Most people don’t budget for a family medical crisis until something scary happens. By then, you’re stressed, you’re tired, and every money decision feels like a trap. The goal of this guide is to set things up *before* that point, using simple, repeatable steps that work in real life, not just on spreadsheets.

—

Why planning for a family medical crisis matters in 2025

Health care costs in 2025 are still climbing faster than most salaries. Deductibles and copays keep creeping up, and even the best health insurance plans for families often leave gaps big enough to hurt: out‑of‑network emergencies, high prescription prices, or therapy that’s only partly covered. One emergency room visit or short hospital stay can wipe out a year’s worth of savings if you’re not prepared.

On top of that, more care is moving outside hospitals—telehealth, at‑home monitoring, subscription clinics. That’s good for access, but it also means your expenses are more scattered and harder to track. Planning for a medical crisis now is less about one big “insurance choice” and more about building a flexible system that can handle a bunch of different scenarios.

—

Tools and accounts you actually need

To protect your family, you don’t need a PhD in health finance. You just need a small toolkit you understand and can maintain. Think of it like a home toolbox: a hammer, a screwdriver, a wrench. For medical finances, those “tools” are insurance, savings accounts, and a few add‑ons that plug big holes.

Key tools to consider:

– A solid family health insurance plan (through work, marketplace, or government program)

– A dedicated medical emergency fund in cash

– Tax‑advantaged accounts like HSAs and FSAs

– Affordable critical illness insurance for families if your budget allows

– Simple digital tracking tools (apps, spreadsheets) so nothing gets lost

When you compare family health insurance and HSA plans, look at them as a package, not as separate products. A higher‑deductible plan paired with a well‑funded HSA can be powerful for healthy families with some savings. A lower‑deductible plan might make more sense if you have ongoing conditions or expect frequent care and you know you’ll hit the deductible every year.

You’ll also see a lot of “family medical expense savings account options” marketed with fancy names—wellness cards, health wallets, medical membership programs. Most of them boil down to three real categories: traditional savings, tax‑advantaged accounts, and niche add‑on insurance. If you can identify which is which, you’re already ahead of most people.

—

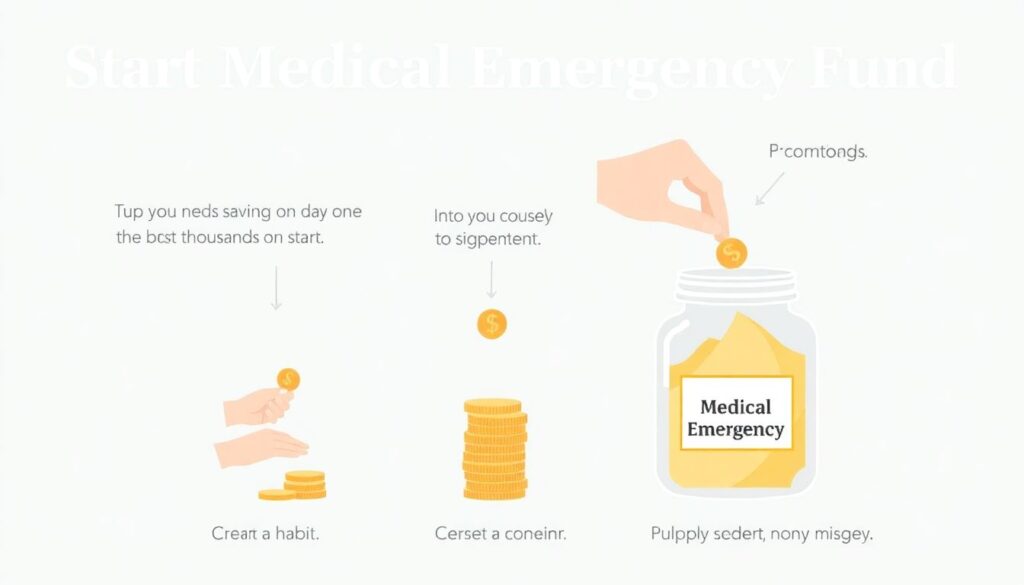

How to start a medical emergency fund without feeling broke

When people ask how to start a medical emergency fund, they often imagine needing thousands of dollars on day one and give up before they begin. That’s backwards. Your job at the beginning isn’t to be “fully prepared”; it’s to create a container and establish a habit. Money can grow; habits are harder to build and more valuable over time.

Start by opening a separate high‑yield savings account and naming it something specific, like “Family Health Buffer” or “Medical Crisis Fund.” The name matters because it creates a mental wall between this money and your everyday spending. Even $20–$50 per paycheck, set to auto‑transfer, turns this from a wish into a system.

