Why your retirement timeline matters more than your “magic number”

Most beginners start with one question: “How much money do I need to retire?”

That’s not a bad question — but it’s incomplete.

The smarter starting point is your retirement timeline:

when you want to stop (or change) work, how long your money should last, and what has to happen at each stage of your life to get there.

Money is just the fuel.

Your timeline is the map.

This guide is retirement planning for beginners who want clear steps, plain English, и a couple of нестандартных идей along the way.

—

Step 1. Define retirement like a scientist, not like Instagram

Forget the standard image: beach, hammock, no emails ever again.

Modern retirement is much more flexible, and that massively changes the math.

Think of retirement as a spectrum, not a switch:

– Full‑time career mode

– “Coast” mode (simpler job, less pressure, maybe less pay)

– Semi‑retirement (part‑time, consulting, own small project)

– Full stop (no active income at all)

The earlier you allow yourself to slide along this spectrum, the less you need to save for a hard “all or nothing” age.

Non‑standard twist:

Instead of asking *“At what age can I stop working completely?”* ask:

– *“At what age do I want the freedom to say no to any job I dislike?”*

– *“When do I want working to be optional, not mandatory?”*

Your retirement timeline by age then becomes a plan to buy freedom of choice, not just a pile of money.

—

Step 2. Build your personal retirement timeline by age

Let’s sketch a typical modern timeline. Adapt it, don’t worship it.

– Age 20–29: Exploration + habits

– Learn how money works, not how to get rich quick.

– Build the habit of investing tiny amounts consistently.

– Your main asset is income growth, not your account size.

– Age 30–39: Acceleration decade

– This is the sweet spot: higher income, still many years ahead.

– Focus on increasing savings rate and killing stupid debt.

– Decide roughly when you’d like work to become optional.

– Age 40–49: Strategic decade

– Correct course: fix under‑saving, adjust lifestyle.

– Protect what you’ve built: insurance, emergency fund, skills.

– Maybe plan for a downshift or career change without panic.

– Age 50–59: Risk management decade

– Less gambling, more preservation.

– Clear strategy for how you’ll turn investments into income.

– Decide if you actually want a “full stop” retirement or phased exit.

– Age 60+: Harvesting and adaptability

– Withdraw money with a rule, not by guessing.

– Stay flexible: expenses, housing, part‑time work options.

– Periodically check if your money is on track to outlive you.

Unusual idea:

Treat each decade as a “scientific experiment” with a hypothesis:

> “If I save X%, invest like this, and live like that, I should reach freedom around age Y.”

Then, every 3–5 years, you review the experiment and adjust the variables — not your dream of freedom.

—

Step 3. Translate dreams into numbers (without math anxiety)

You don’t need to be a financial engineer. But you do need ballpark numbers.

At a beginner level, use this three‑step mental model:

1. Annual cost of your ideal life in today’s money

Housing, food, healthcare, hobbies, travel, buffer.

Don’t understate it — self‑deception is not a strategy.

2. Adjust for the fact that prices grow

That’s inflation. If your retirement is 25 years away, today’s $40,000 might be more like $80,000 in future dollars.

3. Use a very rough rule

Many planners use something like the “25× rule”:

annual expenses × 25 ≈ portfolio needed for a conservative withdrawal rate.

This is not a precise forecast. It’s a range finder to see if your current path is even in the same galaxy as your goal.

