Why Paying Down Your Mortgage Faster Is a Modern Obsession

Back in the mid‑20th century, a 30‑year fixed mortgage was almost a rite of passage. People kept one job for decades, bought one home, and slowly chipped away at the loan. No one really asked how to pay off mortgage faster; they just paid whatever the bank told them and called it a day.

Fast‑forward to today, and things look very different. Interest rates swing, careers change every few years, people move more often, and access to financial information has exploded. Now it’s common to hear questions like: *“What are the best ways to pay down mortgage principal?”* or *“Can I use biweekly mortgage payments to pay off loan early?”* The old idea of passively waiting 30 years is being replaced by a more active, strategic approach.

The good news: paying down your mortgage faster isn’t rocket science.

The bad news: plenty of people make totally avoidable mistakes along the way.

Let’s walk through the logic, the methods, and the pitfalls — in plain English.

—

Basic Principles: How Extra Payments Really Work

Interest vs. Principal: The Core Battle

A mortgage is basically two parts:

– Principal – the amount you borrowed.

– Interest – the price you pay for borrowing that money.

At the beginning of your loan, each monthly payment is mostly interest and only a small slice of principal. That’s why it feels like the balance barely moves in the first few years.

Here’s the key:

Every extra dollar that goes directly to principal reduces future interest. It’s like cutting off a branch of the interest tree before it grows.

If you want to understand how to pay off mortgage faster, your mission is simple: send more money to principal, more often, and as early as possible — without wrecking the rest of your financial life.

—

The Power of “Earlier, Not Just More”

Two people can pay the same total amount of extra money but get very different results depending on *when* they do it.

– Extra payments in the first 5–10 years of a 30‑year loan can save *tens of thousands* in interest.

– The same extra payments thrown in near the end of the loan might only shave off a few months.

Time magnifies your efforts.

Think of it like compound interest in reverse: you’re preventing future interest from ever being charged.

—

Rule of Thumb: Make It Automatic, Make It Clear

To accelerate your mortgage, you need two things:

1. A recurring extra payment (even a small one).

2. Clear instructions to your lender: “Apply this to principal only.”

If you skip that second part, the bank may treat your extra payment as an early payment of *future* installments, not as a direct hit on principal. That’s one of the rookie mistakes we’ll come back to.

—

Practical Strategies to Speed Up Your Mortgage

Let’s get specific and talk about strategies to pay off 30 year mortgage in 15 years — or at least get a lot closer to that.

1. The Classic: Fixed Monthly Extra to Principal

This is the simplest and most flexible approach:

1. Look at your current payment.

2. Add a fixed amount you can truly afford — say, $100–$500.

3. Set up an automatic transfer each month.

4. Tell your lender in writing or via your online portal: “Extra amount to principal only.”

Over years, that small bump can wipe out many years of payments.

You won’t feel like you’re “doing something fancy,” but the math quietly works in your favor.

—

2. Biweekly Payments: Turning 12 Into 13

Biweekly payments mean:

– Instead of paying once a month (12 payments/year)…

– You pay every two weeks (26 half‑payments/year).

Those 26 half‑payments equal 13 full payments. That “extra” payment each year goes straight toward cutting the principal faster — if the lender handles it correctly.

People often ask if it really helps to use biweekly mortgage payments to pay off loan early. Yes, it can. Over the life of a 30‑year loan, this alone can shrink the term by several years. Just make sure:

– Your lender applies those extra amounts properly.

– You’re not paying junk fees for a “biweekly service.”

You can often DIY this by just dividing your monthly payment by 12 and adding that amount to each month as an extra principal payment. Same result, more control.

—

3. “Round It Up” Method

This one is psychologically easy.

If your payment is $1,143, you might:

– Round up to $1,200

– Or even $1,300 if you can swing it

That extra $57 or $157 each month can shorten your mortgage by years. It feels casual, but it’s consistent — and consistency is where the magic happens.

—

4. Use Windfalls Strategically

Tax refund? Bonus? Gift money? Side‑hustle income?

Instead of letting it quietly evaporate, decide in advance that a percentage goes straight to principal. For example:

1. 50% to mortgage principal

2. 25% to savings

3. 25% to fun or lifestyle

This way you’re making big dents in your loan without tightening your monthly budget too aggressively.

—

5. Refinancing With a Purpose

Refinancing to a lower rate can help, but only if you use it strategically:

– If you move from a 30‑year to a 15‑year at a lower rate and can afford the higher payment, you’re locking in speed.