Your first realistic target: cover your health insurance deductible. If that’s too big, aim for half. Then, move toward a stretch goal of 3–6 months of typical medical spending: prescriptions, therapies, devices, plus a cushion for an ER visit. You don’t need to hit these numbers in a year; you just need a path that slowly but relentlessly heads in that direction.

—

Step‑by‑step savings game plan

Here’s a practical, phased process you can use, even if money is tight right now. Think “minimum viable safety net,” then upgrades.

1. Map your risk in under an hour

– List everyone in the family and any ongoing conditions (asthma, diabetes, ADHD, chronic pain, etc.).

– Pull your current health plan’s summary of benefits: deductible, out‑of‑pocket max, copays, and network.

– Look up last year’s medical spending from your insurer’s portal or bank statements.

2. Set tiered savings goals

– Tier 1: $500–$1,000 for small shocks (urgent care, surprise copays).

– Tier 2: Your in‑network deductible.

– Tier 3: Your out‑of‑pocket maximum plus one month of normal living expenses.

Write these down where you’ll see them—on a note in your budgeting app or taped next to your desk.

3. Automate tiny, boring transfers

Redirect a slice of each paycheck into your medical fund. If you’re paid twice a month and you move $40 each time, that’s almost $1,000 a year without any big, painful decisions. Whenever your income jumps (raise, bonus, side gig), bump the transfer by 10–20%.

4. Use tax‑advantaged accounts strategically

– If you have a high‑deductible health plan, max what you reasonably can into a Health Savings Account. HSAs are triple‑tax‑advantaged: pre‑tax in, tax‑free growth, tax‑free for qualified medical costs.

– With FSAs, be more cautious: they’re “use it or lose it” with limited rollover. Fund them to cover predictable expenses (glasses, regular meds, planned procedures), not vague “just in case” money.

5. Choose add‑on protection where it really helps

This is where affordable critical illness insurance for families can make sense. If cancer, heart attack, or stroke would cripple your finances, a small policy that pays a lump sum on diagnosis can plug a dangerous gap, especially if you’re the main earner.

6. Create a crisis checklist now, not during the crisis

– Which hospital is in‑network and high‑quality for emergencies?

– Which urgent care or telehealth service should you try first?

– Where are your insurance cards, HSA/FSA cards, and login details?

This cuts down “panic spending” in the moment—like heading to an out‑of‑network ER because it’s the closest name you recognize.

—

Keeping costs down before a crisis hits

Saving for a medical emergency is easier if your baseline health costs aren’t already maxed out. Small proactive moves—boring as they are—can free up cash you can redirect into your fund. This isn’t about becoming a health minimalist; it’s about buying the *right* care at the *right* price.

Practical cost‑control moves:

– Use in‑network providers whenever it’s clinically reasonable. Out‑of‑network bills are where budgets go to die.

– Ask your doctor and pharmacist about generics and 90‑day prescriptions; they’re often cheaper over time.

– Schedule preventive visits you’re already paying for via premiums—vaccines, checkups, screenings—so problems are caught earlier and treated cheaper.

– Price‑shop planned procedures using insurer tools or third‑party apps; the cost difference between facilities can be massive.

One often‑overlooked area: mental health. Therapy and medication can be expensive, but untreated issues also cause lost income, ER visits, and strained relationships. Building mental health into your “essential care” budget is not optional self‑care; it’s financial risk management.

