Define Financial Objectives and Startup Vision

Before diving into startup financial planning, it’s crucial to clearly articulate your business model, revenue streams, and long-term financial objectives. Many founders underestimate the importance of aligning their financial goals with the startup’s mission and market positioning. Begin by forecasting key metrics such as customer acquisition cost (CAC), lifetime value (LTV), and gross margin. These indicators will form the backbone of your financial strategies for startups and influence every subsequent decision, from product pricing to operational scaling.

Develop a Comprehensive Budget

Budgeting for startup launch requires more than estimating initial setup costs. A comprehensive startup budget should incorporate fixed and variable expenses, capital expenditures, and at least 12 months of cash flow projections. Typical oversight includes underestimating marketing expenses and over-optimism regarding time-to-revenue. To mitigate this, apply conservative estimates and stress-test scenarios. Avoid relying solely on linear growth models; instead, model multiple outcomes to evaluate financial resilience under fluctuating market conditions.

Common Mistake: Neglecting Working Capital Needs

A frequent error in financial management for new businesses is ignoring the importance of working capital. Founders often focus on fundraising and overlook the necessity of maintaining sufficient liquidity for daily operations. This misstep can lead to cash flow shortages during critical growth phases. A healthy working capital buffer ensures that your startup can cover payroll, inventory, and vendor obligations without recurring to emergency funding or incurring high-interest debt.

Explore and Compare Startup Funding Options

Understanding and selecting appropriate startup funding options is a pivotal step. Equity financing (e.g., angel investors, venture capital) and debt instruments (e.g., SBA loans, convertible notes) each come with distinct implications for ownership and repayment. Novice founders may rush into equity deals, diluting ownership prematurely. Instead, evaluate funding sources based on your startup’s stage, risk profile, and projected revenue timeline. Crowdfunding and bootstrapping are also viable routes, especially for early validation without immediate investor pressure.

Common Mistake: Misjudging the Cost of Capital

A critical miscalculation is underestimating the cost of capital. Whether it’s equity dilution or interest payments, each funding mechanism bears a long-term financial impact. For example, issuing equity too early may lead to significant loss of control, while excessive debt can burden cash flow. A sound approach to startup financial planning involves calculating the internal rate of return (IRR) and comparing it to the expected cost of capital to ensure sustainable growth.

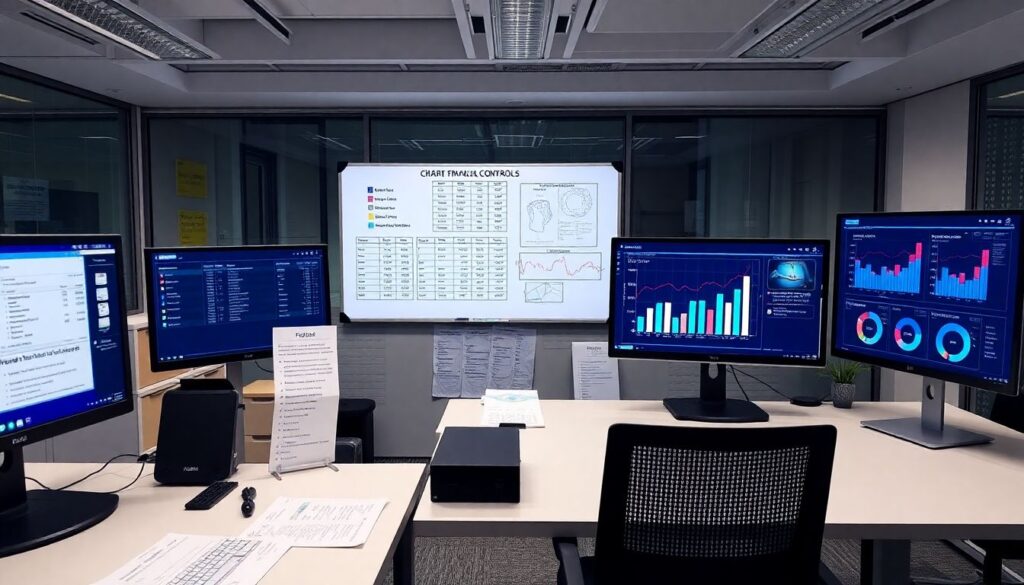

Implement Financial Controls and Monitoring Tools

Once capital is secured and budgets are defined, the next phase involves establishing robust financial controls. This includes selecting appropriate accounting software, setting up chart of accounts, and defining expense approval protocols. Use real-time dashboards to track KPIs and variance analysis to compare actuals against projections. Financial management for new businesses should be proactive, with monthly reviews to adjust forecasts and avoid budget overruns.

Common Mistake: Delayed Financial Reporting

Many startups fail to prioritize timely financial reporting, leading to uninformed decision-making. Without accurate and current data, it’s impossible to identify cash burn patterns or measure ROI on marketing spend. Establish a monthly closing routine and ensure your data sources (e.g., bank feeds, invoicing systems) are integrated for real-time accuracy. Consider hiring a fractional CFO if internal expertise is limited.

Plan for Tax Obligations and Regulatory Compliance

Tax planning is often overlooked during the startup phase. However, failing to account for local, state, and federal tax obligations can result in penalties or audits. Incorporate estimated tax liabilities into your budget and consult with a CPA experienced in startup taxation. Additionally, be aware of compliance requirements related to payroll taxes, sales tax, and international transactions if applicable. Early investment in compliance infrastructure can prevent costly legal issues later.

Tip for First-Time Founders

One of the most valuable financial strategies for startups is maintaining a rolling 12-month cash flow forecast. This dynamic tool allows you to anticipate funding gaps and align expenditures with revenue milestones. Incorporate sensitivity analysis to prepare for worst-case scenarios. Also, don’t underestimate the value of mentorship—engage with experienced entrepreneurs or financial advisors who can identify blind spots you may not see.

Conclusion: Build a Financially Sustainable Launch

A smooth startup launch hinges on disciplined financial planning and a clear understanding of economic trade-offs. By proactively addressing budgeting for startup launch, selecting the right startup funding options, and implementing strong financial management for new businesses, founders can minimize risks and enhance their venture’s success trajectory. Avoid common pitfalls such as cash flow mismanagement, premature equity dilution, and lack of financial oversight. With strategic foresight and operational discipline, your startup will be better positioned for sustainable growth and investor confidence.