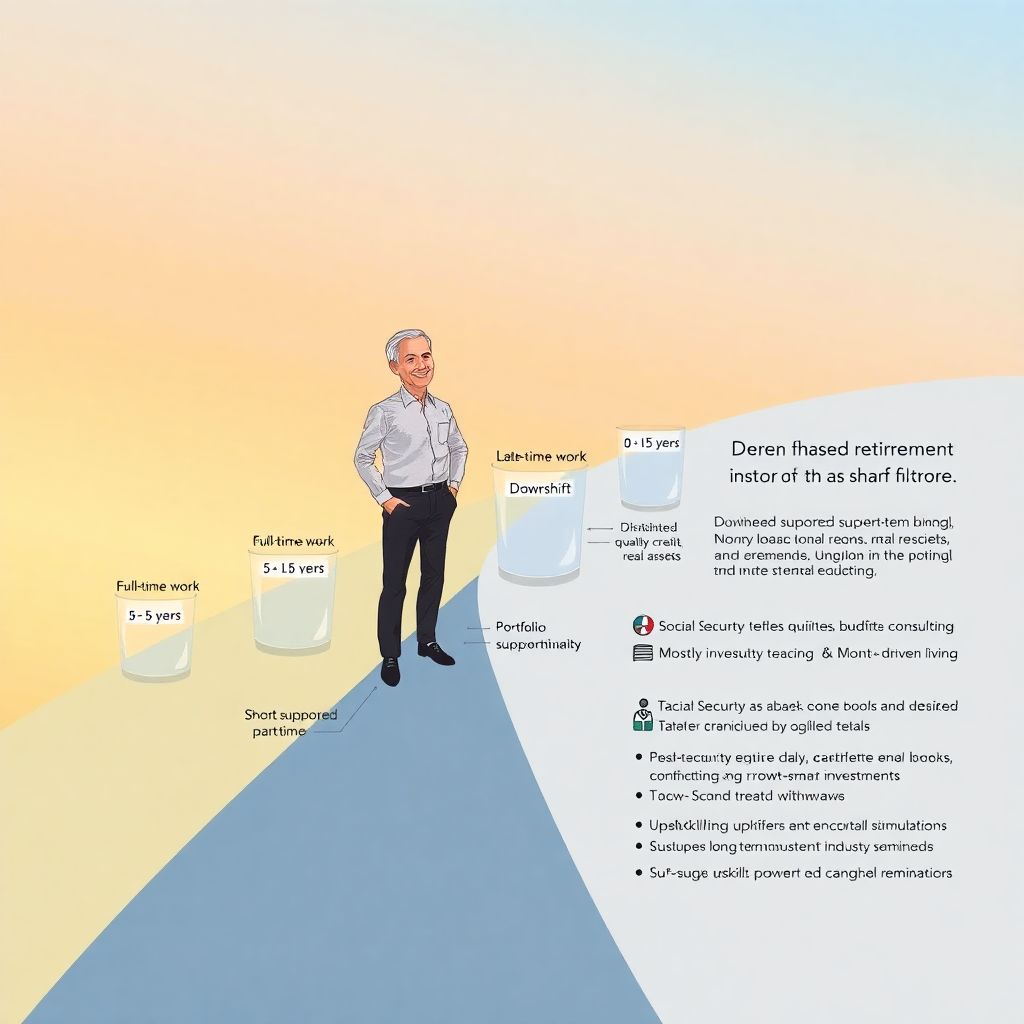

How to build an investment plan for a successful phased retirement

Rethinking What Phased Retirement Really Means A phased retirement investment plan starts with accepting that retirement is no longer a cliff; it is a slope. Surveys from Gallup and the OECD show that 30–40% of workers expect to keep earning after traditional retirement age, and the share rises every cohort, which means your money has…

-

How to create a realistic budget for a family of four and save money monthly

Economic context for a family‑of‑four budget Why “realistic” matters more than “perfect” A budget for семью из четырёх человек — это уже не абстрактный Excel‑файл, а финансовая модель домохозяйства среднего размера. В развитых экономиках расходы такой семьи включают обязательные платежи (жильё, налоги, страхование), переменные траты (продукты, транспорт, одежда) и долгосрочные обязательства (ипотека, образовательные сбережения). По…

-

Social security benefits explained: a practical guide to understanding your payments

Why Social Security Still Matters in 2025 Even в 2025 году, когда новостные ленты забиты разговорами про крипту, ИИ и инвестиции в индексные фонды, для большинства американцев социальное обеспечение остаётся самым надёжным и предсказуемым источником дохода на пенсии. Social Security не создана, чтобы сделать вас богатым, она создана, чтобы вы не обеднели окончательно, если рынок…

-

Frugal living: how to build wealth step by step and secure your future

Why Frugal Living Still Works in 2025 За последние три года мир стал ощутимо дороже: в США инфляция в 2022 году достигала около 8 %, в 2023 уже снизилась к ~4 %, а в 2024 колебалась ближе к 3 %. При этом по данным Fed, личный уровень сбережений упал с двузначных значений в 2021 до…