– If you refinance to another 30‑year just to lower your monthly bill — and then *don’t* pay extra — you might actually lengthen how long you’re in debt overall.

A smart move is to refinance to a lower rate, keep paying what you were paying before, and treat the difference as a built‑in extra principal payment.

—

Using Tools Without Being Ruled by Them

Mortgage Calculators: Helpful, If You Don’t Obsess

An online mortgage payoff calculator extra payments can be a great reality check. You plug in:

– Balance

– Interest rate

– Remaining term

– Extra monthly payment or yearly lump sum

It shows you how many years you’ll shave off and how much interest you’ll save. That’s motivating.

Just don’t let it turn into a guilt machine. It’s a tool for planning, not a scoreboard for your self‑worth.

—

Real‑Life Examples of Faster Payoff

Example 1: The “Extra $150” Couple

Alex and Jamie have a 30‑year mortgage, $300,000 balance, 5% interest, payment around $1,610/month (principal + interest).

They decide:

– Add $150 per month to principal

– Keep it fully automated

– Review once a year

Result: They cut several years off their term and save tens of thousands in interest, all from an amount they barely miss after a few months.

No complicated tricks. Just steady, boring, effective action.

—

Example 2: The Biweekly DIY Method

Sam’s monthly payment is $1,800. Instead of signing up for a paid biweekly program, Sam does this:

1. Divides $1,800 by 12 = $150

2. Adds $150 each month to the payment

3. Chooses “Apply to principal” in the online portal

Sam doesn’t technically pay “biweekly,” but the effect is identical to making one extra full payment per year. The loan term shortens, and Sam pays far less in interest, without new fees or complexity.

—

Example 3: Windfall Warrior

Taylor gets:

– A $4,000 tax refund

– A $2,000 annual bonus

Taylor decides ahead of time: “Half of every windfall goes to the mortgage.”

So $3,000 per year is thrown at the principal, on top of normal payments.

Within a decade, Taylor has shortened the mortgage significantly and gained the flexibility to ease off extra payments later if needed.

—

Common Beginner Mistakes (And How to Avoid Them)

Let’s get to the part that trips people up. New borrowers often have good intentions but fall into predictable traps.

Mistake 1: Ignoring Higher‑Interest Debt First

If you’re carrying credit card debt at 20% interest and aggressively attacking a 4–6% mortgage, your priorities are upside down.

Yes, it feels emotionally good to say you’re paying off your house faster. But mathematically, paying off high‑interest debt first almost always wins. Otherwise, you’re saving a little on the mortgage while bleeding money on credit cards.

Fix:

Before going all‑in on the mortgage, clear high‑interest consumer debt, or at least put it on a fast‑track payoff plan.

—

Mistake 2: Not Building an Emergency Fund

Another common error: throwing every spare dollar at the mortgage and leaving yourself with no cash cushion.

Then something happens — car dies, job loss, medical bill — and you end up using credit cards or personal loans. Now you’re back in high‑interest territory and may have to pause extra mortgage payments altogether.

Fix:

Build at least a basic emergency fund (often 3–6 months of essential expenses) before cranking up extra principal payments. Speed is useless if you’re one surprise away from financial chaos.

—

Mistake 3: Not Marking Extra Payments as “Principal Only”

This one is purely technical but very important.

If you just send extra money and don’t specify that it goes to principal, your lender might:

– Treat it as an early payment for future months, or

– Apply it toward interest in a way that doesn’t actually accelerate payoff much

Fix (this is crucial):

1. In your online account, look for a field or checkbox that says something like “additional principal.”

2. If paying by check, write “Apply to principal only” in the memo.

3. Double‑check your next statement to confirm the principal balance dropped more than usual.

—

Mistake 4: Going “All or Nothing” With Extra Payments

Some people start aggressively — big extra payments every month — and then burn out. One unexpected bill, and they completely stop extra payments for years.

It’s like extreme dieting for your money.

Fix:

Choose an amount you can sustain through bad months, not just good ones. You can always bump it up later when income rises.

—

Mistake 5: Forgetting About Opportunity Cost

There’s a hidden risk in obsessively killing your mortgage: you might starve your other goals.

If your employer offers a 401(k) match, ignoring it to pay off a 4–5% mortgage could mean you’re skipping “free money” and potential investment growth that beats your mortgage savings.

Fix:

Before cranking payments way up, ask:

1. Am I getting my full employer match?

2. Am I putting at least something toward long‑term investing?

3. Will this extra mortgage payment prevent me from doing other smart things with my money?

A balanced plan usually beats an extreme one.

