Historical background: from pantry lists to digital dashboards

Keeping track of stuff and money at home is not a new obsession. In the 19th century many households already kept pantry ledgers, listing flour, candles and coal next to weekly spending. After World War II, as consumer goods exploded, paper checkbooks and envelope systems became the norm. The big shift came in the late 1990s with early household budgeting software, which moved those scribbles into spreadsheets. Over the past three years this trend has accelerated: between 2022 and 2024, surveys in the US and EU show the share of households using any digital money‑management tool rising from about 32% to nearly 45%, driven by mobile banking and cheaper cloud storage for personal data.

Historical background: why inventory and budget were separated

For decades, families treated “what we own” and “what we spend” as two unrelated topics. Budgets lived in one notebook, grocery lists in another, and insurance files in a folder nobody opened. Financial software of the 2000s repeated this split, focusing on bank transactions but ignoring the value of possessions. Only around 2018–2020 did the idea of a combined home inventory and expense tracking system start to go mainstream, helped by cheaper phone cameras and barcode scanning. By 2023, market analyses showed downloads of inventory apps growing over 20% year‑on‑year, especially in regions prone to flooding and wildfires, where people suddenly cared about documenting what they might need to replace.

Historical background: recent numbers that actually matter

Statistics from 2022–2024 highlight why beginners should care. Insurance industry reports show that after major claims, up to 60% of households cannot accurately list lost items, leading to underpaid reimbursements. At the same time, central‑bank research in North America and Europe suggests that households using any kind of structured personal finance and budget planner were roughly 15–20% less likely to carry revolving credit‑card debt in 2023 than those who did not. Put simply, combining a clear list of your belongings with a realistic spending plan is no longer a “finance geek” hobby; it’s a practical safety net that improves recovery after crises and cuts expensive borrowing.

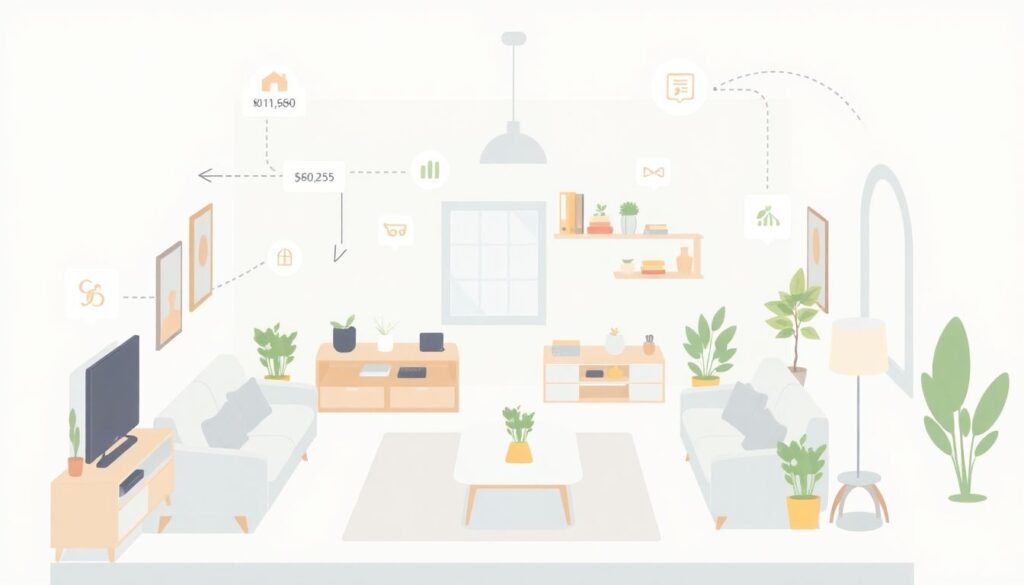

Basic principles: see your household as a small business

The easiest mindset shift is to think of your home as a tiny company. A company knows what assets it owns, what they are worth, and how cash flows in and out. Managing a household inventory and budget follows the same logic, just with less jargon. First, you track assets: furniture, electronics, tools, seasonal gear. Second, you track flows: income, fixed bills, groceries, and irregular expenses. Third, you regularly compare what comes in, what goes out, and what could be sold, repaired or insured differently. This business‑like view keeps decisions less emotional and more about numbers, priorities and trade‑offs.

