Why budgeting feels different when you’re starting a new chapter

When life changes sharply — new city, baby, divorce, career pivot, emigration — your old money habits stop working.

You’re not “bad with money”; your context has changed faster than your budget.

Over the last three years, life transitions have become the norm, not the exception:

– According to the U.S. Bureau of Labor Statistics, job changes have remained elevated since 2022, with voluntary quits higher than pre‑2020 averages.

– A 2023 Fidelity survey reported that 64% of respondents went through at least one major life event (marriage, move, job change, health event) in the previous 12 months.

– The Federal Reserve’s 2024 “Economic Well-Being of U.S. Households” report shows that 37% of adults would struggle to cover a $400 emergency expense, only slightly improved from 2022.

So if you’re in the middle of a big transition and your finances feel messy, you’re statistically normal.

This is where intentional financial planning for major life changes matters more than usual. Let’s go step by step and keep it practical.

—

Step 1. Define the “new chapter” in numbers, not just words

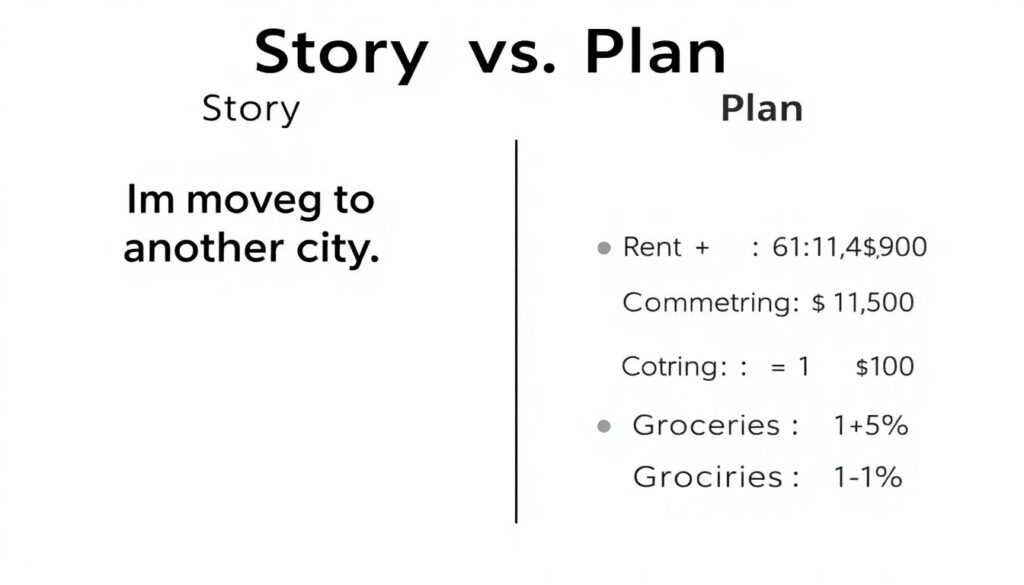

Saying “I’m moving to another city” is a story.

Saying “My rent will go from $900 to $1,450, commuting from $80 to $0, and groceries +15%” is a plan.

Turn your life change into a financial snapshot

Ask yourself three blunt questions:

1. What is definitely changing?

Income source, location, family size, health costs, visa status, work schedule, currency, tax regime.

2. What might change?

Side income, childcare support, transport needs, housing stability.

3. What must not fail for the next 12 months?

Housing, basic food, healthcare, debt payments, immigration or license fees.

Now translate that into numbers:

– New net income range (optimistic / realistic / worst case)

– Fixed costs that must be paid

– Commitments that are *optional but important* (education, travel to see family, therapy, etc.)

—

Technical block: Quick “transition snapshot” formula

“`text

Transition Income = (Expected Base Income × 0.8) + (Reliable Side Income × 0.5)

Minimum Survival Cost = Rent/Mortgage + Utilities + Groceries (basic)

+ Transport (cheapest viable) + Minimum Debt Payments

+ Essential Insurance + Non‑negotiable Fees

Runway (in months) = (Cash + Accessible Savings) / (Minimum Survival Cost – Transition Income)

Target: 6+ months runway during major life changes, 3+ months at an absolute minimum.

“`

Why the discounts? In the first 6–12 months of a new chapter, both your income and expenses tend to be more volatile than you expect.