—

Mistake 6: Not Reading the Fine Print

Some mortgages have:

– Prepayment penalties

– Rules about how often you can pay extra

– Specific instructions for how extra payments are applied

Most modern loans in many countries don’t penalize prepayments, but some still do.

Fix:

Call your lender or read your loan documents. Ask directly:

1. “Is there any prepayment penalty?”

2. “How do I make sure extra payments go to principal?”

3. “Are there limits on extra payments?”

Better to know now than be surprised later.

—

Mistake 7: Chasing Every Trendy Tip

You’ll find all kinds of “advanced” tricks online, like “mortgage acceleration programs,” “special accounts,” or complicated shuffle‑money‑here, move‑money‑there systems.

Some are just rebranded versions of simple strategies. Others come with fees or unrealistic assumptions.

Fix:

If a method sounds complex or requires you to pay for “secret software,” step back. The best ways to pay down mortgage principal are usually the boring ones:

– Pay extra

– Pay earlier

– Pay consistently

—

A Simple Step‑by‑Step Game Plan

Here’s a straightforward sequence you can follow, without overthinking.

Step‑by‑Step Plan

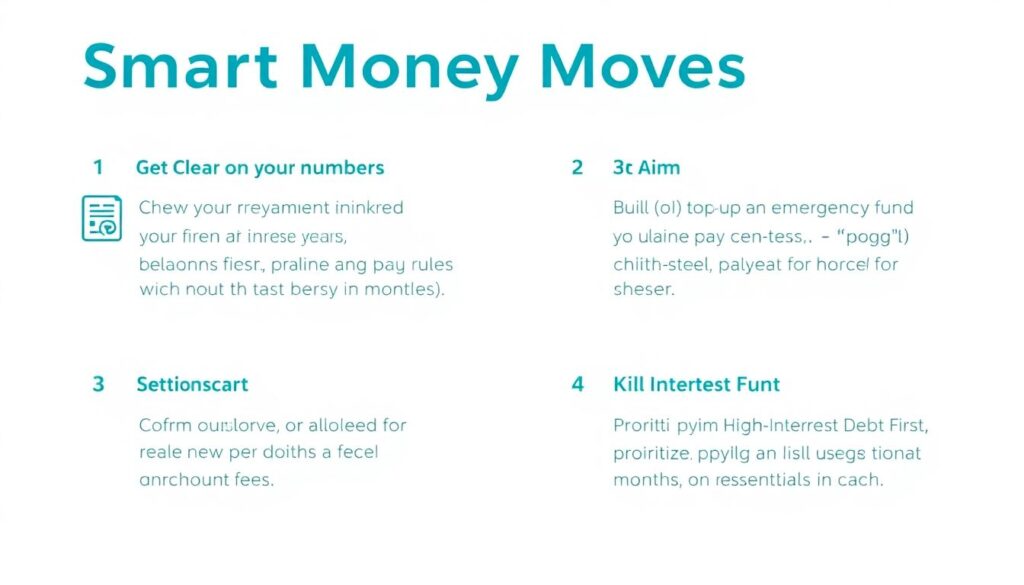

1. Get Clear on Your Numbers

Know your balance, interest rate, remaining years, and monthly payment.

2. Check for Prepayment Penalties and Rules

Confirm you’re allowed to pay extra without fees.

3. Build (or Top Up) an Emergency Fund

Aim for at least a few months of essentials in cash.

4. Kill High‑Interest Debt First

Credit cards and personal loans usually take priority over mortgage acceleration.

5. Decide on a Basic Strategy

– Monthly extra principal

– “Round up” payments

– Windfalls to principal

– DIY biweekly style by adding 1/12 of your payment each month

6. Automate It and Label It Clearly

Set it up online and make sure it’s marked as “principal only.”

7. Review Once a Year

Use a calculator to see how much time and interest you’ve shaved off, and adjust your extra payment if your income or expenses change.

—

Final Thoughts: Speed Matters, But Balance Matters More

Paying off your home early can feel incredible. No mortgage means lower monthly obligations, more flexibility, and a sense of security that’s hard to measure.

But the mission isn’t just “strategies to pay off 30 year mortgage in 15 years at any cost.” It’s about:

– Reducing interest

– Keeping your finances resilient

– Still investing in your future

– Avoiding stress and burnout

If you pick one or two simple strategies, avoid the common beginner mistakes, and stick with the plan, you’ll wake up one day and realize your mortgage balance is dropping faster than you ever expected — and you didn’t have to turn your life upside down to make it happen.