Why a “Balanced Budget with High Savings” Actually Matters

When people hear “budget”, they imagine a strict diet for money and assume they’ll have to cut every joy out of life. In reality, a balanced budget with high savings is more like a nutrition plan: you decide what matters, you make space for it, and you trim the waste. Technically, a budget is just a written or digital plan that matches your income with your spending and saving goals over a set period (usually a month). A “balanced” budget means your planned outflows (spending, debt payments, transfers) never exceed your inflows. “High savings” means a deliberate, above‑average share of income is routed into savings or investments—often 20–40% for aggressive goals. The trick is to hit that high savings rate without feeling constantly deprived, and that’s where structure and smart tools come in.

Key Terms You’ll Use While Building Your Budget

Before diving into how to create a budget to save money fast, it helps to lock down a few basic terms so you don’t get lost in jargon. “Net income” is what lands in your bank account after taxes and mandatory deductions; this is the only income number that matters for your day‑to‑day budget. “Fixed expenses” are costs that barely change from month to month, like rent, insurance or a streaming bundle. “Variable expenses” move up and down: groceries, fuel, coffee runs, spontaneous online shopping. “Savings rate” is the percentage of your net income you consistently set aside for future goals. Finally, “discretionary spending” is everything non‑essential: eating out, leisure shopping, vacations. Expert financial planners constantly emphasise that just knowing these buckets already makes most people more intentional with money, because they stop seeing it as one blurry balance and start seeing it as categories they can adjust.

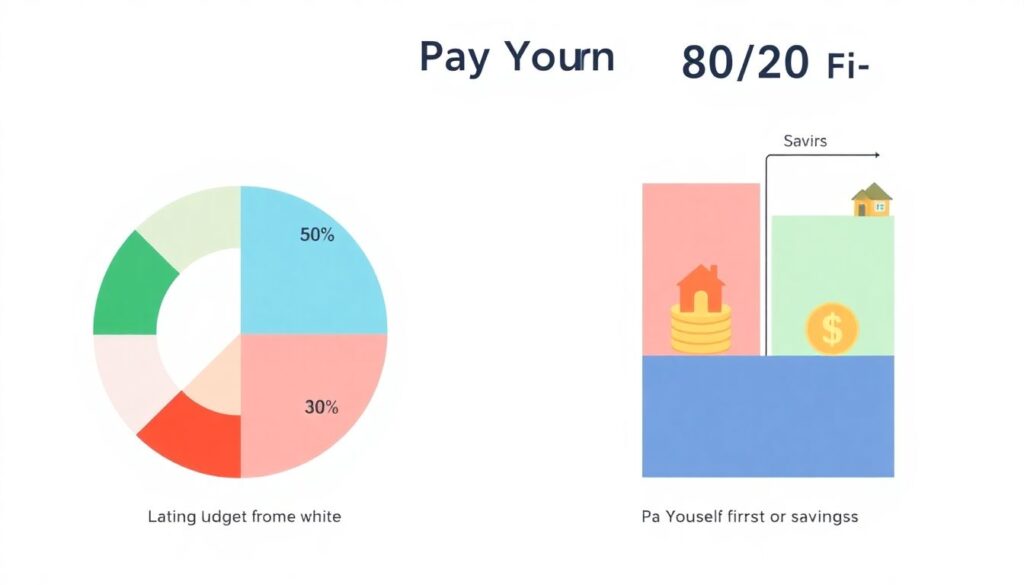

Choosing a Savings‑First Budgeting Framework

There are many budgeting frameworks, but the best budgeting plans for high savings generally share one idea: you pay yourself first, then design your lifestyle around what’s left. Two popular frameworks worth comparing are the “50/30/20 rule” and the “80/20 pay‑yourself‑first” method. In 50/30/20, 50% of net income goes to needs, 30% to wants, 20% to savings and debt payoff. This is beginner‑friendly but may cap your savings lower than you’d like. The 80/20 approach is simpler: target 20% or more directly into savings and investments the moment you get paid, and live off the remaining 80% (or less). Experts who work with high‑income but “always broke” clients often push a more aggressive twist, like 60/20/20: 20% to long‑term savings, 20% to short‑term goals and buffers, 60% for everything else. The more automated and “invisible” those savings transfers feel, the easier it becomes to maintain a high savings rate without daily willpower battles.

Step‑by‑Step: How to Build a Balanced Budget with High Savings

If you want a clear path for how to create a budget to save money fast without turning your life upside down, follow this simple sequence that financial coaches consistently recommend: 1) calculate your average monthly net income from all sources over the last three to six months; 2) list your fixed monthly expenses, then your variable ones, based on actual statements, not guesses; 3) decide your target savings rate (start with 15–20% and push higher once you see where the slack is); 4) “pay yourself first” by scheduling automatic transfers to savings or investments on payday; 5) cap your discretionary spending using category limits, and review weekly to catch drift early. Thoughtful experts also add step 6: plan for the irregular but predictable costs—insurance renewals, car maintenance, gifts—by breaking them into monthly chunks and parking that money in a dedicated sinking‑fund account, so they don’t blow up your budget once a year.