—

Step 2. Start with a 90-day budget, not a 12‑month fantasy

When people ask how to create a budget for a new chapter in life, they often start with a yearly view. That’s too fuzzy while everything is shifting.

Think in 90-day windows instead. It’s long enough to matter, short enough to revise quickly.

The 90-day budgeting framework

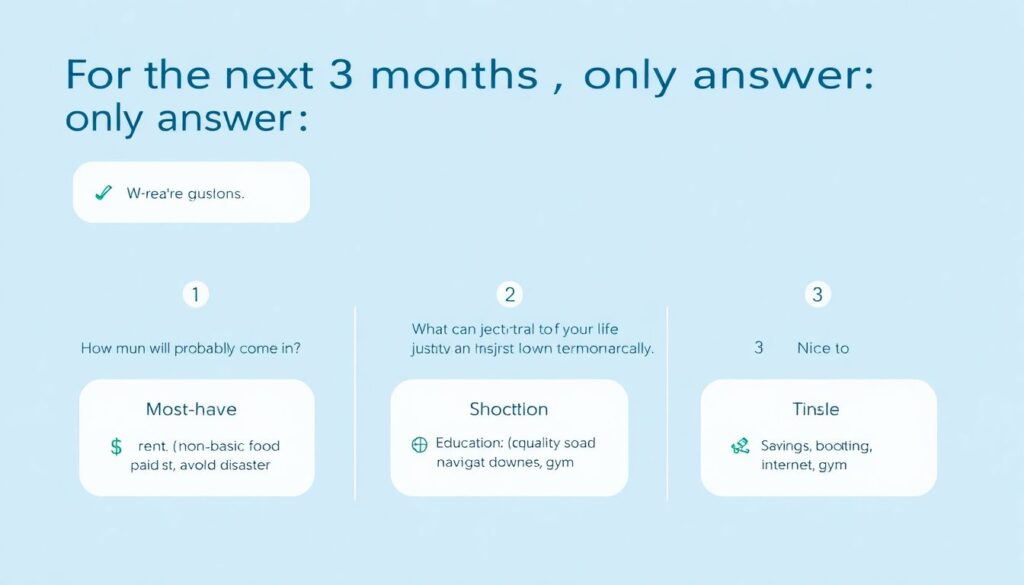

For the next 3 months, you only need to answer:

1. How much will probably come in?

2. What *must* be paid to avoid disaster?

3. What *can* be adjusted down temporarily?

Build three buckets:

1. Must-have (non‑negotiable survival)

2. Should-have (important for quality of life or future goals)

3. Nice-to-have (fully optional)

Use conservative estimates:

– If you expect to earn $3,000–$3,800/month, plan on $3,000 for now.

– If your new rent “should be around $1,200”, plan on $1,300–$1,350 until you sign the actual lease.

—

Real‑life example: Career switch at 34

Lena (34) left a marketing job in 2023 to study UX design full‑time:

– Old net income: ~$3,700/month

– New income (part‑time café job + freelancing): ~$2,100/month (highly variable)

– Fixed costs after moving to a smaller apartment: ~$1,450/month

Her 90‑day plan:

– Must-have: $1,450 (rent, utilities, groceries, transport, minimum loan, insurance)

– Should-have: $300 (courses, portfolio website, coworking 2 days/week)

– Nice-to-have: $150 (eating out, trips, subscriptions)

She capped total spending at $1,900, leaving $200/month as a buffer.

That gave her about 7 months of runway with her savings — enough to finish her course without panic.

—

Step 3. Build your budget from scratch (not from your past habits)

Your old categories are often wrong for your new life. Starting over helps.

This section works as a step by step guide to starting a budget from scratch tailored to transitions.

