Historical Context of Budgeting in Seasonal Small Businesses

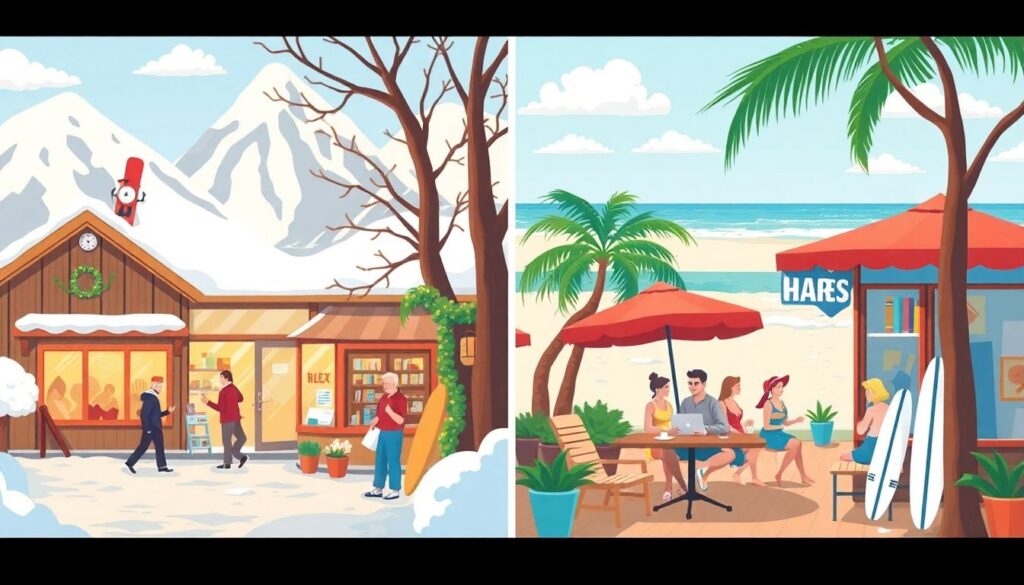

Seasonal small businesses have long been a cornerstone of local economies, from ski rentals in winter towns to beachside cafés operating during summer months. Historically, these businesses relied on basic budgeting techniques, often using prior years’ revenues as a benchmark for expense planning. In the mid-20th century, many such enterprises operated on a cash accounting basis, reacting to income fluctuations rather than proactively managing them. With limited access to financial tools and data, predictive budgeting was rarely practiced. However, as digital financial services evolved in the early 2000s, even small operators gained access to budgeting software, enabling more nuanced approaches. Despite this progress, many seasonal businesses still struggle with cash flow volatility and inefficient capital allocation due to outdated budgeting models.

Core Principles of Smart Budgeting for Seasonality

Smart budgeting for seasonal small businesses centers around adaptability, foresight, and resource optimization. Unlike year-round operations, these businesses must plan for revenue gaps and fluctuating demand. There are several foundational concepts that underpin effective seasonal budgeting:

1. Revenue Smoothing: Instead of viewing income as a peak-and-valley graph, smart budgeting spreads seasonal income across the fiscal year using accrual accounting methods or digital cash flow modeling.

2. Zero-Based Budgeting (ZBB): Every season starts from scratch, with no assumptions about previous expenses. This forces critical analysis of every cost.

3. Scenario Planning: Develop multiple financial models for best-case, average-case, and worst-case seasons to ensure resilience.

4. Cost Elasticity Awareness: Identify which expenses are fixed, variable, or semi-variable to adjust spending dynamically.

5. Off-Season Opportunity Mapping: Allocate budget to revenue-generating activities in the off-season, such as online sales or partnerships.

These principles allow seasonal enterprises to weather unpredictable cycles, allocate capital efficiently, and make more informed financial decisions throughout the year.

Unconventional Strategies for Optimized Seasonal Budgeting

To elevate traditional practices, here are some innovative approaches that can transform seasonal budgeting from reactive to strategic:

1. Staggered Micro-Budgets: Instead of an annual or seasonal budget, implement monthly micro-budgets that are adjusted based on real-time performance indicators such as foot traffic, weather forecasts, or online engagement metrics.

2. Dynamic Pricing Allocation: Integrate pricing algorithms that adjust product or service costs based on demand forecasts, and funnel the incremental profits into a contingency reserve.

3. Subscription Models During Off-Season: Convert one-time seasonal buyers into subscribers by offering exclusive deals or early bird discounts. This generates off-season cash flow and improves customer retention.

4. Reverse Budgeting: Begin with a profit goal and work backwards to determine allowable expenses, forcing a value-first mindset.

5. Shared Resource Pools: Collaborate with nearby seasonal businesses to share warehousing, staff, or marketing budgets during peak periods, reducing overhead and improving efficiency.

These smart budgeting strategies require more than just spreadsheets—they call for creativity, data literacy, and a willingness to experiment. When implemented thoughtfully, they can redefine the financial resilience of seasonal small businesses.

Common Misconceptions About Seasonal Budgeting

Many entrepreneurs fall prey to myths that can sabotage their financial planning. Here are some of the most prevalent:

1. “The Off-Season Is Dead Time”: A dangerous assumption. In reality, the off-season is ideal for brand building, training, product development, and digital marketing efforts.

2. “Cash Flow Issues Are Inevitable”: While fluctuations are normal, poor planning exacerbates them. Smart forecasting, expense layering, and emergency funds can mitigate most cash flow problems.

3. “Budgeting Once a Year Is Enough”: Seasonality demands continuous oversight. Static budgets become obsolete quickly when weather or consumer behavior shifts unexpectedly.

4. “Marketing Isn’t Necessary in Low Season”: On the contrary, off-season marketing maintains customer engagement and primes demand for peak seasons.

5. “Fixed Costs Can’t Be Changed”: Even semi-fixed costs like rent or utilities can sometimes be renegotiated, especially if landlords or service providers understand your seasonal model.

Recognizing and challenging these misconceptions is the first step toward building a more agile and profitable business.

Real-World Applications and Case Studies

Consider the example of a small mountain bike rental shop in Colorado. Traditionally, their income was concentrated between May and September. By adopting dynamic pricing based on trail conditions and tourist volume, they increased peak season revenue by 18%. During the off-season, they launched a virtual workshop series on bike maintenance, generating modest but consistent income and keeping their brand top-of-mind.

Another case involved a pop-up ice cream vendor in Florida. By collaborating with a local bakery during winter months, they co-created frozen dessert kits sold online. This not only extended their revenue stream but also diversified their customer base.

These examples highlight how smart budgeting—when combined with innovation—can unlock hidden potential and buffer the unpredictability of seasonal cycles.

Conclusion: From Survival to Strategy

Seasonal small businesses face unique financial challenges, but smart budgeting transforms those challenges into opportunities. By embracing dynamic, data-driven, and collaborative budgeting techniques, entrepreneurs can not only survive the low season but thrive year-round. As economic and climate patterns become more volatile, adaptability in financial planning is no longer optional—it’s a strategic imperative.