The silent war between your wants and needs

Most people think they know the difference between “want” and “need” until they open their banking app and panic. On бумаге everything is clear: rent, food, meds are needs; gadgets, trips, décor are wants. But in real life the line gets blurry fast. “I need a new phone for work”, “I deserve this weekend away”, “Everyone in the office dresses like that”. Newbies in personal finance mix emotions with logic, treating any discomfort as a “need”. The first step to train your brain to spend wisely is to admit: your mind is wired to rationalize almost any purchase, and it does it very quickly and very convincingly. Your job is not to kill all desires, but to slow this process down and see what’s really happening inside your head before money leaves your account.

Common beginner mistakes when judging purchases

The biggest rookie mistake is using mood, not numbers, as the main filter. You feel tired after work, scroll a store, and click “buy” because “it’s not that expensive”. Another trap: comparing each item only to your current feeling, not to your plans. A beginner asks, “Can I afford this right now?” instead of “What am I sacrificing long‑term if I buy this?” That’s exactly how impulse buying grows into credit card debt. When you start searching how to stop impulse buying and save money, you often focus on willpower instead of system. Meanwhile, your brain keeps counting quick dopamine hits as “small harmless joys”, ignoring that together they eat your savings, your emergency fund, and your peace of mind over and over again.

The psychology behind “I deserve this”

If you’ve ever said “I had a hard week, I deserve this”, you’ve seen reward-based thinking in action. Your brain loves closing loops: work → stress → reward. The reward becomes proof that your effort mattered, so your mind defends it as a “need for mental health”. Newbies rarely notice that this loop can be rewired. You can keep the reward, but change its price and format. Instead of a shopping cart, use rest, movement, or a tiny planned treat that actually fits your budget. One client of an online therapy for overspending and money anxiety discovered she shopped every time she felt unappreciated at work. Once she started asking for feedback and planning cheap but meaningful rewards, her “needs” list shrank on its own, and her savings finally started to grow consistently.

Real cases: when “needs” quietly explode

Picture a guy who decides he “needs” a car to look solid in front of clients. The math doesn’t work, but his identity screams louder than his calculator. He takes a loan, pays insurance, parking, maintenance, and suddenly his so‑called “tool for work” eats half of his cash flow. Another case: a young designer convinced herself she needed every new gadget “for creativity”. Her drawers were full of hardware, yet her portfolio barely moved. The turning point came when she used budgeting apps to track wants vs needs for a month without changing habits. The report was brutal: over 40% of income went to “tools” that didn’t raise income at all. Seeing this in numbers, not feelings, helped her cut gear spending, upgrade only when a project really required it, and channel the difference straight into an emergency fund.

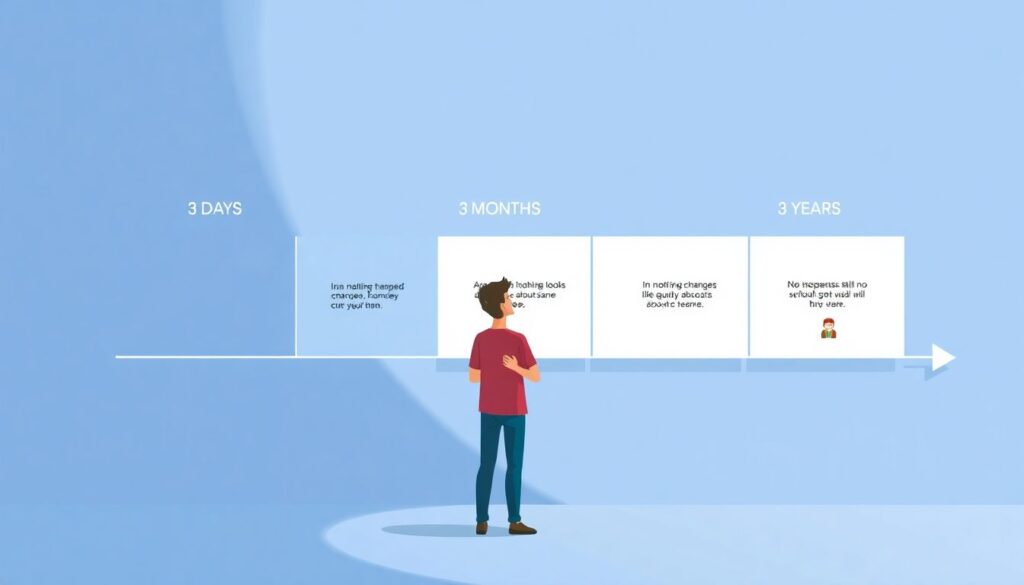

Non-obvious solutions: redefine “need” using time

A surprisingly effective trick: define needs not by category, but by time and consequence. Ask, “What happens in three days, three months, and three years if I don’t buy this?” If in three days nothing breaks, in three months your life quality is about the same, and in three years there’s no serious damage, it’s almost always a want. This reframe kills a lot of fake urgency. Newbies skip this question; pros use it automatically. Another angle: connect every big “want” to a long‑term “need”. For example, travel might be a want, but emotional recharge and broadening outlook are real needs. When you tie the trip to concrete goals and save for it deliberately, it stops being an impulse leak and becomes a planned project that coexists with investments and security, instead of fighting them.

Alternative methods: train your brain like a scientist

Instead of just reading tips, treat your behavior like an experiment. For 30 days, write down every purchase over a given threshold and note your emotional state before buying. Then, once a week, review the list as if it belongs to a stranger. What would you tell that person? This distanced view weakens your internal excuses. Some people prefer structured personal finance courses to control spending, where they get ready‑made templates and feedback. Others respond better to self‑driven learning through the best books on money psychology and spending habits, combining theory with their own observations. The point is not to find a perfect system, but to collect evidence about how your mind works, so “wants” stop masquerading as “needs” unnoticed.

Pro-level lifehacks for everyday decisions

Professionals don’t rely on motivation; they build friction. They delete card data from stores, keep money in separate “delay” accounts, and impose a 48‑hour pause on non‑essential buys. That pause isn’t about torture; it gives your rational brain time to wake up and check alignment with goals. Another trick: rename your accounts not “savings 1” and “savings 2”, but “freedom fund”, “peace of mind”, “six‑month safety”. Pulling money from “peace of mind” to pay for sneakers feels very different. For recurring slips, some even discuss patterns in online therapy for overspending and money anxiety to untangle deeper triggers like shame, fear of scarcity, or childhood scripts. The more honestly you name these forces, the less power they have over your wallet.

Putting it all together without becoming a money robot

Separating wants from needs is not about banning joy or counting every coffee. It’s about making sure your money serves your real life instead of numbing your feelings for a few minutes. You can use budgeting apps to track wants vs needs, read the best books on money psychology and spending habits, take personal finance courses to control spending, or even try online therapy for overspending and money anxiety — but none of it will stick if you keep lying to yourself about what is truly necessary. When you pause, question your stories, and see patterns in cold numbers, your brain slowly learns a new reflex: before buying, it asks, “What am I really trying to get here — an object, an emotion, or a future I actually care about?” That’s the moment you start spending wisely without feeling deprived.