1. List your actual constraints

– Location: rent levels, transport options

– Legal: visas, licenses, registration fees

– Health: regular meds, therapies, insurance

– Dependents: kids, parents, pets

2. Create just 7–10 core categories

Too many categories kill consistency. Focus on:

1. Housing (rent/mortgage, essential utilities)

2. Food (groceries + minimal eating out)

3. Transport (public transit, fuel, passes)

4. Health (insurance, meds, therapy)

5. Debt & obligations (loans, alimony, support)

6. Life & work essentials (phone, internet, tools, childcare)

7. Buffer & savings (emergency, sinking funds)

8. Optional lifestyle (everything else)

—

Technical block: Simple allocation ratios for unstable times

“`text

If income is stable:

– 50–60% Needs (housing, food, health, transport, basic utilities)

– 10–20% Financial goals (debt beyond minimums, savings, investments)

– 20–30% Wants (flexible lifestyle)

If income is unstable or you’re in transition:

– 60–70% Needs (keep the roof and basics rock‑solid)

– 5–15% Financial goals (prioritize emergency fund over investing)

– 15–25% Wants (keep some joy so you can sustain the plan)

Absolute priority order:

1) Housing & survival

2) Minimum debt & legal obligations

3) Essential health care

4) Emergency buffer

5) Everything else

“`

In periods of change, even many personal finance coach for life changes programs temporarily reduce investing in favor of pure liquidity.

—

Step 4. Use data, not vibes: track 30 days in “observation mode”

Before optimizing, understand reality.

For one month, don’t judge your spending — measure it. No cuts, no guilt, just data collection.

You can do this using:

– A banking app’s built‑in analytics

– A simple spreadsheet

– Manual logging in notes — not fancy, but works

Focus on:

– How much goes to housing, food, and transport

– Which “small” categories add up (coffee, rideshares, online orders)

– What spending directly supports your new chapter (courses, networking, documents, therapy)

—

Recent trend: small costs, big impact

Over the last 3 years:

– A 2024 McKinsey report found that subscription spending per household rose by ~15% between 2022 and 2024, driven by streaming, cloud storage, and niche services.

– Bank of America internal data (2023) showed that digital subscriptions often account for $200–$400/month for middle-income households, many forgotten.

In transitions, cutting dead subscriptions is a clean win: no lifestyle downgrade you’ll actually miss, but real cash freed.

—

Step 5. Choose the right tools for your transition (not forever)

People often ask about the best budgeting tools for life transitions as if there’s one universal answer. The better question is: *what tool matches your current mental bandwidth and income complexity?*

Match tool to situation

1. Simple move / modest change, low mental load

– Use: built‑in bank categorization + one spreadsheet tab

– Goal: clarity, not perfection

2. Freelance / multiple incomes / relocation

– Use: envelope-style apps (YNAB, Goodbudget, or similar), or a custom spreadsheet with “buckets”

– Goal: track cash flow timing and categories

3. Chaos mode (new baby, illness, divorce)

– Use: lowest‑friction method possible — even notes app + weekly 15-minute review

– Goal: avoid overdrafts and missed bills more than optimize every dollar

—

Technical block: One-spreadsheet “Transition Budget” layout

“`text

Sheet 1: Income

– Columns: Date, Source, Gross, Tax/Fees, Net, Notes

Sheet 2: Fixed Costs

– Columns: Category, Amount, Due Date, Auto-pay (Y/N), Risk if missed (High/Med/Low)

Sheet 3: Variable Spend

– Columns: Date, Category, Amount, Notes (e.g., “moving cost”, “job search”)

Sheet 4: Summary (auto-calculated)

– Total Net Income (month)

– Total Fixed Costs

– Total Variable Costs

– Net Cash Flow = Income – (Fixed + Variable)

– % of Income to Needs / Goals / Wants

“`

No design awards, but it works, and you can adjust it as your life stabilizes.

—

Step 6. Budget for volatility, not just averages

In a new chapter, the “average month” exists only on paper. Cash flow timing is critical.

Think less about “$X/month” and more about:

– What cash do I have *before* the 1st?

– Which bills hit *when*?

– What if money arrives a week later than expected?

Create a “cash timing” calendar

1. Put your expected income dates in a calendar.

2. Add every fixed bill with due date.

3. Look for negative gaps: weeks where expenses > available cash.

Then:

– Move non-critical payments to later in the month if possible.

– Ask to change bill dates (many utilities and cards allow this).

– Keep a micro-buffer in your checking (e.g., $200–$500) to avoid overdrafts.