—

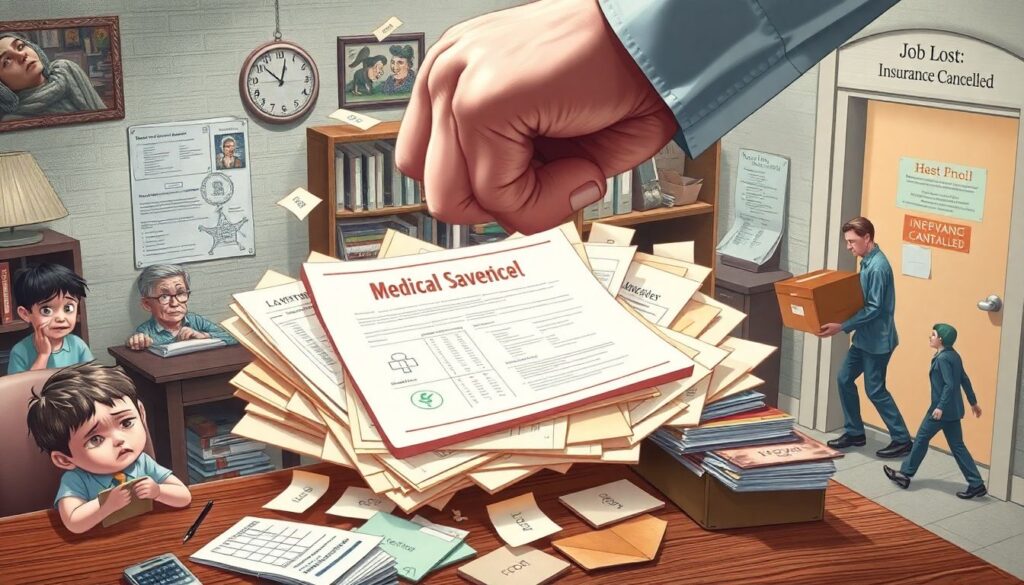

Troubleshooting: when the plan blows up

Even the best‑laid medical savings plan gets punched in the face by reality. Maybe two kids get sick the same month, or a parent needs surgery, or your job—and with it, your insurance—vanishes. When that happens, the goal is not perfection; it’s controlled damage.

If you’re in a crunch:

– Prioritize survival expenses. Keep the lights on, keep food on the table, and keep insurance active. Those three outrank every other bill.

– Call providers early. Most hospitals and clinics offer payment plans or financial assistance, especially if you ask *before* the account goes to collections.

– Push back on errors. Medical billing mistakes are common. Ask for an itemized bill, compare it with your Explanation of Benefits, and dispute anything that doesn’t match.

Sometimes the real problem isn’t the bills; it’s the emotional weight. Medical crises stir up guilt, fear, and family conflict about money. It helps to set one rule in advance: “We attack the bill, not each other.” That means focusing your energy on plans—negotiations, extra income, adjusted goals—instead of blame.

And if you burn through your emergency fund faster than you thought possible, don’t see that as proof the fund “didn’t work.” It did exactly what it was supposed to do: absorb shock so you could stay afloat. The next phase is simply rebuilding, with better information about what a realistic target looks like for your family.

—

Choosing and adjusting your insurance intelligently

Most families pick health insurance once a year during open enrollment and then try not to think about it again. Given how expensive mistakes can be, it’s worth an evening of real comparison, even if the options feel confusing at first.

When you compare family health insurance and HSA plans, run through these questions:

– How often do we actually use care—monthly, a few times a year, or rarely?

– Do we already know we’ll hit the deductible because of ongoing conditions?

– Could we realistically afford the higher deductible if we chose a cheaper premium plan?

If your family tends to be healthy and your budget can handle it, a high‑deductible plan plus HSA can work like a “stealth retirement account” for future medical needs. If you have kids with frequent visits or a partner with a chronic illness, a richer plan with higher premiums but lower out‑of‑pocket costs may be cheaper overall. Run the math assuming a “typical” year *and* a “worst‑case” year; your decision should survive both scenarios.

—

What’s changing next: forecast for the next 5–10 years

Since it’s 2025, it’s worth looking forward. The way families save and pay for medical crises is going to keep shifting, and planning with those trends in mind will make your setup more future‑proof.

Over the next decade, expect:

– More hybrid insurance‑savings products. You’ll see new family medical expense savings account options that blend traditional HSAs with wellness rewards, employer contributions tied to health metrics, or automatic premium discounts for consistent contributions.

– Dynamic pricing and personalized deductibles. As insurers get better data, premiums and deductibles may adjust more closely to your family’s risk profile and behavior (step counts, preventive visits, disease management). That can reward healthy habits—but also make comparisons trickier.

– Growth in specialized coverage. Affordable critical illness insurance for families, hospital indemnity plans, and income‑replacement policies are likely to become more common as people realize standard health insurance doesn’t protect their paycheck. Choosing the right mix will feel more like building a custom package than picking one big plan.

– More transparent, upfront pricing. Regulatory pressure and tech innovation are slowly pushing hospitals and clinics toward clearer, posted prices. That makes it easier to shop around—and to estimate how large your medical emergency fund should actually be.

– Smarter financial tools. Budgeting apps will pull in insurance data, health savings, and medical bills automatically, suggesting contribution amounts and warning you when you’re drifting off track. Your phone will nudge you: “You hit 50% of your deductible this year—consider increasing next year’s FSA by $X.”

The big picture: the system will probably stay complicated, but *your side* of it can get simpler if you lean on automation and a small set of well‑chosen tools. You won’t be able to predict every diagnosis or accident, but you’ll be able to say, “If something happens, we know what money we have, where it is, and what to do first.”

—

You don’t need to turn your life upside down to save for a family medical crisis. You need a separate account, small automatic transfers, insurance that fits your real risk, and a written plan for how you’ll respond when things go wrong. Start with the next tiny step—opening the account, setting the first $20 transfer—and let the structure do the heavy lifting for you.