—

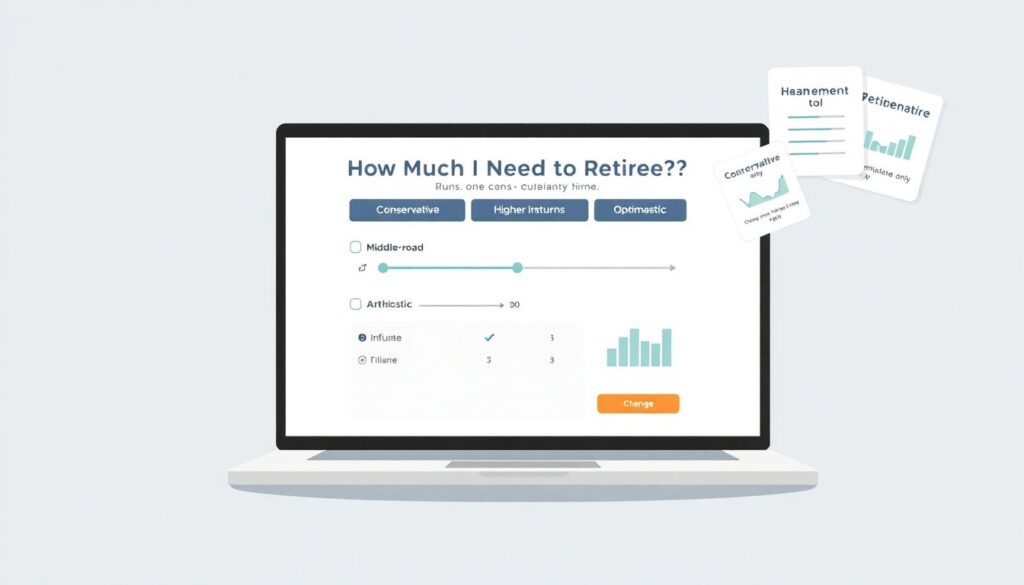

Step 4. Use a calculator the right way (so it doesn’t lie to you)

Online tools like a how much do I need to retire calculator can be helpful — if you understand their limitations.

To use them wisely:

– Run several scenarios, not one:

– Conservative: lower returns, higher inflation.

– Middle‑of‑the‑road.

– Optimistic (for curiosity only).

– Change one variable at a time:

– Savings rate

– Retirement age

– Expected investment return

– Desired annual income

You’ll see something powerful:

your savings rate and retirement age usually matter more than magical investments.

Non‑standard trick:

Treat the calculator like a game. Spend 20 minutes once a year “breaking” the model:

– “What if I retire 5 years later?”

– “What if I live 10 years longer than I expect?”

– “What if my returns are 2% lower?”

You’re not predicting the future; you’re testing how fragile your plan is.

—

Step 5. Best retirement plans for beginners: simplify to amplify

Instead of chasing the “perfect” investment, you want a system that’s hard to screw up.

For many beginners, the best retirement plans for beginners have these traits:

– Automatic: money moves from paycheck to investments without you deciding each month.

– Diversified: you’re not betting on one stock, one property, one miracle.

– Boring: few moving parts, rare changes, minimal drama.

Typical building blocks (names differ by country, but the logic is similar):

– Employer retirement accounts (401(k), 403(b), etc.)

– Individual retirement accounts (IRA, Roth IRA)

– Broad, low‑cost index funds or target‑date funds

– Optional: real estate if you understand it and run it like a business

Unusual angle:

Instead of asking “Which fund will make me the most money?” ask:

> “Which setup makes it hardest for me to sabotage my own plan on a bad day?”

The best system is the one you’ll actually keep using for 20–30 years.

—

Step 6. How to start saving for retirement in your 30s (even if you feel late)

Your 30s are a brilliant decade for retirement planning:

– You likely earn more than in your twenties.

– You still have enough years for compounding to turbo‑charge your savings.

– You’re old enough to see reality, but young enough to change it.

Here’s a pragmatic starter algorithm for how to start saving for retirement in your 30s:

– Freeze lifestyle creep for 12–18 months:

– No big new fixed costs (car loans, oversized housing) without a clear plan.

– Set an automatic transfer on payday:

– Even 5–10% of income is a strong start if invested, not just saved.

– Capture all “new money”:

– Every raise or bonus: pre‑decide to save at least half toward retirement.