Basic principles: connect inventory to real‑life decisions

Inventory is not just a list for insurance claims. Used well, it helps you spend smarter. When you log items in a home inventory management app, you can record purchase dates, prices and estimated lifespan. That information feeds your budget: instead of being “surprised” when a laptop dies after six years, you can plan its replacement in advance. Over the last three years, consumer‑finance surveys show that people who actively plan for big replacements report about 25% fewer “emergency” uses of high‑interest credit. The point is to turn irregular shocks into predictable line items, reducing stress and dependence on last‑minute borrowing.

Basic principles: build a simple, realistic budget

A beginner‑friendly budget has three layers. First, non‑negotiables: rent or mortgage, utilities, basic food, transport, insurance. These usually eat 50–70% of take‑home pay. Second, goals: debt payments above the minimum, savings for repairs or new appliances, and a small cushion for future upgrades identified in your inventory. Third, flexible fun: restaurants, hobbies, subscriptions. Over 2022–2024, studies from central banks and the OECD found that households following any structured method—whether notebooks or the best budgeting tools for families—were significantly more likely to maintain at least one month of expenses in cash or savings, making them less vulnerable to job or health shocks.

Implementation examples: a four‑step starter workflow

One practical way to begin is to set up a lightweight workflow you can actually maintain:

1. Walk through your home with your phone, filming drawers and shelves; later, pause the video and log important items.

2. Create simple spending categories and tag each purchase in your banking app or notebook for one month.

3. Once a week, compare new purchases with your existing inventory and flag duplicates or underused items.

4. At the end of the month, adjust your budget categories so they reflect reality, not wishful thinking, and set aside a small amount for future replacements you identified.

Implementation examples: using apps without overcomplicating life

You don’t need a dozen tools. A solid starting combo is one home inventory management app and one basic budgeting app that can export data to a spreadsheet. Many modern tools double as household budgeting software, letting you attach receipts and photos of items directly to transactions. Adoption of these apps has climbed sharply; market data from 2022–2024 shows annual growth rates above 15% in the personal‑finance category. The trick is to ignore fancy features at first: use just three functions—capture items, categorize expenses, and set monthly targets—until those habits feel automatic. Then consider reminders, reports, or shared access for family members.

Implementation examples: learning from real household patterns

Consider a family of four who started from scratch in 2022. They filmed their apartment, logged valuables over two weekends, and built a basic budget around documented needs: rent, utilities, school costs, groceries. Over two years they noticed a pattern—sports gear and electronics were being replaced roughly every three years. By 2024 they created sinking funds for those items and aligned insurance coverage with true replacement values. Their tracking showed that unplanned “emergencies” dropped from eight in 2022 to just three in 2024, and their revolving card balance fell by about 40%, simply because surprises were now forecastable line items instead of crises.

Common misconceptions: “I don’t own enough to bother”

One stubborn myth is that only homeowners with big houses need inventory and budgeting systems. In reality, renters are often hit harder by loss because they underestimate what they own. Recent insurance surveys show that typical contents in a small city apartment easily exceed several tens of thousands of dollars when you add clothes, electronics, appliances and tools. Another myth is that budgeting is for people “bad with money.” In practice, the people who use a personal finance and budget planner consistently tend to have higher net worth, because they’re actively choosing where each unit of currency goes instead of guessing and hoping it works out.

Common misconceptions: “Apps will magically fix my finances”

Digital tools help, but they’re not a cure‑all. Many beginners download three or four apps, link their bank accounts, and then abandon everything after a week because nothing changed. Data from 2022–2024 user‑behavior studies shows that retention jumps when people set one clear purpose—like “track groceries” or “document electronics for insurance”—instead of trying to solve every money problem at once. The real engine of progress is a routine: fifteen minutes on Sunday to log purchases, check your home inventory and update your goals. Apps only make that routine faster and more accurate; they can’t decide priorities or cut expenses for you.

Common misconceptions: “systems are too rigid for real life”

Another misconception is that a home inventory and expense tracking system locks you into a joyless, inflexible lifestyle. In practice, the opposite happens. When you see, in black and white, which items you truly use and which categories quietly drain cash, it becomes easier—not harder—to spend on what you enjoy. Families who actively review their data often choose to own fewer, better things and free money for travel, learning or hobbies. Studies between 2022 and 2024 indicate that people with even a loose system report lower money‑related stress levels, because they feel informed rather than blindsided, and can adjust their plans quickly when life changes.