Category: Smart Spending

-

Personal finance tips in your 50s: the ultimate guide to smart money management

Understanding the Financial Landscape in Your 50s Reaching your 50s marks a critical juncture in personal finance management. This decade often combines peak earning potential with escalating financial responsibilities—supporting aging parents, helping children with education, and preparing for retirement. At this stage, financial decisions carry more weight due to the shorter time horizon before retirement….

-

Health savings accounts: how to navigate Hsa plans effectively and maximize your benefits

Understanding the Basics of Health Savings Accounts (HSAs) Health Savings Accounts (HSAs) can feel like financial alphabet soup at first glance, but they’re actually one of the most powerful tools for managing healthcare costs—both now and in the future. At their core, HSAs are tax-advantaged savings accounts available to individuals enrolled in high-deductible health plans…

-

Budgeting for a home move: estimate costs and plan your timeline effectively

Budgeting for a Home Move: Costs and Timelines Relocating to a new home can be exciting, but it’s also one of the most financially and logistically demanding tasks you’ll face. Whether you’re moving across town or across the country, understanding the full scope of the costs and how long the process might take is essential…

-

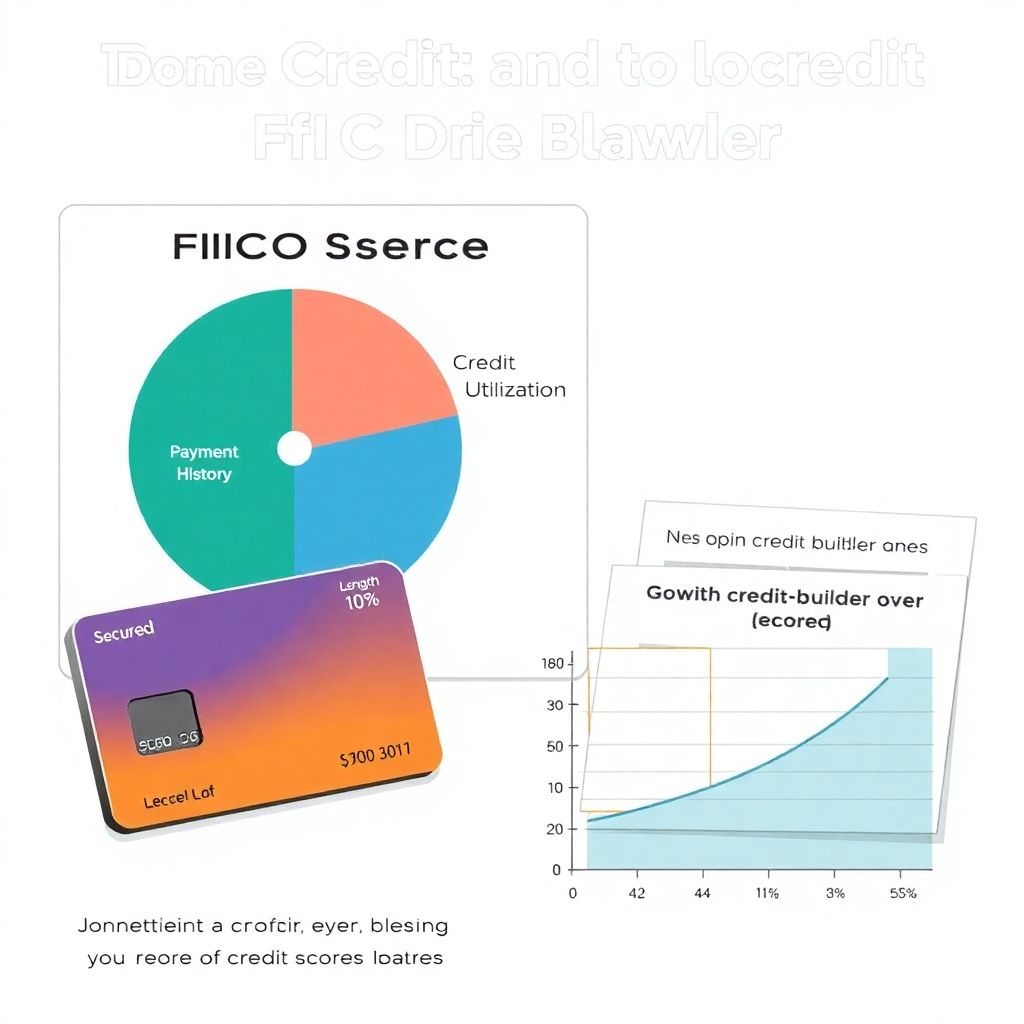

Build your credit score fast with smart and effective financial strategies

Comparing Different Approaches to Building Credit Fast When it comes to improving your credit score, not all strategies are created equal. Some methods deliver quick results but come with risk, while others are slow burners that provide long-term stability. For example, becoming an authorized user on someone else’s credit card can give your score an…

-

Proactive budgeting strategies to boost your career growth and achieve financial success

Understanding Proactive Budgeting in Career Development Proactive budgeting for career advancement involves strategically allocating personal financial resources to support long-term professional growth. Unlike reactive spending—where money is used as needs arise—proactive budgeting anticipates future educational and career opportunities. This forward-thinking method offers professionals a significant edge, especially in an era where continuous skill development is…

-

Building credit from scratch: rookie guide to starting your credit journey right

Understanding Credit: Definitions and Core Concepts Credit refers to a contractual agreement in which a borrower receives something of value now and agrees to repay the lender at a later date, typically with interest. A credit score, typically ranging from 300 to 850, is a numerical representation of a person’s creditworthiness, calculated based on their…

-

Annuities explained: the basics and how they work for long-term financial planning

Understanding the Fundamentals of Annuities Annuities are long-term financial contracts between an individual and an insurance company, designed to provide a steady stream of income, typically during retirement. These instruments are often used as a supplement to traditional retirement plans such as 401(k)s or IRAs. The fundamental idea is simple: you pay into the annuity…

-

Beat inflation with smart budgeting strategies to protect your finances today

Understanding Inflation: A Historical and Economic Perspective Inflation is not a new phenomenon—it’s a recurring economic challenge that has shaped financial behaviors for centuries. From the hyperinflation of the Weimar Republic in the 1920s to the oil crisis-driven price surges of the 1970s, history offers countless lessons on how inflation erodes purchasing power and disrupts…

-

Financial independence and early retirement planning for a secure future

Financial Independence: The Early Retirement Planning in 2025 Early retirement isn’t just a dream anymore — it’s a tangible goal for many. In 2025, the FIRE (Financial Independence, Retire Early) movement continues to gain momentum, especially among millennials and Gen Z. But reaching financial independence takes more than cutting lattes and saving aggressively. It demands…

-

How to save for a wedding without debt and plan your big day stress-free

A Brief Look at Wedding Costs Through History Weddings didn’t always come with a hefty price tag. A few decades ago, ceremonies were often modest family affairs held in backyards or local halls. Spending thousands of dollars was the exception, not the rule. Fast-forward to today, and the wedding industry has ballooned into a multi-billion-dollar…