– Kill high‑interest debt methodically:

– Returns from paying off 20% debt beat most legal investments.

Non‑standard move:

Tie savings to personal experiments, not punishment:

– “For 3 months, every time I order food delivery instead of cooking, I invest the same amount into my retirement fund.”

– “Every time I binge a TV series, I also ‘binge invest’ $50.”

Gamification works better for the brain than vague guilt.

—

Step 7. Use your career as a retirement accelerator

Most guides obsess over cutting coffee. Let’s be blunt: you can’t retire on coupon savings alone.

The biggest lever in your retirement timeline is your earning potential.

Think like a scientist optimizing a system:

– Increase your value per hour:

– Skills that are rare, in demand, and stack well (e.g., data + communication, tech + sales).

– Reduce income fragility:

– One employer = one point of failure.

– Side projects, freelance, or a second skill = redundancy.

– Time high‑effort moves:

– Use your 30s and early 40s for bold career shifts; it’s much harder at 58.

Non‑standard idea:

Think of your job as your primary investment asset until at least your mid‑40s.

Allocating time to learning, networking, and strategic job changes can add far more to your retirement than chasing an extra 0.5% return in a fund.

—

Step 8. Add “safety rails” to your retirement plan

Life will not respect your spreadsheets. So build safety rails into your retirement timeline by age:

– Emergency fund:

– 3–12 months of expenses, depending on how stable your income is.

– Insurance as damage control, not as an “investment”:

– Health, disability, and basic life insurance if others rely on you.

– Skill insurance:

– Regular upskilling so you’re employable longer than you expect to work.

Think of it like spacecraft design:

You don’t just plan for the ideal flight; you design for failures you hope never to see.

—

Step 9. Plan your “Phase 2” identity, not just your bank balance

Many people imagine retirement as endless free time — and then discover that meaning doesn’t magically appear when the alarm clock disappears.

To avoid the “bored millionaire” trap, include in your retirement planning for beginners:

– What problems do you still want to help solve?

– Which people do you want to spend more time with?

– What activities make you lose track of time now?

Non‑standard but powerful exercise:

Write two drafts of your future:

1. “My life if money wasn’t an issue at 60+.”

2. “My life if money wasn’t an issue at 60+, but I’m required to work 10 hours a week on something useful.”

Draft #2 often reveals a more realistic, happier version of retirement — and can radically reduce how much you need saved if you plan for a small, joyful income stream.

—

Step 10. Turn your retirement timeline into a simple system

A good retirement plan fits on one page. After reading, you should be able to write:

– Target “freedom age” (or range):

– Example: “Work becomes optional between 60 and 65.”

– Approximate annual spending goal in today’s money:

– Example: “$45,000 plus healthcare.”

– Core savings rule:

– Example: “Save 15–20% of income; raise by 1% each year until 25%.”

– Main investing method:

– Example: “Max employer plan, then IRA, all in broad low‑cost index funds.”

– Review rhythm:

– Example: “Check progress once a year; adjust every 3–5 years.”

Then you attach automations:

– Direct deposit to retirement accounts

– Automatic increase of savings when salary goes up

– Calendar reminder for annual “money checkup”

The goal is simple:

on an average month, your retirement plan runs itself while you live your life.

—

Key takeaway: Your timeline is a living model, not a prison

Understanding your retirement timeline isn’t about predicting the future with spooky accuracy.

It’s about building a flexible model of your life that:

– Gives you a direction instead of vague anxiety

– Shows you which levers (age, savings, career, spending) matter most

– Lets you adjust your plan without starting from zero every time

Start where you are:

– If you’re in your 20s — build habits and knowledge.

– If you’re in your 30s — turn on acceleration and systems.

– If you’re older — focus on risk, debt, and realistic timelines.

Your retirement timeline is not a countdown to the end of usefulness.

It’s a roadmap to the point where you can finally choose what matters — and have the time, energy, and resources to do it on your own terms.