—

Real‑life example: Freelancer post‑relocation

Aditya moved countries in 2022 and went full‑time freelance:

– Income hits: irregular, 3–6 invoices/month

– Major bills: rent on the 1st, health insurance on the 10th, loan payment on the 18th

He rearranged:

– Negotiated rent due date to the 5th

– Asked the lender to move the loan to the 25th

– Kept at least $600 untouched as his “bounce buffer” in checking

Result: no overdraft fees (which can easily be $30–$35 each) and less panic when clients paid late.

—

Step 7. Protect the essentials: insurance, health, and debt

In turbulent years, skipping protection looks tempting. It’s usually the costliest mistake.

From 2022 to 2024:

– The Federal Reserve’s 2024 report noted that unexpected medical expenses were among the top reasons for financial hardship, with a significant portion of adults who had a major medical bill unable to fully pay it.

– The National Bankruptcy Research Center has consistently shown medical and job-loss related issues as leading triggers for personal bankruptcies.

During a big life change, prioritize:

1. Health insurance or medical safety net

2. Liability coverage (especially if you drive)

3. Minimum payments on all debts (to protect your credit and avoid fees)

Cutting these to save money is like cancelling your fire insurance because you bought candles.

—

Step 8. Decide in advance what you’ll sacrifice — and what you won’t

Budgeting in a new chapter is often about pre-negotiating with your future stressed self.

Create a simple “sacrifice ladder”:

1. Expenses you’ll cut *first* if income drops

2. Expenses you’ll *delay* but not cancel

3. Expenses you’ll defend as long as possible

For example:

1. First cuts: 3rd streaming service, impulse online shopping, expensive gym

2. Delays: travel, major purchases, elective upgrades

3. Protected: therapy, kids’ essential activities, key career course

Writing this down matters. Under stress, people often cut high-value, low-cost items (like therapy) and keep low-value, high-cost items (like car they barely use) because of emotion or habit.

—

Step 9. When to get a professional involved

A good personal finance coach for life changes or fee‑only planner is not there to shame your spending. They’re there to compress your learning curve.

Consider help if:

1. You’re dealing with multiple simultaneous transitions (e.g., divorce + relocation + business launch).

2. There are tax or legal complexities (stock options, cross‑border income, inheritance).

3. You’ve tried to DIY for 3–6 months and still feel lost.

Look for:

– Fee-only or transparent pricing

– Specialization in your type of transition (e.g., expats, divorcees, new parents, career changers)

– Clear scope: are they selling products/investments, or giving you independent planning?

Even one or two sessions can help set up a structure you then maintain alone.

—

Step 10. Review rhythm: weekly, monthly, and milestone check-ins

Budgeting during transitions isn’t “set and forget”; it’s “set and iterate.”

Use this simple rhythm:

1. Weekly (15–20 minutes)

– Check account balances

– Log or review transactions

– Ask: “Am I still on track for this 90-day window?”

2. Monthly (30–45 minutes)

– Compare planned vs actual spending

– Adjust category amounts based on reality

– Update your runway: how many months of essential costs are covered?

3. At life milestones

– New job, visa change, baby, move, major health event, new partner, big raise

– Rebuild your 90‑day plan from scratch, not by tweaking the old one

—

Putting it all together: a 10-step roadmap

Here’s the full sequence in one place:

1. Define your life change in numbers (income, fixed costs, non-negotiables).

2. Create a 90-day budget, not a 12‑month guess.

3. Build fresh categories that fit your new reality, not your past life.

4. Track 30 days of actual spending in observation mode.

5. Pick tools matching your current complexity and energy.

6. Account for timing and volatility, not just monthly averages.

7. Protect essentials: housing, health, basic debt payments.

8. Pre‑decide sacrifices to avoid panic decisions.

9. Get professional help if multiple complex changes stack up.

10. Review regularly and reset after every major milestone.

Follow this as your personal how to create a budget for a new chapter in life framework, and you’re no longer just reacting to circumstances — you’re designing your next phase.

—

Final thought: your budget is a bridge, not a verdict

In the last three years, inflation spikes, job market shifts, and global uncertainty have made stable paths rarer. Many people had to reinvent their careers, locations, and lifestyles — often more than once.

Your budget in this new chapter is not a moral scorecard or a life sentence. It’s a bridge from “unpredictable and scary” to “understandable and adjustable.”

Start with rough numbers. Expect to be wrong.

Adjust every month. Use the data.

And let your budget grow and calm down as your life does.