Visualising Cash Flow: Text‑Based Diagrams That Keep You Grounded

Even if you’re not a visual thinker, simple text diagrams can make your cash flow brutally clear. Imagine your paycheck as a source node at the top, then draw arrows going down. It might look like this: “Paycheck (100%) → Automatic Savings (25%) → Fixed Expenses (45%) → Flexible Spending (20%) → Small Buffer (10%)”. That is a basic diagram of a savings‑first budget. You can create a second one just for savings: “Savings (25%) → Emergency Fund (10%) → Retirement/Investments (10%) → Short‑Term Goals (5%)”. By laying out flows in this style, you see instantly whether your priorities match your diagram or if you’ve designed a plan where almost everything leaks into “flexible” spending. Budgeting coaches often ask their clients to sketch such diagrams before and after redesigning their finances; the comparison alone reveals how much more intentional a high‑savings budget feels.

Comparing a High‑Savings Budget to a Typical Lifestyle Budget

A normal lifestyle budget—what most people follow by default—looks like this: income comes in, bills get paid, and whatever is left is spent until the account hits a low point, with tiny or irregular transfers to savings if there’s anything left near month‑end. In contrast, a high‑savings budget inverts that order, making savings the first, non‑negotiable “bill.” Behavioural economists highlight that this sequence reversal is more powerful than it sounds: when savings happen first, you are forced to manage your monthly expenses using the money that remains, which nudges you to question subscriptions, negotiate bills and downsize certain habits. Another difference is clarity. A lifestyle budget is usually implicit and untracked; a savings‑centred one has written limits per category, routine reviews and often uses a personal budget planner for saving money. The end result is that the same income can produce radically different outcomes—one leads to frequent money stress, the other to a growing safety net and visible progress toward goals.

Expert‑Backed Strategies for Managing Monthly Expenses

When experts talk about how to manage monthly expenses for maximum savings, they almost always start with ruthless visibility. That means pulling 90 days of bank and card transactions and categorising every line, no judgement, just facts. The next move is prioritisation: they encourage a ranking exercise where you sort categories by “life satisfaction gained per dollar.” If dining out ranks lower than travel or early retirement, you shrink the restaurant budget to free room for savings and the things you truly value. Many advisors also suggest a rule of thumb: lock in your fixed living costs (housing, utilities, transport) below 50–55% of your net income whenever possible, because this gives you enough space to raise your savings rate aggressively when needed. To prevent drift, they recommend weekly check‑ins of 10–15 minutes where you compare planned vs actual spending per category and make tiny course corrections, rather than discovering a big overspend at month‑end when it’s too late.

Using Tools and Apps Without Letting Them Run You

Modern budgeting apps to save more money can be extremely useful, but only if they fit your personality. Some people love highly detailed category tracking; others shut down when confronted with too many rules. Financial planners usually advise starting simple and layering complexity only if you need it. At minimum, choose an app or spreadsheet that can automatically import transactions, label them, and show you category totals against your planned limits. This might be a full‑featured app with cash‑flow forecasting or a minimalist tool that just shows your envelopes. What matters is that you interact with it frequently and that it makes overspending visible early. Many experts urge clients to pair digital tools with one or two physical cues: a savings progress thermometer on the fridge, or a sticky note on the laptop with the current savings rate. This combination of software and visual reminders keeps your budget from turning into a forgotten file and anchors it in daily life.

Building Your Own Personal Budget Planner System

A personal budget planner for saving money doesn’t have to be a fancy notebook or expensive software; it’s any system that captures your plans, your actual numbers and your reflections in one place. Think of it as three sections: “Plan”, “Track”, and “Review”. In the Plan section, you outline your income, target savings rate, fixed and variable categories with their caps. In Track, you log (or sync) your real spending throughout the month. In Review, you write short notes: what worked, what failed, which triggers led to impulse buys. Expert coaches find that this reflection piece is where behaviour actually shifts, because people see patterns like “weekend boredom equals online shopping” or “eating out spikes when I skip meal prep”. Over a few months, you’re not just adjusting numbers; you’re redesigning habits around your money, which is where sustainably high savings become possible without constant friction.

One Practical Example of a High‑Savings Budget in Action

Let’s walk through a simplified but realistic scenario. Suppose Alex takes home $3,000 per month. After reviewing three months of statements, Alex sees $1,500 in fixed costs, $1,000 in variable spending and only about $200 making it into savings on average. The first move is to flip the pattern: Alex sets up an automatic $750 transfer to a savings account on payday, targeting a 25% savings rate. Fixed costs are still $1,500, which leaves $750 for everything else. By cancelling two low‑value subscriptions, planning cheaper social hangouts and shifting one grocery trip per month to a budget store, Alex frees an extra $150, allowing a realistic $900 discretionary pool while keeping the higher savings. Over time, Alex uses part of that savings to build a three‑month emergency fund and the rest for investments. The big change isn’t fancy math; it’s the deliberate decision that savings happen first and lifestyle flexes afterward, not the other way around.

Simple Action Plan: From “Wing It” to High‑Savings Budget

To wrap all this into something you can do this week, here is a clear, numbered action plan grounded in the methods experts actually use with clients: 1) gather the last three months of bank and card statements; 2) calculate your average net income and list fixed vs variable expenses; 3) choose a simple savings‑first framework (for example, 20–30% savings, 50–55% needs, the rest wants); 4) open a separate savings account or brokerage account dedicated to your goals; 5) set automatic transfers for the day or day after each paycheck; 6) pick one budgeting tool—an app or spreadsheet—and set category limits aligned with your framework; 7) schedule a 15‑minute weekly review to compare plan vs actual and adjust; 8) every three months, raise your savings rate by 1–2 percentage points if your cash flow allows. By following these steps consistently, you end up not just understanding how to create a budget to save money fast in theory, but actually living with a balanced budget that steadily delivers high savings and more financial breathing room.